Technology investment trends take center stage in this dynamic overview, delving into the current landscape and the driving forces behind the surge in technology investments across various sectors. Stay tuned for a comprehensive exploration of emerging technologies, regional variances, and investment strategies shaping the future of tech investments.

Technology Investment Trends Overview

In today’s rapidly evolving digital landscape, technology investment trends play a crucial role in shaping the future of industries across the globe. With advancements in areas such as artificial intelligence, cloud computing, and cybersecurity, companies are increasingly looking to invest in cutting-edge technologies to stay competitive and drive innovation.

Key Sectors Experiencing Growth

- Artificial Intelligence (AI): AI continues to revolutionize industries such as healthcare, finance, and retail, with companies leveraging machine learning algorithms to enhance decision-making processes and customer experiences.

- Cloud Computing: The shift towards cloud-based solutions has seen significant growth, as organizations embrace the scalability, flexibility, and cost-efficiency offered by cloud services.

- Cybersecurity: With the rise in cyber threats and data breaches, investments in cybersecurity technologies have surged, as businesses prioritize protecting their sensitive information and systems.

Driving Factors Behind Increase in Technology Investment

- Rapid Technological Advancements: The pace of technological innovation is accelerating, prompting companies to invest in emerging technologies to remain at the forefront of their respective industries.

- Demand for Efficiency and Automation: Businesses are increasingly seeking ways to streamline operations, improve efficiency, and automate processes through technology investments, driving growth in sectors like robotics and automation.

- Digital Transformation Initiatives: As organizations undergo digital transformation to adapt to changing market dynamics and consumer behaviors, technology investments are crucial in modernizing infrastructure and enabling digital capabilities.

Emerging Technologies: Technology Investment Trends

As technology continues to evolve at a rapid pace, emerging technologies are attracting significant investment from both companies and investors alike. These cutting-edge technologies have the potential to revolutionize various industries and reshape the future of technology investment.

Artificial Intelligence (AI)

AI has been one of the hottest areas for technology investment in recent years. With advancements in machine learning and deep learning, AI has the potential to transform industries such as healthcare, finance, and transportation. Companies are investing heavily in AI to improve efficiency, automate processes, and enhance decision-making.

Blockchain

Blockchain technology, known for its decentralized and secure nature, has been gaining traction in various sectors, including finance, supply chain management, and healthcare. Investors are betting big on blockchain startups that offer innovative solutions for transparency, security, and trust in transactions.

Internet of Things (IoT)

The IoT landscape is expanding rapidly, with more devices connected to the internet than ever before. This interconnected network of devices has the potential to revolutionize how we interact with technology and the physical world around us. Investors are eyeing IoT startups that offer smart solutions for homes, cities, and industries.

Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies are reshaping the way we experience digital content and interact with our surroundings. From immersive gaming experiences to virtual shopping environments, AR and VR have the potential to transform entertainment, education, and communication. Investors are exploring opportunities in AR and VR startups that push the boundaries of reality.

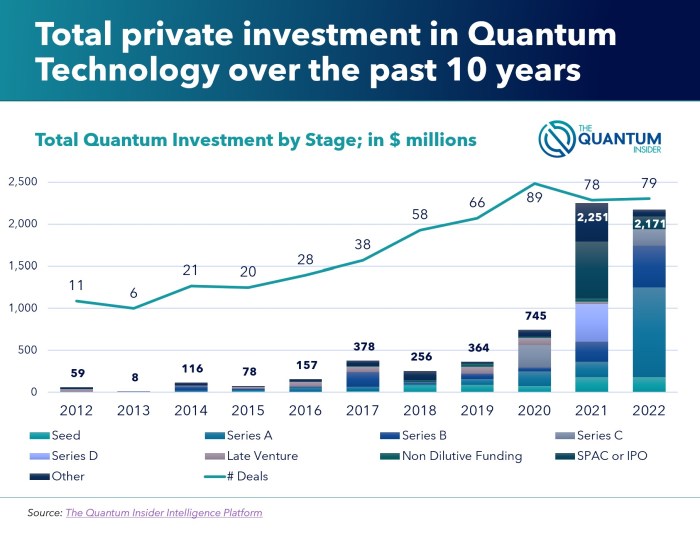

Quantum Computing

Quantum computing is considered the next frontier in computing power, with the potential to solve complex problems that are currently beyond the capabilities of traditional computers. Investors are keeping a close eye on quantum computing startups that are pushing the boundaries of what is possible in the world of computing.

Regional Variances in Technology Investment

When it comes to technology investment trends, different regions around the world exhibit unique characteristics and factors that influence their approach to investing in technology. Understanding these regional variances is crucial for investors looking to capitalize on emerging opportunities in the tech sector.

North America:

In North America, particularly in Silicon Valley, there is a strong focus on innovation and disruption. Investors in this region tend to favor early-stage startups with high growth potential. The availability of venture capital funding and a culture that celebrates entrepreneurship contribute to the vibrant tech ecosystem in North America.

Europe:

In Europe, technology investment trends are influenced by factors such as government regulations, cultural differences, and market maturity. Countries like the UK, Germany, and France have established tech hubs that attract significant investment. Investors in Europe often look for companies with a proven track record and a focus on sustainability.

Asia:

Asia is home to some of the fastest-growing tech markets in the world, with countries like China, India, and South Korea leading the way. Technology investment in Asia is driven by factors such as rapid digital adoption, a young tech-savvy population, and government support for innovation. Investors in Asia often seek opportunities in sectors like e-commerce, fintech, and artificial intelligence.

Emerging Markets:

In emerging markets, such as Africa and Latin America, technology investment trends are shaped by factors like infrastructure development, mobile penetration, and access to capital. Investors in these regions look for startups that address local challenges and have the potential to scale globally. Successful technology investment strategies in emerging markets often involve partnerships with local stakeholders and a deep understanding of the regulatory environment.

Overall, regional variances in technology investment reflect the diverse opportunities and challenges present in different parts of the world. Investors who are able to adapt their strategies to the specific needs and dynamics of each region are likely to achieve success in the ever-evolving tech landscape.

Investment Strategies and Best Practices

Investing in technology requires a strategic approach to maximize returns and minimize risks. Venture capitalists, angel investors, and corporations often employ specific strategies to ensure the success of their technology investments.

Common Technology Investment Strategies, Technology investment trends

- Diversification: Investing in a portfolio of technology companies across different sectors to spread risk and increase chances of success.

- Early-stage Investments: Backing startups in their early stages to benefit from potential high returns if the company succeeds.

- Follow-on Investments: Providing additional funding to promising companies in later funding rounds to maintain ownership and support growth.

- Strategic Partnerships: Collaborating with other investors or industry players to leverage expertise and resources for mutual benefit.

Best Practices for Assessing Viability

- Thorough Due Diligence: Conducting extensive research on the technology, market, competition, and team behind the investment opportunity.

- Scalability Assessment: Evaluating the potential for the technology to scale and address a large market demand effectively.

- Financial Analysis: Reviewing the financial health and projections of the company to assess its growth potential and sustainability.

- Risk Management: Identifying and addressing potential risks associated with the technology, market, or team to mitigate negative outcomes.

Mitigating Risks in Technology Investments

- Portfolio Diversification: Spreading investments across multiple technology companies to reduce the impact of any single investment failure.

- Exit Strategies: Planning for various exit options such as IPOs, acquisitions, or secondary sales to realize returns on investments.

- Continuous Monitoring: Regularly tracking the progress of technology investments and making necessary adjustments to optimize performance.

- Expert Advice: Seeking advice from experienced technology investors or advisors to gain insights and avoid common pitfalls in the industry.

In conclusion, the world of technology investment is evolving rapidly, presenting exciting opportunities and challenges. By staying informed and adopting best practices, investors can navigate this ever-changing landscape with confidence.

Business investment networking is crucial for entrepreneurs looking to expand their connections and find new opportunities. By joining networking events and online platforms, business owners can meet potential investors and partners to grow their ventures. Utilizing Business investment networking effectively can lead to valuable collaborations and long-term success.

Small business financial strategies play a vital role in ensuring the stability and growth of a company. From budgeting and cash flow management to investment decisions, implementing effective financial strategies can make or break a business. Entrepreneurs can learn more about Small business financial strategies to make informed choices and secure their financial future.

Investment advisors for business owners provide expert guidance on managing finances and making smart investment choices. These professionals help entrepreneurs navigate the complex world of investments and create personalized strategies to achieve their financial goals. With the help of Investment advisors for business owners , entrepreneurs can optimize their financial resources and maximize returns.