Business mergers and acquisitions take center stage in the corporate world, shaping the landscape of industries and economies. Dive into this comprehensive guide to explore the nuances and intricacies of these strategic business moves.

Understanding Business Mergers and Acquisitions

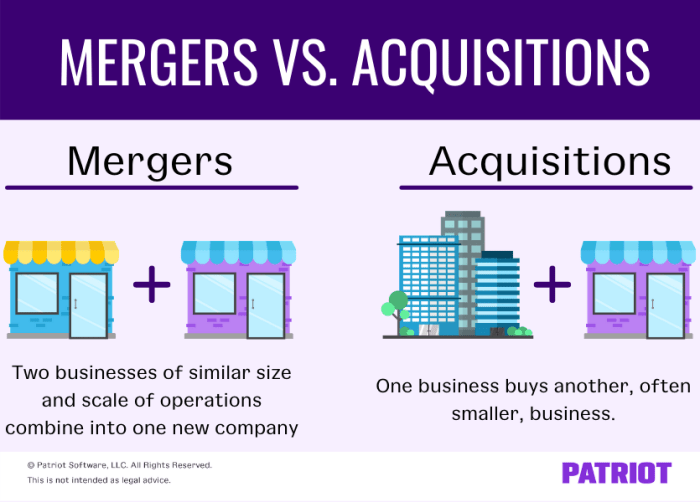

In the world of business, mergers and acquisitions are common strategies used by companies to expand, increase market share, or achieve synergies. While they are often used interchangeably, mergers and acquisitions have distinct differences in terms of structure and purpose.

Difference between Mergers and Acquisitions

When two companies come together to form a new entity, it is known as a merger. In a merger, both companies typically combine their resources, operations, and ownership to create a stronger, more competitive organization. On the other hand, an acquisition involves one company purchasing another, resulting in the acquired company becoming a part of the acquiring company.

Examples of Successful Mergers and Acquisitions

– The acquisition of WhatsApp by Facebook in 2014 for $19 billion is considered a successful move that allowed Facebook to expand its user base and strengthen its presence in the messaging app market.

– The merger between Disney and Pixar in 2006 resulted in the creation of blockbuster movies like Toy Story and Finding Nemo, showcasing the power of combining creative talents and resources.

Reasons for Companies Opting for Mergers and Acquisitions

- Market Expansion: Companies may opt for mergers and acquisitions to enter new markets or expand their presence in existing markets.

- Synergies: By combining resources, expertise, and operations, companies can achieve synergies that result in cost savings or revenue growth.

- Competitive Advantage: Mergers and acquisitions can help companies gain a competitive edge by increasing market share, diversifying product offerings, or accessing new technologies.

- Strategic Growth: Companies may pursue mergers and acquisitions as part of their strategic growth plans to achieve long-term objectives and enhance shareholder value.

Types of Mergers

When it comes to business mergers, there are different types that companies can engage in based on their strategic goals and objectives. Understanding the various types of mergers is essential for companies looking to expand their operations or gain a competitive edge in the market.

Horizontal Merger

A horizontal merger occurs when two companies operating in the same industry and at the same stage of the production process merge together. This type of merger aims to increase market share, reduce competition, and achieve economies of scale. One advantage of a horizontal merger is that it can lead to cost savings through synergies and increased efficiency. However, a major disadvantage is that it may raise antitrust concerns due to reduced competition in the market.

Real-life example: The merger between Exxon and Mobil in 1999 is a classic example of a horizontal merger. Both companies were major players in the oil and gas industry, and the merger allowed them to combine their resources and strengths to become a dominant force in the market.

Vertical Merger

In a vertical merger, companies operating at different stages of the production process within the same industry come together. This type of merger aims to streamline operations, improve supply chain efficiency, and control costs. One advantage of a vertical merger is that it can lead to better coordination between different stages of production. However, a disadvantage is the potential for conflicts of interest between different parts of the merged entity.

Real-life example: The acquisition of Whole Foods by Amazon in 2017 is a notable vertical merger. Amazon, an e-commerce giant, acquired Whole Foods, a grocery chain, to integrate online and offline retail operations, creating a seamless shopping experience for customers.

Conglomerate Merger

A conglomerate merger involves companies that operate in unrelated industries or sectors coming together. This type of merger allows companies to diversify their business interests, reduce risk, and take advantage of growth opportunities in new markets. An advantage of a conglomerate merger is the potential for increased revenue streams and reduced dependence on a single market. However, a disadvantage is the challenge of managing diverse business operations effectively.

Real-life example: The merger between Disney and ABC in 1995 is a well-known conglomerate merger. Disney, a media and entertainment company, acquired ABC, a broadcasting network, to expand its presence in the television industry and diversify its revenue streams.

Strategies for Successful Mergers and Acquisitions

Mergers and acquisitions (M&A) can be complex processes that require careful planning and execution to ensure success. Companies need to consider a range of key strategies to navigate these transactions effectively.

Role of Due Diligence, Business mergers and acquisitions

Due diligence is a critical component of the M&A process, involving a comprehensive assessment of the target company to evaluate its financial, legal, operational, and strategic aspects. This step is essential for identifying potential risks and opportunities associated with the deal, helping companies make informed decisions and avoid costly mistakes.

- Conduct thorough financial due diligence to assess the target company’s financial health, including its assets, liabilities, revenue streams, and growth potential.

- Perform legal due diligence to review contracts, litigation issues, intellectual property rights, and compliance matters that could impact the deal.

- Evaluate operational due diligence to understand the target company’s business processes, technology infrastructure, supply chain, and potential synergies with the acquiring company.

- Strategic due diligence is crucial to assess how the deal aligns with the acquiring company’s overall business goals, market position, and growth strategy.

Effective due diligence can help companies mitigate risks, identify value drivers, and optimize the deal structure for a successful merger or acquisition.

Cultural Integration in M&A

Cultural integration plays a vital role in the success of mergers and acquisitions, as it affects employee morale, productivity, and overall organizational performance. Companies must focus on aligning the cultures of the merging entities to create a cohesive and harmonious working environment.

- Develop a comprehensive cultural integration strategy that addresses differences in communication styles, leadership approaches, organizational values, and work practices.

- Engage employees from both companies in the integration process to foster collaboration, build trust, and promote a sense of shared purpose and identity.

- Provide cultural awareness training to help employees understand and appreciate the diverse perspectives, norms, and behaviors within the newly combined organization.

- Establish clear communication channels, feedback mechanisms, and recognition programs to reinforce a positive cultural environment and facilitate smooth integration.

By prioritizing cultural integration, companies can enhance employee engagement, retention, and performance, leading to a more successful merger or acquisition.

Legal and Regulatory Considerations

In any merger or acquisition, there are several legal and regulatory considerations that must be taken into account to ensure a smooth process and compliance with the law.

Legal Steps in a Merger or Acquisition

When it comes to legal steps in a merger or acquisition, there are several key components to consider. Firstly, due diligence is crucial, where both parties conduct a thorough investigation of each other’s financial and legal standing. Next, a confidentiality agreement is typically signed to protect sensitive information during negotiations. Once terms are agreed upon, a definitive agreement is drafted outlining the terms of the deal. Finally, the deal is closed, and legal documentation is filed with the appropriate regulatory bodies.

Antitrust Issues in M&A Process

Antitrust issues can arise during the merger or acquisition process, especially if the resulting company would have a dominant market position that could potentially harm competition. To address antitrust concerns, parties may need to seek approval from regulatory bodies such as the Federal Trade Commission (FTC) or the Department of Justice (DOJ). These agencies will assess the potential impact on market competition and may require certain conditions to be met before approving the deal.

Role of Regulatory Bodies in M&As

Regulatory bodies play a critical role in overseeing mergers and acquisitions to ensure fair competition and protect consumers. They review proposed transactions to assess their impact on the market and determine whether they comply with antitrust laws. In the United States, the FTC and DOJ are the primary regulatory bodies responsible for evaluating and approving mergers and acquisitions. Additionally, other countries have their own regulatory agencies that oversee M&A activity to safeguard fair competition and protect consumers from monopolistic practices.

Financial Aspects of Mergers and Acquisitions: Business Mergers And Acquisitions

In the realm of mergers and acquisitions, the financial aspects play a crucial role in determining the success and value of the deal. From valuation to financing options and impact on stock prices, understanding these financial aspects is essential for companies engaging in M&A activities.

Valuation in Mergers and Acquisitions

Valuation in mergers and acquisitions is the process of determining the worth of a company or its assets. There are several methods used for valuation, including:

- Comparable Company Analysis (CCA): This method involves comparing the target company to similar publicly traded companies to determine its value.

- Discounted Cash Flow (DCF) Analysis: This method involves estimating the future cash flows of the target company and discounting them back to present value.

- Asset-Based Valuation: This method involves valuing the assets and liabilities of the target company to determine its net worth.

Financing Options for M&A Activities

Companies engaging in mergers and acquisitions have several financing options available to fund the deal, including:

- Debt Financing: Companies can take on debt through loans or bonds to finance the acquisition.

- Equity Financing: Companies can issue new shares or use their existing stock as a form of financing for the acquisition.

- Hybrid Financing: Companies can use a combination of debt and equity financing to fund the acquisition.

Impact on Stock Prices and Shareholder Value

Mergers and acquisitions can have a significant impact on the stock prices and shareholder value of the companies involved. Some of the impacts include:

- Stock Price Movement: The announcement of a merger or acquisition can lead to fluctuations in the stock prices of both the acquiring and target companies.

- Shareholder Value Creation: Successful mergers and acquisitions can create value for shareholders through synergies, increased market share, and cost savings.

- Shareholder Wealth Transfer: In some cases, the value of the acquiring company’s stock may decrease post-acquisition, leading to a transfer of wealth from shareholders.

In conclusion, navigating the realm of business mergers and acquisitions requires a delicate balance of strategy, diligence, and foresight. As companies continue to seek growth and expansion opportunities, understanding the intricacies of M&A is paramount for success in today’s dynamic market.

Business capital investment plays a crucial role in the growth and sustainability of any business. It involves allocating funds to different aspects of the business to generate profits. Finding business partners for investments can help in expanding the business and sharing risks. When looking for opportunities, it’s essential to research the top industries to invest in. Business capital investment and strategic partnerships are key factors in achieving long-term success.

When searching for potential business partners for investments, it’s important to consider their expertise, resources, and shared vision. Collaborating with the right partners can lead to mutual growth and success. Explore different industries and assess their potential for growth and profitability. Finding business partners for investments can be a strategic move towards achieving your business goals.

Some of the top industries to invest in include technology, healthcare, and renewable energy. These sectors offer promising opportunities for growth and innovation. Conduct thorough market research to identify trends and potential risks before making any investment decisions. Top industries to invest in are constantly evolving, so staying informed is key to making profitable investments.