Starting with Benefits of business investments, this engaging introduction highlights the crucial role of investments in fueling economic growth and innovation, while maximizing returns for businesses.

Delve deeper into the various aspects of business investments and their impact on companies across different industries.

Importance of Business Investments: Benefits Of Business Investments

Investing in business plays a crucial role in driving economic growth, creating job opportunities, increasing productivity, fostering innovation, and enhancing competitiveness in the market. Let’s delve deeper into the significance of business investments:

Economic Growth

Business investments fuel economic growth by injecting capital into various sectors, stimulating demand, and promoting overall economic activity. These investments lead to the creation of new businesses, expansion of existing ones, and ultimately contribute to the growth of the economy as a whole.

Job Creation and Increased Productivity

One of the key benefits of business investments is the generation of employment opportunities. When companies invest in new ventures or expand their operations, they create jobs that help reduce unemployment rates and improve the standard of living. Additionally, investments in technology, infrastructure, and training enhance productivity, leading to higher output levels and efficiency in the workforce.

Innovation and Competitiveness

Business investments drive innovation by funding research and development initiatives, technological advancements, and the creation of new products or services. Companies that strategically invest in innovation gain a competitive edge in the market, attracting customers, increasing market share, and staying ahead of competitors. This continuous cycle of innovation and investment is essential for long-term growth and sustainability.

Examples of Successful Companies

Companies like Apple, Amazon, and Google are prime examples of organizations that have reaped the benefits of strategic business investments. These companies have consistently invested in research, development, and acquisitions to diversify their offerings, expand their market reach, and maintain their position as industry leaders. Their success underscores the importance of making sound investments to drive growth and stay competitive in today’s dynamic business landscape.

Types of Business Investments

Investing in a business can take various forms, each with its own set of risks and potential rewards. From capital investments to research and development and marketing strategies, businesses must consider the different types of investments available to them to drive growth and success.

Capital Investments

Capital investments involve purchasing assets or equipment that will help improve productivity, efficiency, or capacity. For example, manufacturing companies may invest in new machinery to increase production output. While capital investments can be costly upfront, they can lead to long-term cost savings and improved operations.

Research and Development

Research and development investments are crucial for businesses looking to innovate and stay ahead of the competition. Industries such as technology and pharmaceuticals heavily rely on R&D to develop new products and services. While R&D investments can be risky and time-consuming, they can also result in breakthrough innovations that drive significant growth.

Marketing

Marketing investments are essential for businesses to promote their products or services and attract customers. From digital advertising to social media campaigns, businesses must allocate resources to reach their target audience effectively. While marketing investments can yield high returns, businesses must carefully track their ROI to ensure they are maximizing their marketing budget.

Risks and Mitigation

Each type of investment comes with its own set of risks. Capital investments may face the risk of technological obsolescence, while R&D investments may not always result in successful innovations. Marketing investments can be challenging to measure in terms of impact and ROI. To mitigate risks, businesses must conduct thorough research, diversify their investments, and regularly review their strategies.

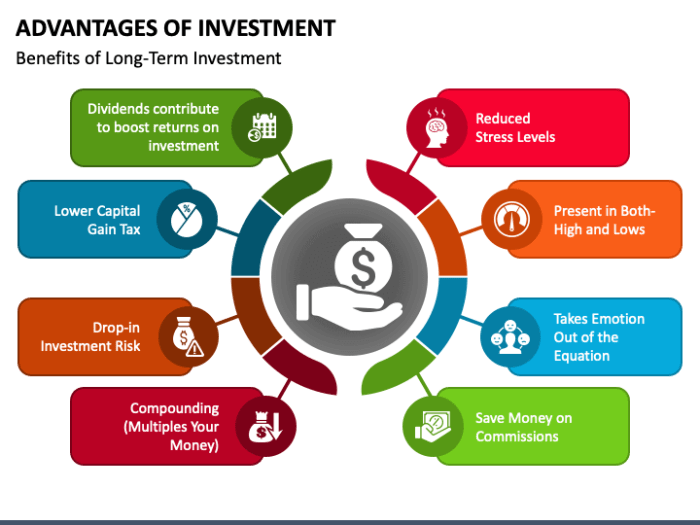

Short-term vs. Long-term Strategies

Short-term investment strategies focus on immediate gains and quick returns, such as cost-cutting measures or product launches. On the other hand, long-term investment strategies prioritize sustainable growth and market expansion, such as building brand equity or entering new markets. Businesses must strike a balance between short-term and long-term strategies to ensure steady growth and profitability.

Financial Benefits of Business Investments

Investing in a business can bring about a range of financial benefits that can significantly impact the bottom line. From increased revenue to profitability, investments play a crucial role in driving the financial success of a company.

Increased Revenue and Profitability, Benefits of business investments

Investments in areas such as marketing, product development, or technology can lead to increased sales and revenue for a business. By enhancing the quality of products or services, attracting new customers, or improving operational efficiency, businesses can see a direct impact on their bottom line.

Return on Investment (ROI)

Return on Investment (ROI) is a key metric used to evaluate the success of investments by comparing the gain or loss generated relative to the amount invested.

Understanding and tracking ROI is essential for businesses to make informed decisions about where to allocate resources for maximum profitability.

Expansion into New Markets or Diversification

Strategic investments can also enable businesses to expand into new markets or diversify their products and services. This can help companies reach a broader customer base, reduce dependency on a single market, and create new revenue streams to drive growth.

Case Studies

- Apple’s acquisition of Beats Electronics in 2014 not only allowed the company to enter the music streaming market but also boosted its overall revenue and market share in the audio industry.

- Amazon’s investment in developing its Prime membership program led to increased customer loyalty, higher sales, and ultimately greater profitability for the e-commerce giant.

Non-Financial Benefits of Business Investments

Investing in a business goes beyond financial gains and can also yield a range of non-monetary benefits that contribute to the overall success and sustainability of the company.

Brand Reputation Enhancement

Building a strong brand reputation is crucial for businesses to attract customers and build trust. By investing in quality products, excellent customer service, and ethical business practices, companies can enhance their brand reputation and stand out in a competitive market.

Employee Training and Development

Investing in employee training and development programs can boost morale, productivity, and retention rates within the organization. Employees who feel supported and valued are more likely to be engaged and motivated, leading to higher performance levels and lower turnover rates.

Sustainable or Socially Responsible Investments

Companies that prioritize sustainable or socially responsible investments can strengthen stakeholder relationships and improve their corporate image. By aligning business practices with environmental and social values, organizations can attract socially conscious consumers and investors, leading to long-term success and positive brand perception.

Examples of Companies Leveraging Non-Financial Benefits

– Patagonia: Known for its commitment to environmental sustainability and fair labor practices, Patagonia has built a loyal customer base and a strong brand reputation.

– Google: By investing in employee perks, development opportunities, and diversity initiatives, Google has created a positive work culture that attracts top talent and fosters innovation.

– Unilever: With its focus on sustainable sourcing, waste reduction, and social impact programs, Unilever has positioned itself as a leader in corporate social responsibility, enhancing its reputation and stakeholder relationships.

In conclusion, the discussion on Benefits of business investments underscores the importance of making strategic investment decisions to achieve both financial and non-financial gains, ultimately leading to a competitive edge in the market.

When considering top industries to invest in , it’s essential to research and analyze the market trends. Technology, healthcare, and renewable energy are some of the sectors showing promising growth potential.

Entrepreneurs looking for online business investment ideas should explore e-commerce, digital marketing, and software development. These sectors offer scalability and profitability in the digital age.

Keeping up with business investment trends is crucial for staying competitive. From impact investing to artificial intelligence, understanding the latest trends can help investors make informed decisions.