Best regions for business investment sets the stage for exploring prime locations for investing, delving into key factors, emerging markets, legal environments, and technological advancements that shape successful business ventures.

Factors influencing business investment decisions: Best Regions For Business Investment

When businesses consider regions for investment, several key factors come into play. These factors can greatly impact the success of the investment and the overall business operations.

Political Stability, Best regions for business investment

Political stability is crucial for businesses looking to invest in a region. A stable political environment ensures predictability and minimizes risks for businesses. Countries with stable political systems are more attractive to investors as they provide a conducive environment for business growth.

Infrastructure

Infrastructure plays a vital role in business investment decisions. Access to reliable transportation, communication networks, and utilities is essential for businesses to operate efficiently. Regions with well-developed infrastructure are more likely to attract investments as they offer better connectivity and logistical support.

Workforce Availability

The availability of a skilled workforce is a key factor for businesses when choosing regions for investment. A region with a well-educated and trained workforce can provide businesses with the talent they need to succeed. Investing in regions with a skilled labor force can lead to increased productivity and innovation.

Economic Policies

Economic policies adopted by a region can significantly impact business investments. Favorable policies such as tax incentives, trade agreements, and regulatory frameworks can attract businesses looking to expand or establish operations. Regions that offer a business-friendly environment are more likely to attract investments.

Cultural Differences

Cultural differences can also influence business investment choices. Understanding the cultural norms, values, and practices of a region is essential for businesses to navigate the local market effectively. Businesses that respect and adapt to cultural differences are more likely to succeed in their investments.

Emerging markets and potential for growth

When it comes to identifying emerging regions with high potential for business growth and investment opportunities, it is essential to analyze various economic indicators that suggest a region is ripe for investment. However, investing in emerging markets comes with its own set of risks that need to be carefully considered and mitigated by businesses. Let’s delve deeper into this topic.

Identifying Emerging Regions

- One emerging region with high potential for growth is Southeast Asia, particularly countries like Vietnam and Indonesia. These countries have seen significant economic growth in recent years, making them attractive for foreign investors.

- Africa is another continent that is increasingly becoming a hotspot for investment, with countries like Rwanda, Ethiopia, and Ghana showing promising growth prospects.

- In Latin America, countries like Colombia and Peru are emerging as favorable destinations for business investment due to their growing economies and business-friendly policies.

Analyzing Economic Indicators

- GDP growth rate, per capita income, ease of doing business index, and political stability are some key economic indicators that suggest a region is ripe for investment.

- A growing middle class, urbanization trends, and infrastructure development also play a crucial role in determining the potential for business growth in emerging markets.

Mitigating Risks

- Risks associated with investing in emerging markets include political instability, currency fluctuations, regulatory challenges, and lack of transparency. Businesses can mitigate these risks by conducting thorough due diligence, building strong local partnerships, and diversifying their investment portfolio.

- Implementing risk management strategies, staying informed about the local market conditions, and adapting to the cultural nuances of the region can also help businesses navigate the challenges of investing in emerging markets.

Success Stories

- One success story is that of Coca-Cola, which invested in emerging markets like India and China early on and reaped significant rewards by capturing a large market share in these countries.

- Another example is Unilever, which expanded its presence in emerging markets like Brazil and South Africa, leveraging local insights and consumer preferences to drive growth and profitability.

Legal and regulatory environment

In the realm of business investment, the legal and regulatory environment plays a crucial role in shaping the decision-making process for potential investors. A favorable legal framework provides stability, predictability, and protection for businesses, ultimately fostering a conducive environment for investment.

Comparison of Legal Frameworks

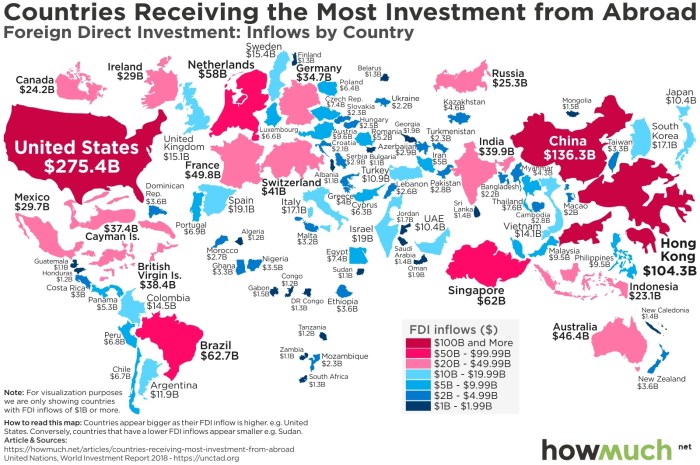

- Regions with robust legal systems, such as the United States and countries in the European Union, offer strong protection of property rights, contract enforcement, and transparency. These factors attract a higher volume of foreign direct investment due to the perceived security and stability.

- In contrast, regions with weak legal frameworks or high levels of corruption, such as certain countries in Africa and Latin America, may deter business investments. The lack of legal protection and uncertainty surrounding regulatory compliance can pose significant risks for investors.

Consequences of Stringent Regulations

- Some regions implement stringent regulations that can act as barriers to entry for businesses. For example, excessive bureaucracy, high taxes, and strict labor laws can hinder the growth and expansion of companies, leading to decreased investment inflows.

- Consequences of restrictive regulations may include reduced competitiveness, limited innovation, and potential legal disputes. These factors can ultimately drive investors away from regions with unfavorable legal environments.

Navigating Complex Legal Systems

- Businesses looking to invest in foreign regions must conduct thorough due diligence to understand the legal landscape and regulatory requirements. Engaging with local legal experts, establishing compliance protocols, and maintaining transparent communication with regulatory authorities are essential steps to ensure successful investment ventures.

- Adopting a proactive approach to compliance, staying abreast of legal updates, and fostering relationships with local stakeholders can help businesses navigate complex legal systems effectively. By prioritizing regulatory compliance and adherence to local laws, investors can mitigate risks and maximize their chances of success in international markets.

Infrastructure and Technological Advancements

When it comes to attracting business investments, having advanced infrastructure and technology plays a crucial role. Regions that offer state-of-the-art infrastructure and technological advancements are more likely to appeal to businesses seeking investment opportunities. These factors not only enhance efficiency and productivity but also contribute to the overall growth and development of businesses in the long run.

Advanced Infrastructure for Business Investment

- Regions with well-developed transportation networks, such as highways, railways, ports, and airports, are highly attractive to businesses. Efficient transportation systems facilitate the movement of goods and services, reducing operational costs and improving supply chain management.

- Access to reliable utilities, such as power, water, and telecommunications, is essential for businesses to function smoothly. Regions with reliable utility infrastructure are more likely to attract investments from businesses that rely heavily on these resources.

- Industrial parks and special economic zones with modern infrastructure, including factories, warehouses, and office spaces, provide businesses with a conducive environment to set up operations and expand their presence in new markets.

Technological Advancements in Business Investment

- Digital connectivity and high-speed internet access are crucial for businesses to stay competitive in today’s digital age. Regions that offer advanced technological infrastructure, such as fiber-optic networks and 5G connectivity, are preferred destinations for businesses looking to leverage digital technologies for growth.

- Smart cities that integrate technology into urban planning and management not only improve the quality of life for residents but also create opportunities for businesses to innovate and collaborate in a tech-savvy ecosystem. Businesses that prioritize sustainability and innovation are drawn to smart cities that offer a conducive environment for growth.

- Case Study: Company XYZ leveraged the advanced technological infrastructure of a smart city to streamline its operations, enhance customer experience, and drive innovation. By embracing digital transformation and investing in cutting-edge technologies, Company XYZ was able to gain a competitive edge in the market and expand its market share significantly.

In conclusion, the journey through the best regions for business investment sheds light on the dynamic landscape of global opportunities, emphasizing the crucial role of strategic decision-making in reaping substantial rewards.

When it comes to international business investments , it is crucial to conduct thorough research and due diligence to ensure success in global markets. Finding the right partners is key in expanding your business globally. Consider utilizing platforms like LinkedIn to network and connect with potential partners for investments. Additionally, seeking professional investment advisors can provide valuable insights and guidance for business owners looking to grow their international portfolio.

When it comes to international business investments, it is crucial to conduct thorough research and due diligence. Understanding the market trends and regulations in different countries is essential for success. By partnering with reputable business partners for investments , you can leverage their expertise and network to navigate the complexities of foreign markets. Additionally, seeking guidance from experienced investment advisors for business owners can help you make informed decisions and maximize your ROI.