Day Trading Strategies – Day trading in the forex market can be both exhilarating and profitable, but it requires a deep understanding of strategies that can maximize gains while minimizing risks. In this article, we will explore 6 effective day trading strategies for forex that can help you navigate the volatile currency markets.

Understanding Forex Day Trading

What is Day Trading?

Day trading involves buying and selling financial instruments within the same trading day. In the forex market, this means opening and closing trades on currency pairs before the market closes for the day. The goal is to capitalize on short-term price movements, allowing traders to make profits from small fluctuations in the market.

Why Forex?

The forex market is the largest and most liquid financial market globally, making it an ideal place for day trading. With over $6 trillion traded daily, it offers numerous opportunities for traders to enter and exit positions quickly. Additionally, forex markets operate 24 hours a day, five days a week, providing flexibility for traders across different time zones.

Trend Following Strategy

Identifying Trends

The trend following strategy is one of the most popular approaches in day trading. It involves identifying the direction of the market trend—whether it’s upward, downward, or sideways—and making trades in that direction.

How to Implement

- Use Moving Averages: Employ tools like the 50-day and 200-day moving averages to identify long-term trends.

- Trendlines: Draw trendlines on charts to visualize the trend direction.

- Enter Trades: Buy when the market is trending upwards and sell when it’s trending downwards.

Key Tools

- Chart Patterns: Recognize patterns like flags, triangles, and head-and-shoulders that indicate potential trend continuations.

- Momentum Indicators: Use indicators like the Relative Strength Index (RSI) to confirm trends.

Breakout Strategy

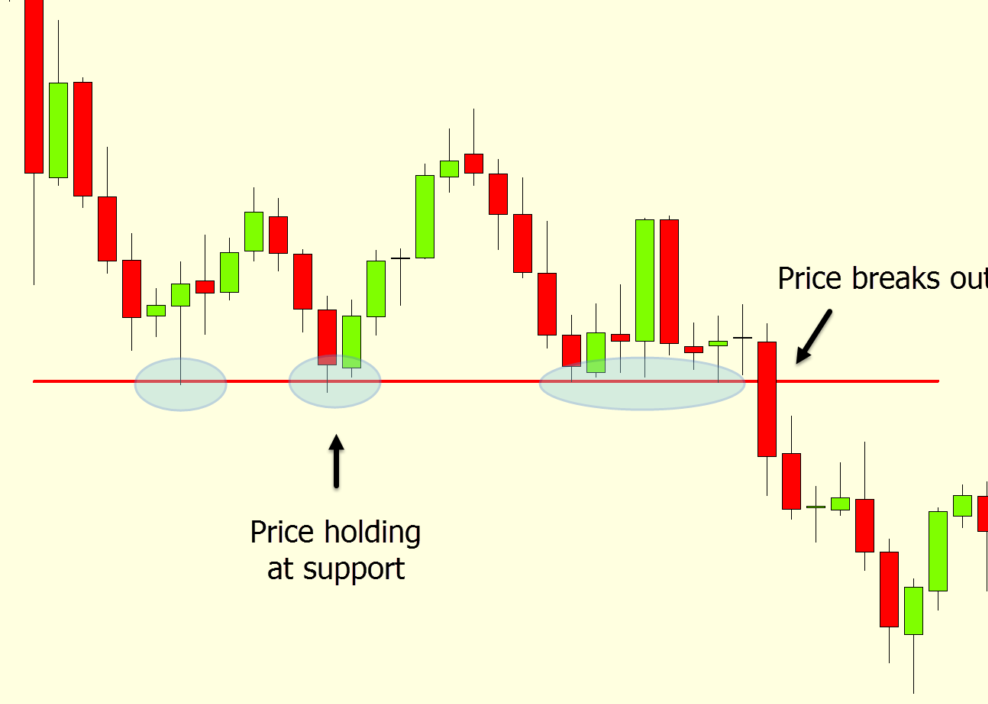

Understanding Breakouts

A breakout occurs when the price moves outside a defined support or resistance level. This strategy capitalizes on the increased volatility that often follows a breakout.

Steps to Execute

- Identify Levels: Determine key support and resistance levels on your charts.

- Wait for Confirmation: Look for strong volume and price action to confirm the breakout.

- Set Stop-Loss Orders: Protect your capital by placing stop-loss orders just below support or above resistance.

Advantages

- High Reward Potential: Breakouts can lead to significant price movements, offering lucrative profit opportunities.

- Clear Entry and Exit Points: Breakouts provide clear signals for entering and exiting trades.

Scalping Strategy

What is Scalping?

Scalping is a rapid trading strategy that aims to make small profits from minor price changes. Traders who employ this technique typically hold positions for a few seconds to a few minutes.

How to Scale Successfully

- Focus on Liquid Markets: Trade highly liquid currency pairs to ensure quick entry and exit.

- Use a Fast Execution Platform: Speed is crucial in scalping; choose platforms with low latency.

- Small Position Sizes: Limit exposure by using small position sizes for each trade.

Tools for Scalping

- Tick Charts: Utilize tick charts to monitor price movements in real-time.

- Level II Quotes: Access Level II quotes for a deeper insight into market depth.

News Trading Strategy

Capitalizing on Economic Events

News trading involves making trading decisions based on economic news releases that can impact currency values. Economic indicators like interest rates, employment figures, and GDP can cause substantial volatility in forex prices.

Steps for News Trading

- Stay Informed: Use an economic calendar to track upcoming news events and their potential impact on the forex market.

- Plan Ahead: Prepare your trading strategy before news releases; decide whether to enter or exit positions.

- Manage Risk: Implement strict risk management practices to protect against market spikes.

Timing is Everything

- Market Reactions: Understand how the market historically reacts to specific news events.

- Volatility: Be prepared for increased volatility immediately following news releases.

Range Trading Strategy

What is Range Trading?

Range trading is a strategy that exploits price fluctuations between established support and resistance levels. This approach is ideal when the market lacks a clear trend.

How to Execute

- Identify Ranges: Use historical price data to identify ranges where the price tends to bounce between support and resistance.

- Buy at Support: Enter buy orders near the support level and sell near the resistance level.

- Use Oscillators: Employ indicators like the Stochastic Oscillator to confirm overbought or oversold conditions.

Benefits of Range Trading

- Lower Risk: This strategy often comes with lower risk compared to trending markets.

- Predictable Outcomes: Ranges can be easier to predict, making it simpler to set target prices.

Technical Analysis Strategy

The Role of Technical Analysis

Technical analysis involves analyzing price charts and using indicators to forecast future price movements. This strategy is crucial for day traders as it helps identify optimal entry and exit points.

Key Components

- Candlestick Patterns: Learn to read candlestick patterns that indicate market sentiment and potential reversals.

- Technical Indicators: Use indicators like MACD, Bollinger Bands, and Fibonacci retracements to enhance decision-making.

Implementing Technical Analysis

- Develop a Trading Plan: Create a systematic approach based on your technical analysis, specifying when to enter and exit trades.

- Backtesting: Test your strategies on historical data to evaluate their effectiveness before using them in live trading.

Conclusion

Day trading in the forex market requires a solid understanding of various strategies to navigate its complexities successfully. Whether you choose to follow trends, capitalize on breakouts, or rely on technical analysis, each strategy has its merits and can be profitable with the right approach.

By implementing these 6 day trading strategies for forex, you can enhance your trading skills and increase your chances of success in this dynamic market. Remember to continuously educate yourself, practice risk management, and stay informed about market conditions to thrive as a day trader.

For more resources and insights into forex trading, consider visiting Forex Factory, a valuable site for traders seeking news, forums, and economic calendars.