Passive business investment ideas: Embark on a journey towards financial growth and stability by exploring various opportunities for passive income. From real estate to stock market investments, discover how you can make your money work for you effortlessly.

Passive Business Investment Ideas

Passive business investments involve putting money into a business or project with minimal effort and involvement on the part of the investor. The goal is to generate a steady stream of income or profit over time without actively managing the business operations.

Benefits of Passive Business Investments

- Steady Income: Passive investments can provide a reliable source of income without the need for constant supervision.

- Portfolio Diversification: Investing in multiple passive business opportunities can help spread risk and protect against market fluctuations.

- Time Freedom: Passive investments allow investors to earn money without being tied down by the day-to-day responsibilities of running a business.

- Scalability: Passive investments have the potential to grow and generate increasing returns over time.

Importance of Diversification in Passive Investments, Passive business investment ideas

Diversification is crucial in passive investments to mitigate risk and maximize returns. By spreading investments across different industries, sectors, and asset classes, investors can reduce the impact of market volatility and minimize potential losses.

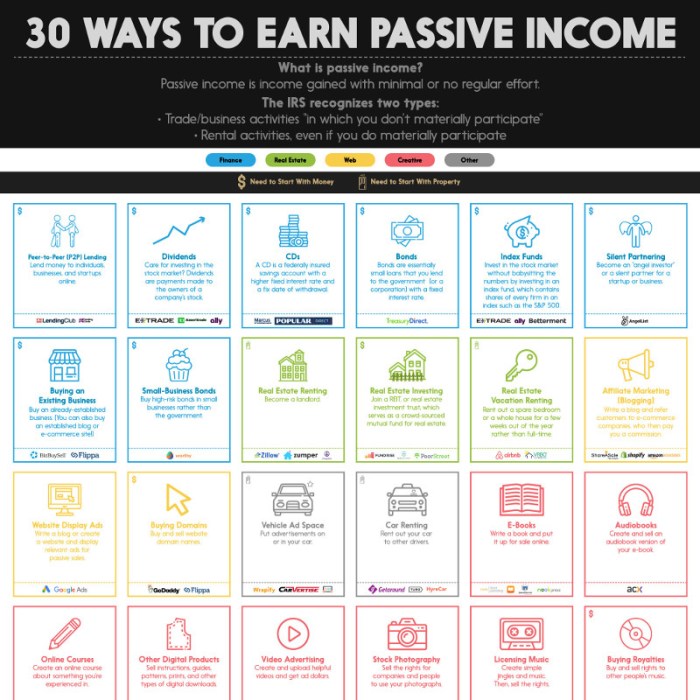

Types of Passive Business Investment Opportunities

Real Estate Investment Trusts (REITs)

REITs allow investors to earn income from real estate properties without the need to directly own or manage them. This passive investment option provides exposure to the real estate market with relatively low capital requirements.

Stock Market Index Funds

Investing in index funds that track the performance of the overall stock market can be a passive way to gain exposure to a diversified portfolio of stocks. Index funds offer broad market exposure and have lower fees compared to actively managed funds.

Peer-to-Peer Lending

Peer-to-peer lending platforms enable investors to lend money to individuals or businesses in exchange for interest payments. This passive investment opportunity can generate regular income through interest payments while diversifying the investment portfolio.

Real Estate Investment

Investing in real estate can be a lucrative way to generate passive income over time. Real estate offers various opportunities for passive investments, allowing investors to earn money without actively managing properties. Let’s explore different ways to invest passively in real estate, along with the potential risks and rewards associated with these investments.

Rental Properties

- One common way to invest passively in real estate is through rental properties. Investors can purchase residential or commercial properties and rent them out to tenants. Rental income can provide a steady stream of passive income.

- Investors can also hire property managers to handle day-to-day operations such as finding tenants, collecting rent, and maintaining the property, making it a more hands-off investment.

Real Estate Investment Trusts (REITs)

- REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investing in REITs allows investors to earn dividends and benefit from the appreciation of real estate assets without owning physical properties.

- REITs are traded on major stock exchanges, providing investors with liquidity and diversification in their real estate portfolios.

Crowdfunding Platforms

- Real estate crowdfunding platforms allow investors to pool their funds together to invest in real estate projects. Investors can choose specific properties or projects to invest in, diversifying their real estate portfolios.

- Crowdfunding platforms handle the management and operations of the properties, making it a passive investment option for individuals looking to enter the real estate market.

Potential Risks and Rewards

- Real estate investments offer the potential for long-term capital appreciation and passive income through rental payments or dividends.

- However, real estate investments can be subject to market fluctuations, economic downturns, and property-specific risks such as vacancies or unexpected repairs.

Tips for Beginners

- Research different real estate investment options and choose the one that aligns with your financial goals and risk tolerance.

- Consider working with a financial advisor or real estate professional to navigate the complexities of real estate investing.

- Start with a small investment to test the waters and gradually expand your real estate portfolio as you gain more experience and confidence in the market.

Stock Market Investments

Investing in stocks can be a lucrative way to generate passive income over time. By purchasing shares of companies, investors can benefit from capital appreciation and dividends without actively managing the day-to-day operations of the business.

Different Stock Market Investment Strategies

- Diversification: Spreading investments across different industries and sectors can help reduce risk and minimize the impact of market volatility.

- Buy and Hold: This strategy involves purchasing quality stocks and holding onto them for the long term, allowing for potential growth and compounding returns.

- Dividend Investing: Focusing on companies that pay dividends regularly can provide a steady stream of income to investors.

Role of Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are popular investment vehicles for passive investors looking to gain exposure to a diversified portfolio of stocks. These funds typically track a specific market index, providing broad market exposure and low management fees.

Tips for Minimizing Risks in Passive Stock Market Investments

- Do Your Research: Before investing in any stock, conduct thorough research on the company’s financials, management team, and industry outlook.

- Set Realistic Expectations: Understand that stock market investments come with inherent risks, and it’s essential to have a long-term perspective to ride out market fluctuations.

- Regularly Review Your Portfolio: Periodically review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance.

Peer-to-Peer Lending

Peer-to-peer lending has gained popularity as a passive income option for investors looking to diversify their portfolios. In this investment model, individuals lend money to other individuals or businesses through online platforms, cutting out traditional financial institutions like banks.

How Peer-to-Peer Lending Works

Peer-to-peer lending platforms connect borrowers with lenders, allowing investors to earn interest on the money they lend out. Investors can choose the amount they want to lend and the interest rate they wish to earn. The platform then matches lenders with borrowers based on their preferences.

Benefits of Peer-to-Peer Lending

- Higher Returns: Peer-to-peer lending often offers higher returns compared to traditional savings accounts or bonds.

- Diversification: Investors can spread their risk by lending to multiple borrowers.

- Control: Investors have control over which loans to fund, allowing them to tailor their risk level.

Risks of Peer-to-Peer Lending

- Default Risk: There is a risk that borrowers may default on their loans, leading to potential losses for investors.

- Liquidity Risk: Unlike stocks or bonds, peer-to-peer loans may have longer terms, limiting liquidity for investors who may need to access their funds quickly.

- Regulatory Risk: Changes in regulations could impact the operations of peer-to-peer lending platforms and affect investor returns.

Choosing the Right Platform

- Research: Look into the track record and reputation of the peer-to-peer lending platform before investing.

- Diversify: Spread your investments across different loans to minimize risk.

- Consider Fees: Be aware of any fees charged by the platform, as they can impact your overall returns.

Comparison with Other Passive Investments

Peer-to-peer lending offers the potential for high returns but comes with its own set of risks. When compared to other passive investments like real estate or stock market investments, peer-to-peer lending provides a unique opportunity for investors to directly participate in lending activities and potentially earn attractive returns.

In conclusion, Passive business investment ideas offer a gateway to building wealth with minimal effort. By wisely diversifying your investments and leveraging different passive income streams, you can secure a prosperous financial future.

When it comes to investment risk management for businesses , it is essential to have a solid strategy in place to protect your assets. By diversifying your portfolio and staying informed about market trends, you can minimize potential risks and maximize returns.

Exploring alternative investments for business can be a great way to diversify your portfolio and potentially achieve higher returns. From real estate to commodities, there are various options available for businesses looking to expand their investment horizons.

For businesses looking to navigate the world of investing, accessing business investor resources can provide valuable insights and guidance. From market analysis to investment strategies, these resources can help businesses make informed decisions and achieve their financial goals.