Welcome to the world of car insurance estimators, where understanding your insurance coverage and premiums becomes a breeze. This guide will take you on a journey to unravel the complexities of car insurance, empowering you to make informed decisions that protect your financial well-being.

In this comprehensive guide, we’ll delve into the various coverage options available, unravel the factors that influence premiums, explore methods for estimating costs, and uncover additional considerations that may impact your insurance expenses. Get ready to unlock the secrets of car insurance and drive towards financial peace of mind.

If you’re looking for an easy way to get a quick estimate on your car insurance, then you should use a car insurance estimator. These tools can help you compare rates from different companies and find the best deal for your needs.

Once you’ve found a few companies that you’re interested in, you can then contact a car insurance broker to get more information and help you make a decision. A broker can help you compare policies, negotiate rates, and file claims.

They can also provide advice on how to reduce your insurance costs.

Car Insurance Coverage Options

Car insurance coverage protects you financially in the event of an accident or other covered incident. There are various types of coverage available, each with its own benefits and limitations.

Car insurance estimators can help you estimate the cost of your car insurance. If you’re looking for a more affordable option, consider car insurance costco. They offer competitive rates and discounts for members.

With a car insurance estimator, you can compare quotes from different providers and find the best deal for your needs.

Liability Coverage

- Protects you if you cause damage to another person or their property in an accident.

- Required by law in most states.

- Typically includes bodily injury liability and property damage liability.

Collision Coverage

- Covers damage to your own vehicle in an accident, regardless of fault.

- Optional coverage, but highly recommended.

- Can help you avoid paying for expensive repairs out of pocket.

Comprehensive Coverage

- Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Optional coverage, but can provide peace of mind.

- Can be especially beneficial if you live in an area prone to certain hazards.

Factors Affecting Premiums

Car insurance premiums vary widely depending on a number of factors, including:

Driving History

- Accidents and traffic violations can significantly increase your premiums.

- A clean driving record can earn you discounts.

Vehicle Type

- Sports cars and luxury vehicles typically have higher premiums than sedans and SUVs.

- Vehicles with safety features may qualify for discounts.

Location

- Premiums tend to be higher in urban areas with more traffic and accidents.

- Areas with high rates of theft or vandalism can also lead to higher premiums.

Age and Experience

- Younger drivers with less experience typically pay higher premiums.

- As you age and gain more driving experience, your premiums may decrease.

Methods for Estimating Costs: Car Insurance Estimator

There are several ways to estimate the cost of car insurance:

Online Calculators, Car insurance estimator

- Provide a quick and easy way to get an estimate.

- May not be as accurate as other methods.

Insurance Agents

- Can provide personalized quotes based on your specific needs.

- May charge a fee for their services.

Company Websites

- Allow you to get quotes directly from insurance companies.

- May offer discounts for online purchases.

Additional Considerations

In addition to the factors discussed above, there are other considerations that may impact car insurance costs:

Discounts

- Many insurance companies offer discounts for things like good driving records, bundling policies, and installing safety features.

Deductibles

- The amount you pay out of pocket before insurance coverage kicks in.

- Higher deductibles typically result in lower premiums.

Payment Plans

- Some insurance companies offer payment plans that allow you to spread out your premiums over time.

- Payment plans may come with additional fees.

Tips for Reducing Costs

- Maintain a clean driving record.

- Drive a safe and reliable vehicle.

- Live in a low-risk area.

- Ask for discounts.

- Consider raising your deductible.

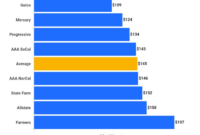

- Shop around for the best rates.

Last Recap

Navigating the world of car insurance doesn’t have to be a daunting task. With the insights gained from this guide, you’re now equipped to make informed decisions that safeguard your financial interests.

Remember, understanding your coverage options, considering the factors that affect premiums, and exploring different estimation methods are key to optimizing your insurance expenses.

By following the tips and strategies Artikeld in this guide, you can confidently secure the right coverage at the right price, ensuring peace of mind on the road.

To find the best deal on car insurance, you’ll need to get quotes from multiple insurers. A car insurance estimator can help you do this quickly and easily. Simply enter your information and the estimator will provide you with a list of quotes from top insurers in your area.

If you’re looking for car insurance in Chicago, be sure to check out our guide to car insurance chicago. We’ll help you find the best coverage at the best price. Getting quotes from multiple insurers is the best way to ensure that you’re getting the best deal on car insurance.

Answers to Common Questions

What are the different types of car insurance coverage available?

Car insurance coverage options typically include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How do I estimate the cost of my car insurance?

You can estimate your car insurance cost using online calculators, consulting with insurance agents, or visiting insurance company websites.

What factors affect my car insurance premiums?

Factors that influence premiums include driving history, vehicle type, location, age, and credit score.

How can I reduce my car insurance costs?

Consider discounts for multiple vehicles, good driving records, and safety features. Additionally, increasing your deductible can also lower premiums.