Angel investing in startups sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Exploring the world of angel investing unveils a realm where innovation meets opportunity, paving the way for budding entrepreneurs to flourish and investors to reap the rewards of their foresight.

Overview of Angel Investing

Angel investing in startups refers to individuals who provide financial support to early-stage companies in exchange for ownership equity. These investors, known as angel investors, play a crucial role in funding startups that may not yet have access to traditional sources of capital, such as banks or venture capitalists.

Role of Angel Investors

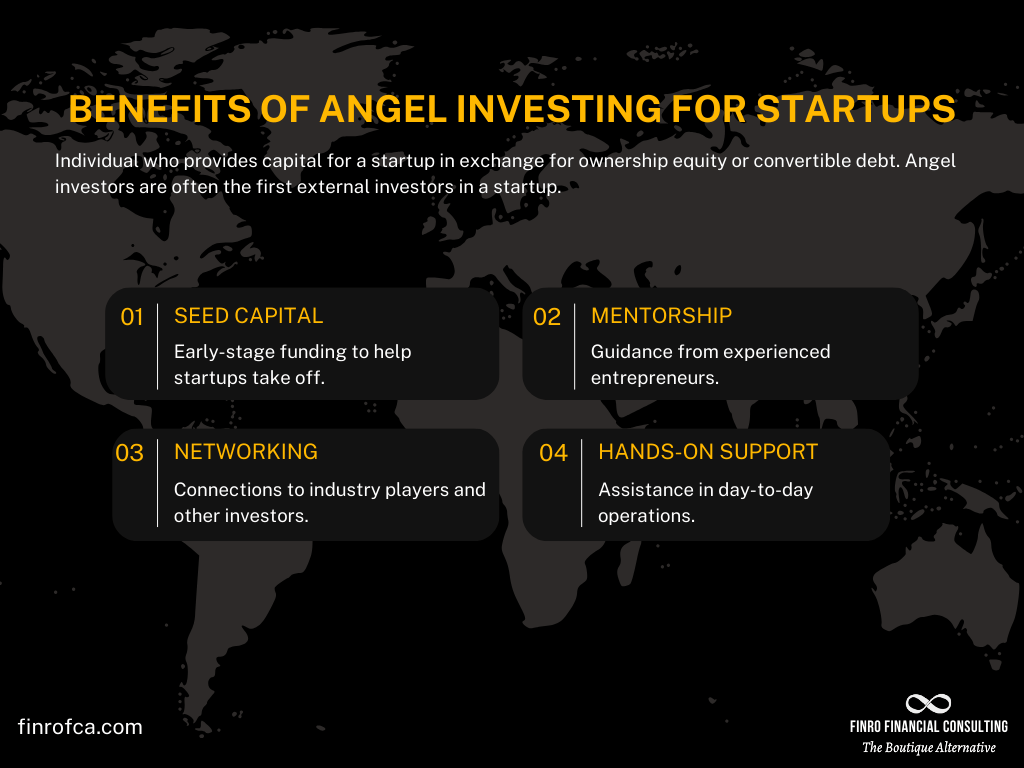

Angel investors typically offer more than just financial support; they also provide valuable mentorship, advice, and networking opportunities to the entrepreneurs they invest in. This hands-on approach can help startups navigate challenges, make strategic decisions, and ultimately increase their chances of success in the competitive market.

Investment Range

The typical investment range for angel investors can vary, but it usually falls between $25,000 to $100,000 per startup. Some angel investors may choose to invest even larger amounts, depending on the potential of the startup and their own financial capabilities. These investments are made in exchange for a percentage of ownership in the company, allowing angel investors to potentially profit from the startup’s growth and success in the future.

Benefits of Angel Investing

Angel investing offers several advantages for startups looking to grow and succeed. One of the key benefits is the access to capital that angel investors provide, allowing entrepreneurs to fund their business ideas and bring them to life. In addition to financial support, angel investors also offer valuable mentorship and guidance to help startups navigate challenges and make strategic decisions.

Providing Mentorship and Guidance

Angel investors bring a wealth of experience and expertise to the table, making them valuable resources for entrepreneurs. They can offer insights, connections, and advice based on their own successes and failures in the business world. By serving as mentors, angel investors can help startups avoid common pitfalls, identify opportunities for growth, and develop effective strategies for long-term success.

Potential Returns on Investment

While angel investing involves risk, it also offers the potential for significant returns on investment. If a startup that an angel investor has backed is successful, the investor stands to gain financially through equity ownership. This means that angel investors have the opportunity to earn a substantial return on their initial investment if the startup grows and eventually exits through an acquisition or IPO.

Risks and Challenges

Angel investing in startups can be a rewarding venture, but it also comes with its fair share of risks and challenges. It’s important for angel investors to be aware of these potential pitfalls in order to make informed decisions and mitigate any negative outcomes.

Risks Associated with Angel Investing

- High Failure Rate: Startups have a high failure rate, with many new businesses not succeeding in the long run. This means that angel investors may lose their investment if the startup they have invested in fails.

- Lack of Liquidity: Investments in startups are often illiquid, meaning that it can be challenging to sell off shares and recoup the initial investment quickly.

- Market and Economic Volatility: External factors such as market fluctuations and economic downturns can impact the success of a startup, leading to potential losses for angel investors.

Challenges Faced by Angel Investors

- Due Diligence: Conducting thorough due diligence on potential startup investments can be time-consuming and require expertise in various industries.

- Management Involvement: Angel investors may need to provide guidance and support to the startups they have invested in, which can be demanding and require a significant time commitment.

- Portfolio Diversification: Building a diversified portfolio of startup investments can be challenging, as it requires identifying promising opportunities across different sectors and stages of development.

Common Pitfalls for Angel Investors

- Overestimating Success: Angel investors may fall into the trap of overestimating the success of a startup based on initial promising results, leading to potential losses when the business fails to meet expectations.

- Ignoring Red Flags: Failing to address warning signs or red flags during the due diligence process can result in investing in high-risk startups that are more likely to fail.

- Emotional Investing: Making investment decisions based on emotions rather than sound financial analysis can lead to poor investment choices and losses for angel investors.

How to Become an Angel Investor

Becoming an angel investor can be a rewarding experience for individuals looking to support innovative startups and potentially earn significant returns on their investments. Here, we will discuss the steps to becoming an angel investor, the criteria for qualifying, and provide tips for those interested in starting angel investing.

Steps to Becoming an Angel Investor

- 1. Build a Strong Financial Foundation: Before considering angel investing, ensure you have a solid financial base to withstand the risks involved.

- 2. Educate Yourself: Take the time to learn about the startup ecosystem, investment strategies, and how angel investing works.

- 3. Network with Experienced Angel Investors: Connect with seasoned angel investors to gain insights, guidance, and potential investment opportunities.

- 4. Join Angel Investor Groups or Platforms: Consider joining angel investor groups or online platforms to access a pool of startups seeking funding.

- 5. Conduct Due Diligence: Thoroughly research and evaluate potential investment opportunities to make informed decisions.

- 6. Make Strategic Investments: Diversify your portfolio by investing in multiple startups across different industries to minimize risks.

Criteria for Qualifying as an Angel Investor

- 1. Accredited Investor Status: In many countries, angel investors are required to meet certain income or net worth criteria to qualify.

- 2. Risk Tolerance: Angel investing involves high risks, so having a high tolerance for uncertainty and potential losses is essential.

- 3. Industry Expertise: Having knowledge or experience in specific industries can be beneficial when evaluating startup opportunities.

- 4. Access to Deal Flow: Establishing connections with entrepreneurs, venture capitalists, and other investors can provide access to promising deals.

Tips for Starting Angel Investing in Startups

- 1. Start Small: Begin with small investments to gain experience and gradually increase your investment amount as you become more comfortable.

- 2. Seek Mentorship: Find a mentor or advisor who can provide guidance and share their expertise in angel investing.

- 3. Stay Informed: Stay updated on industry trends, market conditions, and regulatory changes that may impact your investments.

- 4. Be Patient: Angel investing is a long-term commitment, so be prepared to wait for potential returns as startups grow and scale.

- 5. Trust Your Instincts: While data and research are important, trust your instincts and gut feeling when making investment decisions.

As we conclude this insightful journey into the realm of angel investing, it becomes evident that this unique form of funding holds the potential to shape the future of countless startups, creating a symbiotic relationship where risk and reward intertwine in the pursuit of innovation and success.

When it comes to affordable residential housing, staying updated on key insights, trends, and future prospects is crucial for both buyers and investors. Understanding the market dynamics and potential growth areas can help in making informed decisions. For more information on this topic, check out Affordable Residential Housing: Key Insights Trends and Future Prospects.

Investors looking to delve into residential property appreciation need a comprehensive guide to navigate through the complexities of the market. From understanding factors that influence property value to strategies for maximizing returns, this guide is essential. For a detailed overview, visit Residential Property Appreciation: An In-Depth Guide for Investors.

Maximizing profit through residential rental income requires a deep understanding of key concepts and market trends. By optimizing rental strategies and leveraging the right tools, investors can enhance their profitability. To explore more on this topic, visit Residential Rental Income: Maximizing Profit and Understanding Key Concepts.