With Impact investing in businesses at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Impact investing in businesses involves aligning financial goals with social impact, creating a win-win situation for investors and society alike. As businesses increasingly focus on sustainability and social responsibility, impact investing has emerged as a powerful tool to drive positive change while generating returns. This article delves into the various facets of impact investing in businesses, exploring its types, benefits, challenges, and the crucial aspect of measuring impact for long-term success.

Overview of Impact Investing in Businesses

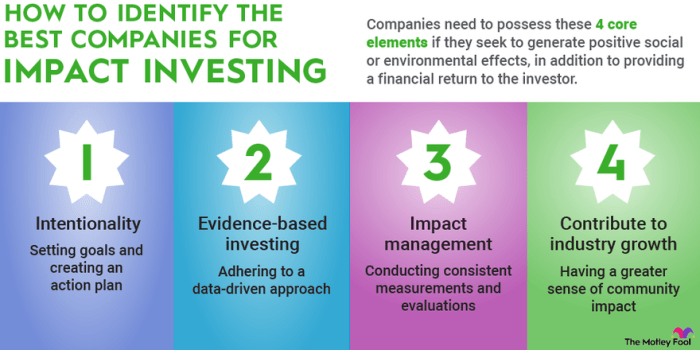

Impact investing in businesses involves making investments with the intention of generating positive social or environmental impact alongside financial returns. This approach goes beyond traditional investing by prioritizing companies that are committed to sustainable practices and making a difference in the world.

Objectives of Impact Investing

Impact investing aims to address pressing social or environmental issues while also seeking financial returns. By supporting businesses that are dedicated to creating positive change, impact investors can contribute to a more sustainable and equitable future.

- Aligning financial goals with social and environmental impact

- Fostering innovation and scalability of impactful solutions

- Driving positive change in communities and industries

- Promoting transparency and accountability in business practices

Importance of Impact Investing for Businesses

Impact investing is crucial for businesses looking to not only maximize profits but also make a meaningful difference in the world. By integrating social and environmental considerations into their operations, companies can enhance their reputation, attract socially conscious consumers, and contribute to a more sustainable future.

Impact investing is a powerful tool for creating positive change and driving innovation in the business world.

Types of Impact Investments

Impact investments come in various forms, each with its own unique characteristics and benefits for businesses looking to make a positive social or environmental impact while generating financial returns. Let’s explore some of the different types of impact investments available for businesses.

Equity Investments

Equity investments involve purchasing shares in a company, giving the investor ownership in the business. This type of impact investment allows investors to have a stake in the success of the company and share in its profits. One example of a successful business that has utilized equity investments is Beyond Meat, a plant-based meat alternative company that has attracted investment from impact-focused funds and individuals.

Debt Investments

Debt investments involve providing loans to businesses that are focused on making a positive impact. In return, the business agrees to repay the loan with interest. This type of impact investment allows businesses to access capital while investors earn a fixed return. An example of a successful business that has utilized debt investments is M-Kopa Solar, a company that provides solar power solutions to off-grid customers in Africa and has received funding from impact investors.

Social Impact Bonds

Social impact bonds are a unique type of impact investment where investors provide upfront capital to fund social programs. If the programs meet predefined targets, the government repays the investors with a return. This type of impact investment incentivizes the achievement of social outcomes. An example of a successful social impact bond is the Massachusetts Juvenile Justice Pay for Success Initiative, which aimed to reduce juvenile reoffending rates.

Microfinance Investments

Microfinance investments involve providing small loans to individuals or businesses in underserved communities. This type of impact investment helps empower entrepreneurs and create economic opportunities in marginalized areas. An example of a successful business that has utilized microfinance investments is Grameen Bank, which provides small loans to low-income individuals in Bangladesh to support entrepreneurship and alleviate poverty.

Benefits of Impact Investing for Businesses

Impact investing offers a range of benefits for businesses looking to make a positive difference while generating financial returns. By engaging in impact investing, companies can align their values with their investment strategies, ultimately leading to a more sustainable and socially responsible business model.

Enhancing Company Reputation

Impact investing can significantly enhance a company’s reputation by demonstrating a commitment to social and environmental causes. By supporting initiatives that address pressing global issues, businesses can build trust with stakeholders, including consumers, employees, investors, and the community at large. This positive reputation can differentiate the company from competitors and attract socially conscious consumers, ultimately leading to increased brand loyalty and market share.

Long-Term Sustainable Growth

One of the key benefits of impact investing for businesses is the potential for long-term sustainable growth. By investing in projects that create positive social or environmental impact, companies can contribute to building a more resilient and equitable society. This can result in a more stable operating environment, reduced risks, and enhanced opportunities for innovation and growth. Additionally, businesses that prioritize impact investing are better positioned to adapt to changing market demands and regulatory requirements, ensuring their long-term viability and success.

Challenges and Risks of Impact Investing

In the realm of impact investing in businesses, there are several common challenges and risks that investors may encounter. These challenges can range from financial uncertainties to social and environmental complexities. It is crucial for investors to be aware of these challenges and have strategies in place to mitigate them effectively.

Financial Risks, Impact investing in businesses

One of the primary challenges in impact investing is the financial risk associated with investing in businesses that aim to generate both financial returns and positive social or environmental impact. These dual objectives can sometimes create a tension between maximizing profits and achieving social goals. Investors may face the risk of lower financial returns compared to traditional investments if the impact initiatives of the business do not yield the expected results.

Social and Environmental Risks

Another challenge is the social and environmental risks that impact investing entails. Businesses focusing on social impact may face obstacles related to community acceptance, cultural differences, or regulatory issues. Environmental impact investments may be vulnerable to changing regulations, market demands, or natural disasters. These risks can affect the success and sustainability of the business in the long run.

Strategies to Mitigate Risks

To address these challenges, investors can implement several strategies to mitigate risks effectively. Conducting thorough due diligence on potential impact investments, diversifying the investment portfolio, and setting clear impact metrics and measurement systems are essential steps to manage financial, social, and environmental risks. Engaging with stakeholders, building strong partnerships, and staying informed about industry trends can also help investors navigate the complexities of impact investing.

Real-World Examples

One real-world example of a business facing challenges in impact investing is a renewable energy company that struggled with regulatory changes affecting its operations. Another example is a social enterprise that faced financial difficulties due to limited market demand for its products. By learning from these examples and adapting their strategies, investors can better prepare for and mitigate the challenges and risks associated with impact investing in businesses.

Measuring Impact in Impact Investing: Impact Investing In Businesses

Impact investing in businesses goes beyond just financial returns; it also aims to generate positive social and environmental impact. Measuring this impact is crucial to ensure that investments are making a difference and achieving the desired outcomes.

Importance of Measuring Impact

Measuring impact is essential for investors to track the effectiveness of their investments and ensure accountability. It helps in evaluating the success of projects, identifying areas for improvement, and making informed decisions for future investments.

- Quantifying Social and Environmental Impact: Impact measurements provide concrete data on the social and environmental changes brought about by investments, allowing investors to assess the extent of their contribution to sustainable development goals.

- Enhancing Transparency and Accountability: By measuring impact, businesses can demonstrate their commitment to responsible investing and communicate the outcomes of their initiatives to stakeholders, fostering trust and credibility.

- Driving Innovation and Continuous Improvement: Impact measurement enables businesses to identify best practices, learn from failures, and refine their strategies to maximize positive impact, leading to better outcomes over time.

Key Metrics and Tools for Measuring Impact

To measure impact effectively, businesses can utilize a variety of metrics and tools tailored to their specific goals and target areas. Some commonly used metrics include:

- Social Return on Investment (SROI): SROI is a ratio that measures the social value created by an investment relative to the resources invested. It helps in quantifying the social impact in monetary terms.

- Environmental Footprint: This metric assesses the environmental impact of businesses by measuring factors such as carbon emissions, water usage, and waste generation, providing insights into sustainability efforts.

- Impact Reporting and Investment Standards (IRIS): IRIS is a set of standardized metrics that businesses can use to measure and report on their social, environmental, and financial performance, facilitating comparability and transparency.

Tracking and Reporting Impact to Stakeholders

Businesses can effectively track and report their impact to stakeholders by:

- Establishing Clear Objectives: Defining specific impact goals and targets helps businesses align their measurement efforts with their overall mission and communicate progress to stakeholders.

- Implementing Robust Data Collection Systems: Investing in reliable data collection methods and tools enables businesses to gather accurate information on impact metrics and track performance consistently.

- Engaging with Stakeholders: Involving stakeholders in the impact measurement process fosters collaboration, builds trust, and ensures that the reported impact resonates with the values and expectations of the community.

In conclusion, impact investing in businesses offers a unique opportunity for companies to not only make a difference in the world but also improve their financial performance. By embracing impact investing, businesses can secure a more sustainable and responsible future while contributing to positive societal change. As the world continues to prioritize sustainability and social impact, integrating impact investing strategies can set businesses on a path towards long-term success and meaningful impact.

When looking for funding for your startup, joining business angel networks can be a game-changer. These networks connect entrepreneurs with wealthy individuals looking to invest in promising ventures. Additionally, exploring business investor resources can provide valuable insights and guidance on securing investments. If you need financial support, consider checking out different small business loan options available to help grow your business.

Business angel networks play a crucial role in connecting investors with startups looking for funding. These networks provide a platform for both parties to meet and discuss potential partnerships. By joining a Business angel network , investors can gain access to a diverse range of investment opportunities while startups can benefit from mentorship and financial support.

When it comes to finding the right resources for business investors, it’s essential to have access to reliable information and tools. From market analysis to investment strategies, Business investor resources can help investors make informed decisions and maximize their returns. These resources can also provide valuable insights into industry trends and emerging opportunities.

For small businesses in need of financial assistance, exploring different small business loan options is essential. Whether it’s a traditional bank loan or an alternative funding solution, understanding the available options can help businesses secure the capital they need to grow and thrive. Small business loan options can vary in terms of interest rates, repayment terms, and eligibility requirements, so it’s important to research and compare before making a decision.