Embark on a journey into the realm of start-up investment tips, where we uncover essential strategies for making informed decisions and maximizing returns in the dynamic world of entrepreneurship.

Learn how to navigate the complexities of start-up investments and unlock the potential for lucrative opportunities while minimizing risks.

Factors to Consider Before Investing in a Start-up

Investing in a start-up can be a lucrative opportunity, but it comes with risks. Before committing your funds, it’s crucial to consider several key factors to ensure you make informed decisions.

Identify Key Market Trends

To assess a start-up’s growth potential, it’s essential to identify and analyze key market trends. Understanding the industry’s direction, consumer behavior, and emerging technologies can give you valuable insights into whether the start-up is positioned for success.

Evaluate the Start-up’s Business Model

A start-up’s business model is the blueprint for how it plans to generate revenue and sustain operations. Before investing, analyze the scalability and sustainability of the business model. Consider factors like customer acquisition costs, revenue streams, and potential for expansion.

Assess the Competitive Landscape

Understanding the competitive landscape is crucial for determining a start-up’s market positioning. Evaluate the strengths and weaknesses of competitors, identify potential threats, and assess how the start-up differentiates itself in the market. This analysis can help you gauge the start-up’s ability to capture market share and thrive in a competitive environment.

Analyze the Start-up’s Leadership Team

The leadership team plays a critical role in the success of a start-up. Evaluate the experience, track record, and expertise of the founders and key executives. Consider their industry knowledge, past successes, and ability to navigate challenges. A strong and experienced leadership team can significantly increase the start-up’s chances of success.

Strategies for Diversifying Start-up Investments

When it comes to investing in start-ups, diversification is key to managing risk and maximizing returns. By spreading your investments across different industries, stages of development, and investment types, you can create a well-rounded portfolio that increases your chances of success.

Explore investing in different industries to spread risk

Investing in start-ups from various industries can help mitigate the risk of a downturn in any particular sector. By diversifying across industries such as technology, healthcare, consumer goods, and more, you can protect your investments from industry-specific challenges and capitalize on opportunities in different sectors.

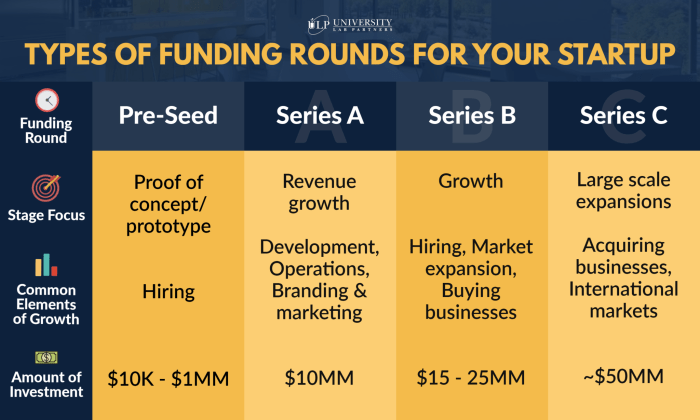

Consider investing in start-ups at various development stages

Diversifying across different stages of development, such as early-stage, growth-stage, and late-stage start-ups, allows you to balance risk and reward. Early-stage start-ups offer high growth potential but come with higher risk, while growth-stage start-ups may be more stable but offer slightly lower returns. By diversifying across different stages, you can optimize your risk-return profile.

Diversify investment types like equity, convertible notes, or revenue-based financing

In addition to industry and development stage diversification, consider diversifying your investment types. Equity investments give you ownership in the company, convertible notes offer the option to convert debt into equity, and revenue-based financing provides a share of future revenues. By diversifying your investment types, you can tailor your portfolio to your risk tolerance and investment goals.

Partner with other investors or join investment syndicates for pooled resources

Collaborating with other investors or joining investment syndicates can provide access to pooled resources, expertise, and deal flow. By partnering with other investors, you can leverage their knowledge and networks to make more informed investment decisions. Investment syndicates also allow you to spread risk by co-investing with a group of like-minded investors.

Due Diligence Process for Start-up Investments

When investing in start-ups, conducting due diligence is crucial to mitigate risks and make informed decisions. This process involves thorough research and analysis to assess the start-up’s potential for success and sustainability.

Conduct Background Checks on the Founders and Key Team Members

Before investing in a start-up, it is essential to evaluate the founders and key team members. Verify their experience, expertise, and track record in the industry to ensure they have the necessary skills to drive the start-up’s growth.

Review Financial Documents

Examining the start-up’s financial documents, including revenue projections and burn rate, is vital. This information provides insights into the company’s financial health, growth potential, and profitability. Analyzing these documents helps investors make informed decisions based on financial data.

Scrutinize Intellectual Property Rights and Legal Obligations

Assessing the start-up’s intellectual property rights, such as patents, trademarks, and copyrights, is crucial to protect the company’s innovations and assets. Additionally, reviewing legal obligations, contracts, and potential liabilities helps investors understand any legal risks associated with the investment.

Seek Feedback from Current Investors or Advisors

Gathering feedback from current investors or advisors who are familiar with the start-up can provide valuable insights into the company’s performance, management team, and growth prospects. Their perspectives and experiences can help investors assess the start-up’s potential and make informed investment decisions.

Exit Strategies for Start-up Investments

When investing in start-ups, it is crucial to consider your exit strategy to maximize returns on your investments. Here are some key points to keep in mind when planning your exit strategy for start-up investments:

Explore potential exit options like acquisition, IPO, or secondary market sale:

– Acquisitions: Selling the start-up to a larger company can be a profitable exit strategy for investors.

– IPO: Taking the start-up public through an Initial Public Offering can provide liquidity for investors.

– Secondary market sale: Selling your stake in the start-up to another investor in the secondary market can be a quick way to exit the investment.

Set clear investment timelines and milestones for exit planning:

– Define specific timelines for when you expect to exit your investment in the start-up.

– Establish key milestones that need to be achieved before you consider exiting the investment.

Monitor the start-up’s progress regularly to assess exit readiness:

– Keep track of the start-up’s performance and growth to determine if it is on track to meet your exit goals.

– Evaluate the market conditions and industry trends to gauge the timing of your exit.

Consider reinvesting returns from successful exits into new start-up opportunities:

– Reinvesting profits from successful exits into new start-up investments can help you diversify your portfolio and potentially increase your returns.

– By continuously reinvesting in new opportunities, you can compound your gains and grow your investment portfolio over time.

Potential Exit Options

- Acquisitions: Selling the start-up to a larger company.

- IPO: Taking the start-up public through an Initial Public Offering.

- Secondary market sale: Selling your stake to another investor in the secondary market.

In conclusion, mastering the art of start-up investment tips is crucial for aspiring and seasoned investors alike, as it offers a pathway to financial growth and innovation in the ever-evolving landscape of start-up ventures.

When looking into the real estate market, one of the most sought-after topics is Affordable Residential Housing: Key Insights Trends and Future Prospects. Understanding the trends and prospects in this sector can provide valuable insights for both buyers and investors.

For investors seeking to maximize their returns, delving into the details of Residential Property Appreciation: An In-Depth Guide for Investors is crucial. This guide offers a comprehensive look at the factors influencing property appreciation and how investors can benefit from them.

When it comes to generating income from rental properties, knowing how to Maximize Profit and Understand Key Concepts of Residential Rental Income is essential. This guide provides valuable insights into strategies for increasing rental income and understanding the key concepts involved.