Private equity investment – Kicking off with Private equity investment, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

Private equity investment involves strategic investments that aim to maximize returns and foster business growth, making it a crucial aspect of the financial world. This article delves into the intricate details of private equity investments, exploring its various types, benefits, risks, processes, and current trends, providing a comprehensive understanding of this dynamic field.

What is Private Equity Investment?

Private equity investment refers to the investment made into privately-held companies or assets that are not publicly traded on the stock exchange. This type of investment involves investing in companies that are not listed on the stock market, providing capital to help these companies grow and expand.

Concept of Private Equity

Private equity involves investors pooling their funds together to acquire equity ownership in companies. These investors are typically institutional investors, high-net-worth individuals, or private equity firms. The goal of private equity investment is to provide capital to companies in exchange for a stake in the business, with the expectation of generating a return on investment.

- Private equity investors typically take an active role in the companies they invest in, providing strategic guidance and operational support to help the business grow.

- Private equity investments are typically held for a long-term period, with the aim of increasing the value of the company over time before eventually exiting the investment.

- Private equity firms may use a variety of strategies, such as leveraged buyouts, growth capital investments, or distressed asset investments, to generate returns for their investors.

Types of Private Equity Investments

Private equity investments come in various forms, each serving a different purpose in the investment landscape. The main types of private equity investments include venture capital, buyout funds, and growth equity. Let’s explore the characteristics and differences among these types.

Venture Capital vs. Buyout Funds

Venture capital funds typically invest in early-stage companies with high growth potential. These investments are often riskier but offer the potential for significant returns if the company succeeds. On the other hand, buyout funds focus on acquiring established companies, often with the goal of restructuring or expanding them to increase their value. Buyout funds usually target mature companies with stable cash flows.

- Venture capital investments are more focused on innovation and disruptive technologies, while buyout funds concentrate on operational improvements and financial engineering.

- Venture capital investments tend to have longer investment horizons and higher risk compared to buyout funds, which aim for quicker returns and more predictable cash flows.

- The exit strategies for venture capital investments often involve an initial public offering (IPO) or acquisition by a larger company, while buyout funds may opt for a sale to another company or a recapitalization.

Role of Growth Equity

Growth equity sits between venture capital and buyout funds, providing capital to companies that have already demonstrated strong growth and profitability. These investments aim to accelerate the company’s expansion and take it to the next level without radically changing its business model.

- Growth equity investments are less risky than venture capital but offer higher returns compared to buyout funds.

- Investors in growth equity focus on companies that have proven their business model and market fit, seeking to scale them further and increase their market share.

- Growth equity can be an attractive option for companies looking to expand their operations, enter new markets, or make strategic acquisitions.

Benefits of Private Equity Investment

Private equity investment offers several advantages for businesses looking to raise capital and grow their operations. By partnering with private equity firms, companies can benefit from strategic guidance, operational expertise, and access to a network of industry contacts. This can help them streamline their operations, improve efficiency, and accelerate growth.

Advantages of Private Equity Investments

Private equity investors often take an active role in the companies they invest in, providing valuable insights and guidance to help improve performance. This hands-on approach can lead to better decision-making, more effective management practices, and ultimately, increased profitability.

- Strategic Guidance: Private equity investors bring a wealth of industry knowledge and experience to the table, helping companies develop strategic plans and identify growth opportunities.

- Operational Expertise: Private equity firms can assist in optimizing business operations, implementing best practices, and driving operational efficiencies to enhance overall performance.

- Access to Network: By partnering with private equity investors, companies can gain access to a vast network of industry contacts, potential customers, and business partners, which can open up new avenues for growth and expansion.

How Private Equity Can Help Companies Grow

Private equity investment can provide the necessary capital for companies to fund expansion initiatives, launch new products or services, enter new markets, or make strategic acquisitions. This infusion of capital can fuel growth opportunities that may not have been feasible through traditional financing methods.

Private equity investors are often willing to take calculated risks to support companies with high growth potential, providing the capital and expertise needed to unlock new opportunities and drive long-term success.

Potential for High Returns with Private Equity Investments

One of the key attractions of private equity investment is the potential for high returns. While there are risks involved, successful investments can yield substantial profits for both the private equity firm and the company being invested in. This can create significant value for stakeholders and shareholders, making private equity an appealing option for companies seeking growth capital.

- High Return on Investment: Private equity investments have the potential to generate significant returns, especially if the company experiences rapid growth or achieves a successful exit through an acquisition or initial public offering (IPO).

- Long-Term Value Creation: Private equity investors focus on creating long-term value for the companies they invest in, working closely with management teams to drive growth, improve operations, and maximize profitability.

- Diversification of Portfolio: For investors, private equity offers a way to diversify their investment portfolio and potentially achieve higher returns compared to traditional asset classes like stocks or bonds.

Risks Associated with Private Equity Investment

Investing in private equity comes with its own set of risks that investors need to consider before committing capital. Understanding these risks is crucial for making informed investment decisions in the private equity space.

Liquidity and Exit Challenges

Private equity investments are illiquid in nature, meaning that investors may not be able to easily sell their stake or exit the investment whenever they want. Unlike publicly traded stocks, private equity investments are typically long-term commitments that can tie up capital for several years. This lack of liquidity can pose a challenge for investors who may need access to their funds on short notice.

- Exit Strategies: Private equity investors need to carefully plan their exit strategies to ensure they can realize returns on their investments. This may involve selling their stake to another investor, taking the company public through an IPO, or facilitating a merger or acquisition.

- Market Conditions: The ability to exit a private equity investment can be heavily influenced by market conditions. A downturn in the economy or a lack of buyer interest can make it difficult to exit an investment at a favorable price.

Impact of Economic Downturns

Private equity investments are not immune to the effects of economic downturns. During times of economic instability, the value of investments in private companies can decline, leading to potential losses for investors. The impact of economic downturns can be especially pronounced in industries that are sensitive to economic cycles, such as real estate, manufacturing, and retail.

- Portfolio Diversification: Diversifying across different industries and geographies can help mitigate the impact of economic downturns on a private equity portfolio. By spreading investments across a range of sectors, investors can reduce their exposure to any one industry that may be disproportionately affected by economic downturns.

- Due Diligence: Conducting thorough due diligence on potential investments is essential for identifying and mitigating risks associated with economic downturns. Understanding the financial health, market position, and growth prospects of target companies can help investors make more informed decisions and protect their capital during challenging economic conditions.

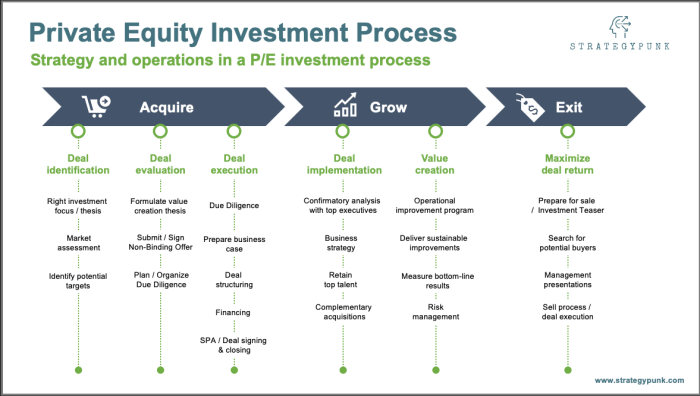

Private Equity Investment Process

Private equity investments involve a structured process that private equity firms follow to identify, evaluate, and manage potential investment opportunities. Understanding the typical process can help investors navigate this complex and high-risk investment landscape.

Sourcing Investments

Private equity firms source investment opportunities through various channels, including industry contacts, investment banks, proprietary deal flow, and networking events. The goal is to identify potential companies that align with the firm’s investment criteria and objectives.

Evaluation and Due Diligence

Once a potential investment opportunity is identified, private equity firms conduct thorough due diligence to assess the company’s financial health, management team, market position, growth prospects, and potential risks. This process involves financial analysis, market research, and extensive discussions with the company’s management.

Deal Structuring and Negotiation

After completing due diligence and evaluating the investment opportunity, private equity firms work on structuring the deal, including determining the investment amount, ownership stake, governance rights, and exit strategy. Negotiations with the target company’s management and shareholders take place to finalize the terms of the investment.

Post-Investment Management

Once the investment is made, private equity firms actively work with the company’s management to drive growth, improve operational efficiency, and ultimately increase the company’s value. This hands-on approach often involves strategic guidance, operational support, and access to the firm’s network of industry experts.

Trends in Private Equity Investment

In the dynamic landscape of private equity investment, various trends are shaping the industry and influencing investment decisions. From technological advancements to a growing focus on environmental, social, and governance (ESG) considerations, these trends are impacting how private equity firms operate and allocate capital.

Impact of Technology on Private Equity Investments

Technology has revolutionized the way private equity investments are sourced, evaluated, and managed. Firms are increasingly leveraging data analytics, artificial intelligence, and machine learning to identify potential investment opportunities, conduct due diligence, and optimize portfolio performance. The use of technology not only enhances operational efficiency but also enables better decision-making, risk management, and value creation in private equity investments.

Rise of ESG Considerations in Private Equity Investing

ESG considerations have gained prominence in the private equity industry as investors and stakeholders emphasize the importance of sustainability, social responsibility, and ethical business practices. Private equity firms are integrating ESG factors into their investment processes, from assessing environmental risks to evaluating social impact and governance practices. By incorporating ESG criteria, firms can mitigate risks, drive long-term value creation, and meet the evolving expectations of investors and society.

In conclusion, private equity investment offers a unique opportunity for businesses to access capital, expertise, and growth potential. By carefully navigating the risks and leveraging the benefits, companies can thrive in today’s competitive landscape and achieve substantial returns on their investments.

When it comes to affordable residential housing, it’s essential to stay informed about the latest trends and future prospects. Understanding the key insights in this market can help investors make informed decisions. To learn more about Affordable Residential Housing: Key Insights Trends and Future Prospects, check out this informative guide here.

Investors looking to maximize profit through residential property appreciation need to have a deep understanding of the market. An in-depth guide can provide valuable insights and strategies for success. For more information on Residential Property Appreciation, visit this comprehensive resource here.

Maximizing profit from residential rental income requires a solid grasp of key concepts and strategies. By understanding how to maximize profit, investors can optimize their returns. Explore more about Residential Rental Income: Maximizing Profit and Understanding Key Concepts by visiting this informative link here.