Forex copy trading platforms are revolutionizing the trading landscape, empowering traders to tap into the expertise of seasoned professionals. Dive into this comprehensive guide to discover the benefits, features, and strategies for navigating these platforms and maximizing your trading potential.

Forex copy trading platforms offer a convenient way to follow the trades of experienced traders, allowing beginners to learn from their strategies. However, it’s important to understand the risks involved, including the potential for losses.

For those looking to delve deeper into the complexities of currency trading, Forex forward contracts explained provides a comprehensive overview of these instruments and their applications.

By understanding the nuances of forward contracts, traders can make informed decisions and potentially mitigate risks in their Forex copy trading strategies.

In this article, we will delve into the intricacies of Forex copy trading platforms, exploring their features, advantages, and potential risks. We will provide a step-by-step guide to help you choose the right platform and navigate its functionalities effectively.

Forex copy trading platforms offer an accessible way to profit from the forex market without extensive knowledge or experience. If you’re looking to take your trading to the next level, consider using MetaTrader 4, a powerful trading platform that provides advanced tools and features.

Our comprehensive guide, How to trade Forex using MetaTrader 4 , will guide you through every step of the process, from setting up your account to executing trades.

With MetaTrader 4, you can access real-time market data, automate your trading strategies, and connect with other traders through copy trading platforms, making it an ideal choice for both beginners and experienced traders.

Introduction

Forex copy trading platforms offer traders the ability to automatically copy the trades of experienced traders, allowing them to potentially profit from the market without having to make their own trading decisions.

These platforms offer a range of benefits, including increased profitability, reduced risk, and the ability to learn from experienced traders.

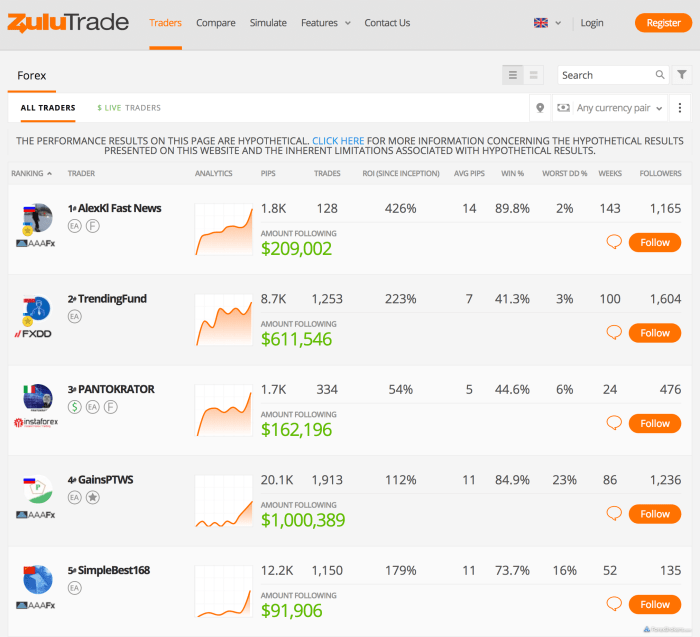

Some popular Forex copy trading platforms include:

- ZuluTrade

- eToro

- Myfxbook AutoTrade

- CopyFX

- FBS CopyTrade

Features of Forex Copy Trading Platforms

Forex copy trading platforms offer a range of features that can enhance the trading experience, including:

- Risk management tools: These tools allow traders to set stop-loss and take-profit orders, which can help to protect their capital.

- Social trading capabilities: These features allow traders to interact with each other, share ideas, and learn from each other.

- Performance tracking: These tools allow traders to track the performance of their own trades and the trades of the traders they are copying.

- Automated trading: These features allow traders to set up automated trading rules, which can help to remove the emotion from trading.

How to Choose a Forex Copy Trading Platform

When choosing a Forex copy trading platform, there are a number of factors to consider, including:

- Platform reliability: It is important to choose a platform that is reliable and has a good track record.

- Trader track record: It is important to choose a platform that has a good track record of providing profitable trades.

- Fees: It is important to consider the fees charged by the platform before signing up.

Using a Forex Copy Trading Platform

Using a Forex copy trading platform is relatively straightforward. Once you have chosen a platform and signed up, you will need to:

- Set up a trading plan: This plan should Artikel your trading goals, risk tolerance, and trading strategy.

- Manage your risk: It is important to manage your risk by setting stop-loss and take-profit orders.

- Copy the trades of experienced traders: Once you have found a few experienced traders to copy, you can start copying their trades.

Benefits and Risks of Forex Copy Trading Platforms

Forex copy trading platforms offer a number of benefits, including:

- Increased profitability: Forex copy trading platforms can help traders to increase their profitability by allowing them to copy the trades of experienced traders.

- Reduced risk: Forex copy trading platforms can help traders to reduce their risk by allowing them to set stop-loss and take-profit orders.

- Learning opportunities: Forex copy trading platforms can provide traders with the opportunity to learn from experienced traders.

However, there are also some risks associated with Forex copy trading platforms, including:

- The potential for losses: Forex copy trading platforms do not guarantee profits. There is always the potential for losses, even when copying the trades of experienced traders.

- The risk of scams: There are a number of scams associated with Forex copy trading platforms. It is important to do your research before choosing a platform.

Epilogue

Whether you’re a seasoned trader or just starting your Forex journey, Forex copy trading platforms offer a unique opportunity to enhance your trading experience.

By carefully considering the factors discussed in this guide, you can select a platform that aligns with your trading style and risk tolerance. Embrace the power of copy trading and unlock the potential for increased profitability and reduced risk.

General Inquiries: Forex Copy Trading Platforms

What are the key benefits of using Forex copy trading platforms?

Forex copy trading platforms offer a convenient way to follow the trades of experienced traders, allowing beginners to learn and profit from their expertise.

However, it’s crucial to understand the concept of Forex margin trading , which involves trading with borrowed funds to increase potential profits.

By understanding the risks and rewards associated with margin trading, traders can make informed decisions when using copy trading platforms.

Copy trading platforms offer numerous benefits, including access to experienced traders’ strategies, reduced risk through diversification, and the potential for increased profitability.

How do I choose the right Forex copy trading platform?

Consider factors such as platform reliability, trader track record, fees, and the availability of risk management tools and social trading capabilities.

What are the potential risks associated with Forex copy trading?

Copy trading involves following the trades of others, and there is always the risk of losses. It’s essential to manage risk effectively and understand the potential drawbacks.