Types of business investments encompass a wide range of strategies to grow wealth and achieve financial goals. From short-term investments to long-term ventures, understanding the various options is crucial for success in the business world. Let’s delve into the intricacies of different investment types and their implications.

As we navigate through the nuances of business investments, we will uncover the key factors that drive investment decisions and explore the risks and rewards associated with each investment vehicle.

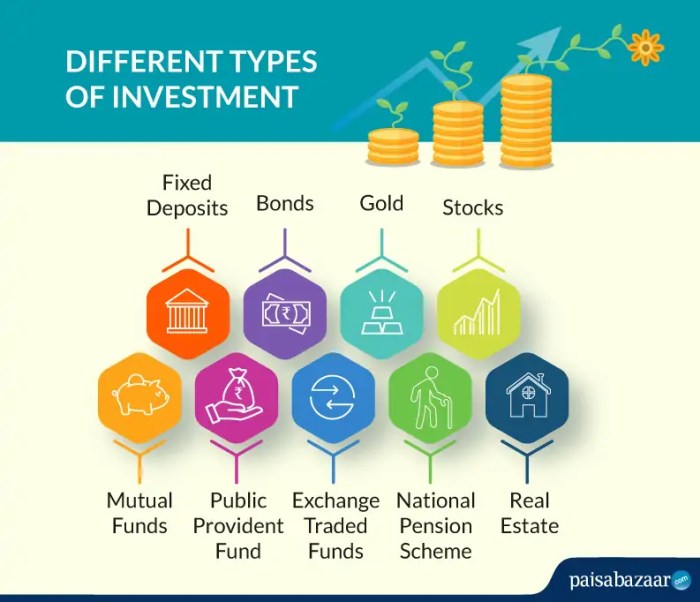

Types of Business Investments

In the world of business, investments play a crucial role in the growth and success of a company. There are various types of business investments that entrepreneurs can consider based on their financial goals and risk tolerance. Understanding the different types of business investments is essential for making informed decisions that align with the company’s objectives.

Short-Term Business Investments

Short-term business investments are typically held for a year or less and are aimed at providing quick returns. These investments are characterized by low risk and high liquidity, making them ideal for companies looking to park excess cash for a short period. Short-term business investments may include certificates of deposit (CDs), money market accounts, and treasury bills. While the returns on short-term investments are relatively low, they offer stability and quick access to funds when needed.

Long-Term Business Investments

On the other hand, long-term business investments are held for an extended period, usually more than a year, with the aim of generating higher returns over time. Long-term investments are often associated with higher risk compared to short-term investments but offer the potential for significant growth. Examples of long-term business investments include stocks, real estate, and bonds. Investing in long-term assets allows companies to build wealth and secure their financial future.

Equity Investments vs. Debt Investments

Equity investments involve purchasing ownership stakes in a company, entitling the investor to a share of the profits and voting rights in decision-making. On the other hand, debt investments involve lending money to a company in exchange for regular interest payments and the return of the principal amount at maturity. Equity investments are considered riskier but offer the potential for higher returns, while debt investments provide a steady income stream but with lower growth potential. Understanding the differences between equity and debt investments is crucial for diversifying a company’s investment portfolio and managing risk effectively.

Investment Vehicles: Types Of Business Investments

When it comes to business investments, there are various investment vehicles that companies can utilize to grow their capital and achieve financial goals. These vehicles play a crucial role in diversifying investment portfolios and managing risk effectively.

Stocks and Bonds

Stocks and bonds are common investment vehicles used by businesses to raise capital and generate returns. Stocks represent ownership in a company, while bonds are debt securities issued by corporations or governments. Including a mix of stocks and bonds in a business investment portfolio can help balance risk and return.

- Stocks offer the potential for high returns but come with higher risk due to market fluctuations.

- Bonds provide a steady income stream through interest payments and are considered less risky than stocks.

- Diversifying between stocks and bonds can help mitigate risk and optimize returns for businesses.

Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets. These vehicles offer businesses the opportunity to access a wide range of securities without the need for individual stock selection.

- Mutual funds are actively managed by professional fund managers who make investment decisions on behalf of investors.

- ETFs are passively managed and typically track a specific index, providing a cost-effective way to gain exposure to various asset classes.

- Both mutual funds and ETFs can help diversify business investment portfolios across different sectors and asset classes.

Real Estate Investments

Real estate investments are another popular option for businesses looking to diversify their investment portfolios and generate passive income. Investing in commercial properties, rental properties, or real estate investment trusts (REITs) can offer several advantages for businesses.

- Real estate investments provide potential for capital appreciation and rental income, offering a hedge against inflation.

- They can act as a stable source of income and provide tax benefits through deductions on mortgage interest and depreciation.

- Real estate investments can add diversification to a business’s investment portfolio and reduce overall risk exposure.

Risk Management in Business Investments

When it comes to business investments, managing risks is crucial to ensure the long-term success and sustainability of the investment portfolio. Implementing effective risk management strategies can help businesses navigate uncertainties and unexpected events that could impact their investments.

Strategies for Managing Risks in Business Investments, Types of business investments

- Diversification: By spreading investments across different asset classes, industries, and geographical regions, businesses can reduce the impact of any single investment underperforming.

- Due Diligence: Conducting thorough research and analysis before making investment decisions can help identify potential risks and opportunities, allowing businesses to make more informed choices.

- Risk Assessment: Regularly evaluating the risk profile of the investment portfolio can help businesses adjust their strategies and allocation to mitigate potential threats.

Importance of Asset Allocation in Reducing Investment Risks

Asset allocation plays a crucial role in reducing investment risks by spreading capital across different types of assets, such as stocks, bonds, and real estate. This diversification can help businesses minimize the impact of market fluctuations and economic downturns on their overall portfolio.

Hedging Against Market Risks Using Derivatives

Businesses can hedge against market risks by using derivatives, such as options and futures contracts. These financial instruments allow businesses to protect their investments from adverse market movements by locking in prices or minimizing potential losses.

Examples of Risk Mitigation Techniques for Business Investments

- Stop-Loss Orders: Setting predetermined price levels at which investments will be sold can help limit potential losses in volatile markets.

- Insurance Policies: Purchasing insurance coverage for specific risks, such as property damage or liability claims, can provide a safety net for businesses against unforeseen events.

- Options Contracts: Buying put options can give businesses the right to sell assets at a predetermined price, protecting them from potential downside risks.

Factors Influencing Investment Decisions

When it comes to making business investment decisions, there are several factors that play a crucial role in shaping the strategy and direction of investments. These factors can range from economic conditions to technological advancements, all of which can significantly impact the success of an investment.

Economic Factors Impacting Business Investments

Economic factors such as interest rates, inflation, and GDP growth can have a profound effect on investment decisions. For example, a rise in interest rates may lead to higher borrowing costs, making it less attractive for businesses to invest in new projects. On the other hand, a booming economy with high GDP growth rates may present lucrative investment opportunities for businesses looking to expand.

- The fluctuation of interest rates can influence the cost of borrowing for businesses.

- Inflation can erode the purchasing power of capital and affect the profitability of investments.

- GDP growth rates can indicate the overall health of the economy and impact the demand for goods and services.

Role of Industry Trends in Investment Opportunities

Industry trends play a crucial role in determining where businesses should allocate their investments. Emerging industries or sectors experiencing rapid growth may present attractive investment opportunities, while declining industries may signal a need to divest from certain assets. Staying abreast of industry trends can help businesses make informed decisions about where to invest their capital.

- Identifying emerging industries can lead to early investment in high-growth sectors.

- Monitoring declining industries can help businesses avoid investing in assets with diminishing returns.

- Adapting to changing consumer preferences and technological advancements can drive investment decisions in specific industries.

Influence of Regulatory Changes on Business Investment Strategies

Regulatory changes can have a significant impact on business investment strategies by altering the operating environment and introducing new compliance requirements. Businesses must stay informed about regulatory developments to ensure that their investments align with legal and industry standards. Failure to comply with regulatory changes can result in financial penalties or reputational damage.

- Changes in tax laws can affect the profitability of investments and the overall financial health of businesses.

- New regulations related to environmental standards or data privacy can influence investment decisions in certain industries.

- Compliance with industry-specific regulations can shape the risk management strategies of businesses and their investment choices.

Impact of Technological Advancements on Modern Business Investments

Technological advancements have revolutionized the way businesses operate and invest in the modern era. From artificial intelligence to blockchain technology, businesses must stay ahead of the curve to leverage these advancements for competitive advantage. Investing in cutting-edge technologies can enhance operational efficiency, drive innovation, and create new revenue streams for businesses.

- Adopting automation technologies can streamline business processes and reduce operational costs.

- Investing in cybersecurity measures is essential to protect sensitive data and maintain the trust of customers and stakeholders.

- Exploring opportunities in emerging technologies like the Internet of Things (IoT) or machine learning can position businesses for long-term growth and sustainability.

In conclusion, Types of business investments offer a diverse landscape of opportunities for businesses to grow and thrive. By carefully evaluating risks, diversifying portfolios, and staying informed about market trends, businesses can make informed investment decisions that lead to long-term success.

When it comes to estate planning for business owners, it is crucial to consider the future of your company and assets. Proper planning can help ensure a smooth transition for your business in case of unforeseen circumstances. By consulting professionals and creating a comprehensive plan, you can protect your business and loved ones. Learn more about estate planning for business owners to secure your legacy.

Small business owners often face challenges when it comes to funding their ventures. Understanding the various sources of funding available can help you make informed decisions for your business. Whether it’s through loans, grants, or investors, exploring different options can provide the necessary capital for growth. Discover more about small business funding sources to support your entrepreneurial journey.

Creating a successful social media investment strategy is essential for businesses looking to expand their online presence. By analyzing trends, identifying target audiences, and engaging with followers, companies can maximize their ROI on social platforms. Investing time and resources in the right strategies can lead to increased brand awareness and customer engagement. Explore effective social media investment strategies to elevate your online marketing efforts.