Kicking off with Portfolio diversification for businesses, this comprehensive guide delves into the importance of diversification, strategies for implementation, asset allocation tips, and risks to be aware of. Stay tuned to learn how businesses can thrive through effective portfolio diversification.

Importance of Portfolio Diversification

Portfolio diversification is a strategy that involves spreading investments across different assets to reduce risk. In the context of businesses, portfolio diversification refers to expanding the range of products, services, or markets that a company operates in. This approach can help businesses mitigate risks and maximize opportunities for growth.

Benefits of Diversifying a Business Portfolio

- Diversification can help businesses reduce dependence on a single market or product, thereby spreading risk across multiple areas.

- By entering new markets or offering new products/services, businesses can tap into additional revenue streams and expand their customer base.

- Portfolio diversification can enhance a company’s resilience to market fluctuations, economic downturns, or industry-specific challenges.

- It can also improve overall performance and profitability by capitalizing on different market trends and opportunities.

How Portfolio Diversification Reduces Risks for Businesses

- By diversifying their portfolios, businesses can minimize the impact of potential losses in one area by gaining from successes in other areas.

- Diversification helps protect businesses from industry-specific risks, regulatory changes, or shifts in consumer preferences that could negatively affect a single product or market.

- It can also reduce the overall volatility of a business’s financial performance, providing stability and long-term sustainability.

Examples of Successful Portfolio Diversification

- Amazon: Originally an online bookstore, Amazon diversified its portfolio to include cloud computing services (Amazon Web Services), streaming services (Amazon Prime Video), and smart devices (Amazon Echo).

- Apple: Known for its iPhones and MacBooks, Apple successfully diversified its portfolio by introducing services like Apple Music, Apple TV+, and Apple Pay.

- Procter & Gamble: This consumer goods company diversified its product portfolio to include a wide range of household and personal care products, reducing its reliance on any single category.

Strategies for Portfolio Diversification: Portfolio Diversification For Businesses

When it comes to portfolio diversification, businesses have several strategies at their disposal to minimize risk and maximize returns. Let’s delve into some key approaches that companies can utilize to effectively diversify their portfolios.

Organic Growth vs. Acquisition as Diversification Strategies

Organic growth involves expanding a business through internal means such as launching new products or entering new markets. On the other hand, acquisition entails purchasing another company to diversify the portfolio. While organic growth allows for more control and can be less risky, acquisitions provide a quicker way to diversify and access new markets. Companies must carefully weigh the pros and cons of each strategy based on their specific goals and resources.

Consideration of Market Trends

One crucial aspect of portfolio diversification is the consideration of market trends. By analyzing current market conditions and future projections, businesses can identify emerging opportunities and potential threats. It is essential to align the diversification strategy with market trends to ensure sustainable growth and competitive advantage in the long run.

Best Practices for Implementing Portfolio Diversification Strategies

– Conduct thorough research and analysis to identify suitable diversification opportunities.

– Set clear goals and objectives for the diversification strategy to guide decision-making.

– Diversify across different asset classes, industries, and geographic regions to spread risk.

– Regularly review and adjust the portfolio to optimize performance and adapt to changing market conditions.

– Seek expert advice from financial advisors or consultants to ensure a well-informed diversification strategy.

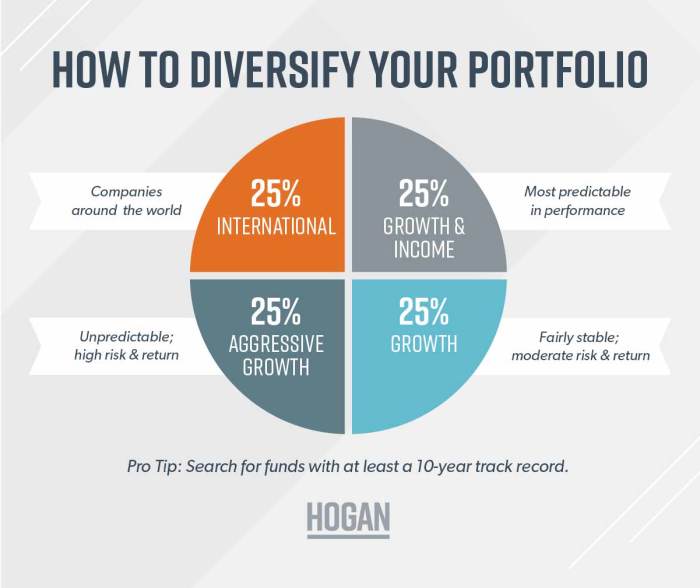

Asset Allocation in Portfolio Diversification

Asset allocation plays a crucial role in portfolio diversification by spreading investment across various asset classes to reduce risk and optimize returns.

Balancing Different Asset Classes

It is important for businesses to balance different asset classes in their portfolio to minimize the impact of market volatility and economic downturns. By diversifying across asset classes, a business can safeguard its investments and achieve a more stable financial performance.

- Equities: Investing in stocks of different companies across various industries.

- Bonds: Allocating funds to government or corporate bonds to generate fixed income.

- Real Estate: Including real estate properties or Real Estate Investment Trusts (REITs) for income and capital appreciation.

- Commodities: Investing in physical goods like gold, oil, or agricultural products for diversification.

Optimizing Asset Allocation

Optimizing asset allocation involves carefully selecting the right mix of asset classes based on the business’s risk tolerance, investment goals, and market conditions. Here are some tips to optimize asset allocation for maximum portfolio diversification:

- Conduct thorough research on different asset classes and their historical performance.

- Regularly review and rebalance the portfolio to maintain the desired asset allocation mix.

- Consider using exchange-traded funds (ETFs) or mutual funds to gain exposure to multiple asset classes with a single investment.

- Diversify globally by investing in international markets to reduce geographical risk.

Risks and Challenges of Portfolio Diversification

When it comes to portfolio diversification for businesses, there are certain risks and challenges that need to be considered in order to make informed decisions. Understanding these potential pitfalls is crucial for successful portfolio management.

Common Risks Associated with Portfolio Diversification

- Market Risk: Fluctuations in market conditions can impact the value of diversified assets.

- Concentration Risk: Over-diversification can dilute returns, while under-diversification can increase risk.

- Liquidity Risk: Some assets may be difficult to sell quickly without significant losses.

- Operational Risk: Challenges in managing a diverse portfolio can arise, especially with complex investments.

Mitigating Risks in Portfolio Diversification, Portfolio diversification for businesses

- Regular Monitoring: Businesses should regularly review their portfolios to assess performance and adjust allocations as needed.

- Diversification Guidelines: Establishing clear diversification guidelines can help prevent overexposure to specific risks.

- Risk Management Strategies: Implementing risk management strategies, such as hedging or insurance, can help mitigate potential losses.

Challenges in Implementing Portfolio Diversification Strategies

- Complexity: Managing a diverse portfolio can be complex and require specialized expertise.

- Resource Allocation: Allocating resources effectively to maintain a diversified portfolio can be a challenge for businesses.

- Behavioral Biases: Emotional decision-making or cognitive biases can hinder effective portfolio diversification.

Real-World Examples of Challenges in Portfolio Diversification

One notable example is the case of Long-Term Capital Management (LTCM), a hedge fund that faced significant challenges due to overleveraging and lack of diversification. The fund’s collapse in 1998 highlighted the risks of not properly managing a diversified portfolio.

In conclusion, Portfolio diversification for businesses is a crucial aspect of sustainable growth and risk management. By adopting the right strategies and staying informed about market trends, businesses can navigate challenges and achieve long-term success.

When it comes to foreign investment in businesses , it’s crucial to stay updated with the latest business investment trends. Understanding the landscape of the market can help investors identify the top industries to invest in for maximum returns.

Foreign investment in businesses plays a crucial role in the global economy, driving growth and creating opportunities for both investors and local communities. It allows companies to expand their operations, access new markets, and enhance their competitiveness. By investing in foreign businesses, investors can diversify their portfolios and benefit from higher returns. To learn more about the benefits and challenges of foreign investment, check out this informative article on Foreign investment in businesses.

Keeping up with business investment trends is essential for staying ahead in today’s competitive market. Understanding where the money is flowing can help investors make informed decisions and capitalize on emerging opportunities. Whether it’s in technology, healthcare, or real estate, knowing the latest trends can give businesses a competitive edge. To explore the current business investment landscape, read this insightful article on Business investment trends.

Choosing the right industry to invest in is crucial for maximizing returns and minimizing risks. Some industries offer more growth potential and stability than others, making them attractive options for investors. From renewable energy to e-commerce, each industry has its own unique opportunities and challenges. To discover the top industries to invest in and explore their potential for growth, check out this comprehensive guide on Top industries to invest in.