Crowdfunding vs. venture capital sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

When exploring the realms of financing options for startups and high-growth companies, the choice between crowdfunding and venture capital can significantly impact the trajectory of a business. This article delves into the nuances of each funding method, shedding light on their unique characteristics and implications for entrepreneurs and investors alike.

Crowdfunding vs. Venture Capital

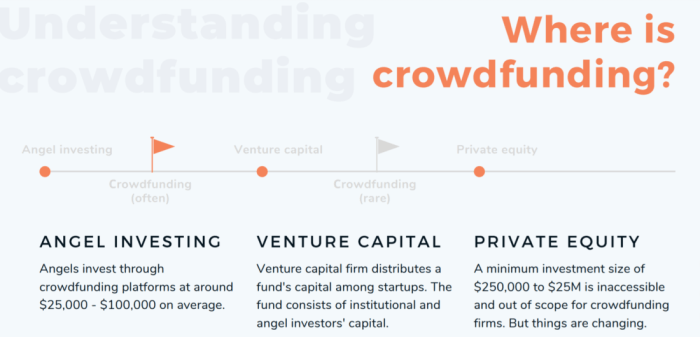

Crowdfunding and venture capital are two popular methods for raising funds for startups or new business ventures. Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. On the other hand, venture capital refers to funding provided by professional investors or venture capital firms in exchange for equity in the company.

Successful Companies Funded Through Crowdfunding

- Pebble Technology: Pebble Technology, a smartwatch company, raised over $20 million through crowdfunding platform Kickstarter.

- Oculus VR: Oculus VR, a virtual reality company, raised $2.4 million through Kickstarter before being acquired by Facebook for $2 billion.

Successful Companies Funded Through Venture Capital

- Uber: Uber, the ride-hailing giant, raised significant funds from venture capital firms such as Benchmark and GV, helping it grow into a global company.

- Airbnb: Airbnb, the online accommodation marketplace, received funding from venture capital firms like Sequoia Capital and Andreessen Horowitz, propelling its growth and expansion.

Benefits and Drawbacks of Crowdfunding Over Venture Capital

- Benefits:

- Access to a larger pool of potential investors.

- Can generate buzz and validation for the product or idea.

- No equity dilution as funds are typically provided as rewards or pre-sales.

- Drawbacks:

- Risk of idea theft or copycats due to public exposure.

- No ongoing support or guidance from experienced investors.

- Potential for campaign failure if funding goal is not met.

Crowdfunding: Crowdfunding Vs. Venture Capital

Crowdfunding is a popular method for raising funds by collecting small amounts of money from a large number of individuals. It offers a way for entrepreneurs, startups, and even established companies to access capital for various projects or business endeavors.

Types of Crowdfunding Models, Crowdfunding vs. venture capital

- Reward-Based Crowdfunding: In this model, backers receive rewards or perks in exchange for their financial support. These rewards can range from early access to products, exclusive merchandise, or personalized experiences.

- Donation-Based Crowdfunding: Individuals contribute money without expecting any tangible returns. This model is often used for charitable causes, disaster relief efforts, or community projects.

- Equity-Based Crowdfunding: Investors receive equity or ownership stakes in the company in exchange for their financial support. This model allows backers to potentially earn a return on their investment if the company succeeds.

Leveraging Crowdfunding for Business Growth

Companies can leverage crowdfunding in several ways to support product development or business growth:

- Testing Market Demand: Crowdfunding campaigns can serve as a way to gauge interest in a new product or service before investing significant resources.

- Building a Community: By engaging with backers and supporters during a crowdfunding campaign, companies can create a loyal customer base and brand advocates.

- Raising Capital: Crowdfunding can provide an alternative source of funding, especially for early-stage companies or projects that may not qualify for traditional financing.

Key Factors for Crowdfunding Success

Several key factors can contribute to the success of a crowdfunding campaign:

- Compelling Storytelling: Sharing a compelling narrative that resonates with backers can help generate interest and support for the campaign.

- Clear Communication: Providing transparent and clear information about the project, goals, and rewards is essential for building trust with potential backers.

- Engagement and Promotion: Actively engaging with the community, responding to questions, and promoting the campaign through various channels can help reach a wider audience.

- Setting Realistic Goals: Setting achievable funding goals and offering realistic rewards can increase the likelihood of reaching and surpassing the target.

Venture Capital

Venture capital plays a crucial role in funding startups and high-growth companies by providing financial support to businesses with high growth potential but also high risk. Venture capitalists typically invest in early-stage companies in exchange for equity ownership.

The Role of Venture Capital

Venture capital firms provide funding to startups in exchange for equity, allowing them to grow and scale their businesses. These firms often take an active role in the companies they invest in, providing not just capital but also expertise, mentorship, and networking opportunities.

- Venture capital firms typically invest in startups with high growth potential in sectors such as technology, biotech, and fintech.

- They are willing to take on the high risk associated with early-stage companies in exchange for the potential for high returns on their investment.

- Venture capitalists often look for startups with innovative ideas, strong management teams, and a scalable business model.

Securing Venture Capital Funding

Securing venture capital funding involves a rigorous process where entrepreneurs pitch their business ideas to potential investors. Venture capitalists evaluate startups based on various criteria, including market potential, competitive landscape, and the team’s expertise.

- Entrepreneurs often need to have a solid business plan, a clear go-to-market strategy, and a strong understanding of their target market.

- Due diligence is conducted by venture capitalists to assess the feasibility and potential of the startup before making an investment decision.

- Negotiations on valuation, equity stake, and terms of the investment are crucial steps in securing venture capital funding.

Advantages and Disadvantages of Venture Capital

Raising capital through venture capital firms offers various advantages, such as access to expertise, networking opportunities, and financial resources to fuel growth. However, there are also disadvantages, including loss of control, dilution of ownership, and pressure to deliver high returns to investors.

- Advantages:

- Access to funding for startups with high growth potential.

- Expertise, mentorship, and networking opportunities provided by venture capitalists.

- Potential for rapid growth and scalability with the support of venture capital firms.

- Disadvantages:

- Loss of control as venture capitalists often take an active role in the company.

- Dilution of ownership as equity is exchanged for funding.

- Pressure to deliver high returns to investors within a specified timeframe.

Financial Considerations

When deciding between crowdfunding and venture capital, one of the most critical factors to consider is the financial implications of each option. Both crowdfunding and venture capital have distinct impacts on a company’s valuation, equity distribution, and overall financial health.

Impact on Valuation and Equity Distribution

Crowdfunding campaigns typically involve offering rewards or equity in exchange for financial contributions from a large number of individuals. This can dilute the ownership stake of existing shareholders but allows the company to retain full control over its operations. On the other hand, venture capital funding involves selling a portion of the company to investors in exchange for capital, which can lead to a decrease in the founders’ ownership stake but also provides access to valuable expertise and resources.

Examples of Growth Strategies

– Oculus Rift, a virtual reality company, used crowdfunding on Kickstarter to raise initial capital for its development. The campaign was a massive success, raising over $2.4 million and generating significant buzz around the product.

– Uber, a transportation technology company, raised venture capital funding to fuel its rapid expansion globally. The funding allowed Uber to enter new markets, develop new technologies, and stay ahead of the competition in the ride-sharing industry.

Overall, the choice between crowdfunding and venture capital depends on the company’s specific financial needs, growth goals, and long-term strategy.

In conclusion, the decision between crowdfunding and venture capital is not merely a financial one but a strategic choice that can shape the future of a company. By weighing the benefits and drawbacks of each approach, entrepreneurs can navigate the complex landscape of fundraising with confidence and foresight.

When it comes to maximizing your investment return on business assets , it’s crucial to diversify your portfolio and carefully monitor market trends. By staying informed and making strategic decisions, you can ensure a healthy return on your investments.

For entrepreneurs looking to raise capital, crowdfunding for business investments has become a popular option. With platforms like Kickstarter and Indiegogo, businesses can reach a wide audience of potential investors and secure the funding they need to grow.

Planning for retirement is essential for business owners, and it’s never too early to start. By setting aside a portion of your profits and consulting with a financial advisor, you can create a solid retirement plan that will provide financial security in your later years.