As E-commerce investment trends takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The ebb and flow of e-commerce investment trends shape the business landscape in dynamic ways, impacting sectors and strategies across the board.

E-commerce Investment Trends Overview

In today’s digital age, e-commerce investment trends play a crucial role in shaping the business landscape. These trends refer to the patterns and developments in the e-commerce sector that investors are focusing on to maximize their returns and stay ahead of the competition. Staying updated on these trends is essential for businesses looking to thrive in the ever-evolving online marketplace.

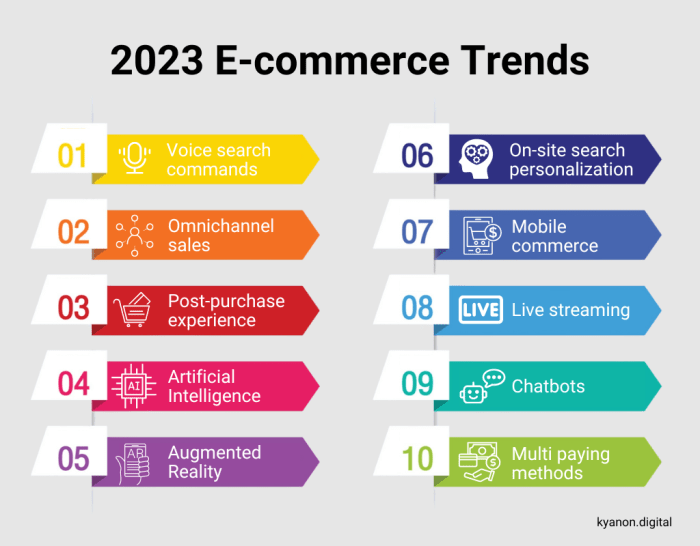

Examples of Recent E-commerce Investment Trends

- Artificial Intelligence (AI) Integration: Many e-commerce companies are investing in AI technology to enhance customer experience, personalize recommendations, and streamline operations.

- Augmented Reality (AR) in Retail: Retailers are incorporating AR technology to allow customers to virtually try on products before making a purchase, improving engagement and reducing returns.

- Sustainable E-commerce Practices: Investors are showing interest in e-commerce businesses that prioritize sustainability, from eco-friendly packaging to carbon-neutral operations.

Importance of Staying Updated on E-commerce Investment Trends

Investors and businesses that stay informed about e-commerce investment trends can make strategic decisions that align with market demands and consumer preferences. By keeping an eye on emerging trends, companies can adapt their strategies, optimize their operations, and capitalize on new opportunities in the competitive e-commerce landscape.

Factors Influencing E-commerce Investment Trends

Investing in e-commerce is influenced by a multitude of factors that shape the landscape of online retail. Understanding these key drivers is crucial for businesses looking to capitalize on the growing opportunities in the digital marketplace.

Consumer behavior plays a significant role in driving e-commerce investment trends. The preferences, habits, and shopping patterns of consumers directly impact the strategies adopted by e-commerce businesses. As consumer expectations evolve, companies must adapt by investing in technologies and services that enhance the online shopping experience.

Impact of Technology Advancements

Technological advancements have revolutionized the e-commerce industry, providing new opportunities for businesses to innovate and grow. From artificial intelligence and machine learning to augmented reality and virtual reality, emerging technologies are reshaping the way consumers interact with online stores. Investments in these technologies can help businesses stay competitive and meet the changing demands of the market.

Market Demand Influence

Market demand plays a crucial role in shaping e-commerce investment trends. Understanding consumer needs and preferences is essential for businesses to identify growth opportunities and develop products or services that resonate with their target audience. By analyzing market trends and consumer behavior, companies can make informed investment decisions that drive profitability and long-term success in the e-commerce sector.

Global E-commerce Investment Landscape: E-commerce Investment Trends

The global e-commerce investment landscape is dynamic and constantly evolving, with different regions around the world experiencing varying trends and patterns in investment activities. Cross-border investments play a significant role in shaping the e-commerce sector, driving innovation, growth, and competition.

Regional E-commerce Investment Trends

- North America: The e-commerce market in North America is mature and highly competitive, with a strong focus on technology and innovation. Major players like Amazon and Walmart dominate the market, attracting significant investments in logistics, AI, and customer experience.

- Europe: E-commerce investments in Europe are characterized by a diverse landscape of startups and established players. The region has seen a rise in cross-border investments, with companies expanding into new markets and leveraging technology to enhance their competitiveness.

- Asia-Pacific: The Asia-Pacific region is a hotbed for e-commerce investment, driven by rapid digital adoption, growing middle-class population, and increasing internet penetration. Countries like China, India, and Southeast Asian nations are witnessing a surge in e-commerce investments across various sectors.

- Latin America: E-commerce investments in Latin America are on the rise, fueled by changing consumer behaviors, improved infrastructure, and increasing access to digital technologies. The region offers opportunities for investors looking to tap into emerging markets and untapped potential.

Cross-Border Investments in E-commerce

Cross-border investments play a crucial role in the e-commerce sector, enabling companies to expand their reach, access new markets, and diversify their revenue streams. By investing in cross-border e-commerce, businesses can leverage global trends, capitalize on international opportunities, and create a competitive advantage in the global marketplace.

Emerging Technologies Shaping E-commerce Investments

Emerging technologies such as Artificial Intelligence (AI), Augmented Reality/Virtual Reality (AR/VR), and blockchain are revolutionizing the e-commerce industry, influencing investment trends and paving the way for innovative business models.

Artificial Intelligence (AI) in E-commerce

AI is being used in e-commerce to personalize customer experiences, optimize pricing strategies, enhance product recommendations, and streamline supply chain operations. Retail giants like Amazon and Alibaba have successfully implemented AI-powered solutions to improve customer engagement and increase sales.

Augmented Reality/Virtual Reality (AR/VR) in E-commerce

AR/VR technologies are transforming the way consumers shop online by providing immersive experiences, allowing customers to visualize products before making a purchase. Companies like IKEA and Sephora have launched AR apps that enable customers to virtually try out furniture and makeup products, enhancing the online shopping experience.

Blockchain Technology in E-commerce

Blockchain technology offers enhanced security, transparency, and traceability in e-commerce transactions, reducing the risk of fraud and ensuring data integrity. Companies like Shopify and OpenBazaar are leveraging blockchain to create decentralized marketplaces, enabling peer-to-peer transactions without the need for intermediaries.

Risks and Rewards of Investing in Cutting-edge E-commerce Technologies

Investing in emerging technologies comes with both risks and rewards. While early adoption of AI, AR/VR, and blockchain can provide a competitive edge and drive business growth, there are challenges such as high implementation costs, integration complexities, and data privacy concerns. It is crucial for investors to carefully evaluate the potential risks and rewards associated with investing in cutting-edge e-commerce technologies to make informed decisions.

In conclusion, understanding and adapting to the ever-changing realm of e-commerce investment trends is crucial for businesses looking to thrive in the digital marketplace. Stay informed, stay agile, and embrace the opportunities that lie ahead.

When it comes to small business funding sources , entrepreneurs have various options to explore. From traditional bank loans to crowdfunding platforms, it’s essential to choose the right funding avenue that aligns with your business goals and financial needs.

Entrepreneurs looking to expand their operations may consider business capital investment as a strategic move. Whether seeking venture capital or angel investors, securing the right funding can propel your business to new heights and unlock growth opportunities.

For those seeking low-risk business investments , options like bonds or treasury securities may be appealing. By diversifying your portfolio with low-risk investments, you can protect your capital while potentially earning steady returns over time.