Building an investment portfolio takes center stage as we delve into the world of strategic wealth creation. This comprehensive guide offers insights into the key components of a successful portfolio and the strategies involved in maximizing returns.

Whether you’re a seasoned investor or just starting out, this exploration of investment portfolio building will equip you with the knowledge needed to make informed decisions and achieve your financial goals.

Introduction to Investment Portfolio Building

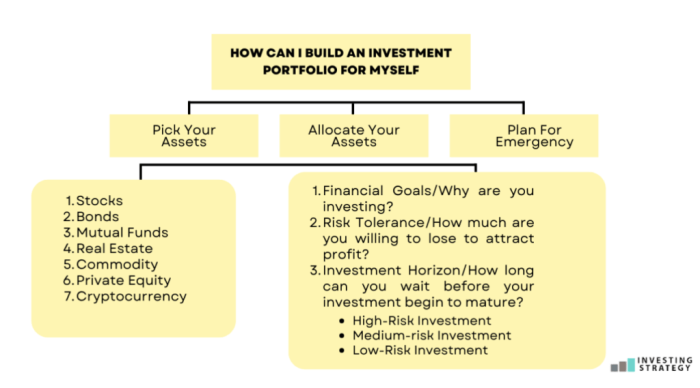

Investment portfolio building involves selecting a mix of assets such as stocks, bonds, real estate, and commodities with the aim of achieving a balance between risk and return. A well-diversified investment portfolio is essential for managing risk and maximizing potential returns over the long term.

Importance of Diversification

Diversification is crucial in an investment portfolio as it helps spread risk across different asset classes. By investing in a variety of assets, you can reduce the impact of a decline in any single investment on your overall portfolio. This can help protect your wealth and ensure more stable returns.

Key Components of a Successful Investment Portfolio

- Asset Allocation: Determining the right mix of asset classes based on your risk tolerance and investment goals.

- Risk Management: Implementing strategies to minimize potential losses and protect your capital.

- Regular Monitoring: Keeping track of your investments and making adjustments as needed to stay on course.

- Diversification: Spreading your investments across different industries, regions, and asset types to reduce risk.

- Long-Term Focus: Investing with a focus on achieving your financial goals over the long term rather than short-term gains.

Setting Investment Goals

Setting clear investment goals is essential before building a portfolio as it provides direction and purpose to your investment strategy. Without defined goals, it is challenging to make informed decisions about asset allocation, risk tolerance, and investment timelines.

When setting investment goals, it is important to consider both short-term and long-term objectives. Short-term goals may include saving for a vacation, purchasing a new car, or building an emergency fund. On the other hand, long-term goals could involve retirement planning, buying a home, or funding a child’s education.

Short-term Investment Goals

Short-term investment goals typically have a timeline of less than five years and may require lower-risk investments to ensure capital preservation. Examples of short-term goals include:

- Saving for a down payment on a house

- Building an emergency fund to cover unexpected expenses

- Funding a dream vacation

Long-term Investment Goals

Long-term investment goals have a timeline of more than five years and can afford to take on higher levels of risk for potentially greater returns. Examples of long-term goals include:

- Saving for retirement

- Investing in a child’s education fund

- Building wealth for financial independence

Influence of Risk Tolerance on Goal Setting

Risk tolerance plays a crucial role in determining the appropriate investment goals for an individual. Those with a higher risk tolerance may choose more aggressive investment strategies to pursue higher returns, while conservative investors may prioritize capital preservation over growth. Understanding your risk tolerance can help align your investment goals with the level of risk you are comfortable with.

Asset Allocation Strategies

When building an investment portfolio, one crucial aspect to consider is asset allocation. This involves dividing your investments among different asset classes to spread risk and optimize returns.

Asset Classes for Investment Portfolios

- Stocks: Investing in stocks provides potential for high returns but comes with higher volatility and risk.

- Bonds: Bonds offer more stability and fixed income, making them a lower-risk option compared to stocks.

- Real Estate: Real estate investments can provide a steady income stream through rental properties or appreciation in property value.

Benefits of Diversification in Asset Allocation, Building an investment portfolio

Diversification is key in asset allocation as it helps reduce risk by spreading investments across different asset classes. By diversifying, an investor can minimize the impact of a decline in one asset class on the overall portfolio. It also allows for potential growth in different sectors of the economy, providing a more balanced and stable investment approach.

Rebalancing a Portfolio

Rebalancing a portfolio involves periodically adjusting the allocation of assets to maintain the desired risk and return profile. This is important to ensure that the portfolio stays aligned with the investor’s goals and risk tolerance. By rebalancing, investors can sell overperforming assets and buy underperforming ones, keeping the portfolio in line with the intended asset allocation strategy.

Risk Management Techniques

Risk management plays a crucial role in building a resilient investment portfolio. By effectively managing risks, investors can protect their capital and minimize potential losses. There are various strategies that investors can employ to manage risks, such as hedging, dollar-cost averaging, and stop-loss orders.

Hedging

Hedging is a risk management strategy that involves taking a position in a financial instrument to offset the risk in another investment. For example, an investor may hedge against a decline in the stock market by purchasing put options on their stock holdings. This way, if the market falls, the put options will increase in value, offsetting the losses in the stock portfolio.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money into an investment over time, regardless of market conditions. This approach helps to reduce the impact of market volatility on the overall portfolio. For instance, by consistently investing a fixed amount each month in a mutual fund, investors can benefit from lower average costs during market downturns and higher average costs during market upswings.

Stop-Loss Orders

Stop-loss orders are used to limit potential losses by automatically selling a security once it reaches a predetermined price. This strategy helps investors to protect their capital and prevent further losses in case the market moves against their positions. For example, an investor may set a stop-loss order at 10% below the purchase price of a stock to limit losses if the stock price declines.

Investment Research and Due Diligence: Building An Investment Portfolio

Investment research and due diligence are crucial steps in building a successful investment portfolio. Conducting thorough research on potential investments and performing due diligence before adding assets to your portfolio can help you make informed decisions and mitigate risks.

Research Process for Potential Investments

When researching potential investments, it is essential to analyze various factors such as the financial health of the company, industry trends, market conditions, and potential risks. Conducting fundamental analysis, technical analysis, and evaluating qualitative factors can provide valuable insights into the investment opportunity.

- Performing fundamental analysis involves examining financial statements, evaluating the company’s management team, assessing competitive advantages, and analyzing growth prospects.

- Technical analysis focuses on analyzing historical price trends, trading volumes, and market patterns to predict future price movements.

- Evaluating qualitative factors such as industry dynamics, regulatory environment, and macroeconomic trends can help you assess the broader market conditions and potential risks.

Significance of Due Diligence

Due diligence is the process of thoroughly investigating an investment opportunity to verify the accuracy of information, assess potential risks, and ensure alignment with your investment goals. By performing due diligence, investors can avoid making impulsive decisions and minimize the possibility of losses.

- Verifying the credibility of the information provided by conducting background checks, reviewing financial statements, and assessing the reputation of the company or asset.

- Assessing the potential risks associated with the investment, including market risks, liquidity risks, regulatory risks, and operational risks.

- Ensuring that the investment opportunity aligns with your investment goals, risk tolerance, and time horizon.

Tools and Resources for Investment Research

There are various tools and resources available to help investors conduct investment research effectively. From financial websites and online databases to investment research reports and analyst recommendations, these resources can provide valuable insights and data to support your decision-making process.

Utilizing financial websites such as Bloomberg, Yahoo Finance, and CNBC can provide real-time market data, news updates, and financial analysis to help you stay informed about investment opportunities.

Accessing online databases such as Morningstar, Thomson Reuters, and FactSet can offer in-depth financial information, company profiles, and industry analysis to support your research efforts.

Reviewing investment research reports from reputable sources, including brokerage firms, investment banks, and independent research providers, can offer expert opinions and recommendations on specific investment opportunities.

Tax-Efficient Investing

Tax-efficient investing is a crucial aspect of building an investment portfolio as it can directly impact your overall returns. By utilizing strategies that minimize the tax implications on investment income and capital gains, investors can maximize their profits over the long term. Here, we will discuss various techniques to help you navigate the complexities of tax-efficient investing and reduce your tax burden.

Tax-Efficient Investment Strategies

- Utilize tax-advantaged accounts: Consider investing in retirement accounts like 401(k)s or IRAs, which offer tax benefits such as tax-deferred growth or tax-free withdrawals in the future.

- Harvest tax losses: Implement tax-loss harvesting by selling investments that have experienced a loss to offset gains and reduce your taxable income.

- Focus on long-term investments: Holding investments for the long term can qualify for lower capital gains tax rates, reducing the tax impact on your portfolio.

- Consider municipal bonds: Municipal bonds are often exempt from federal taxes and sometimes state taxes, providing a tax-efficient way to generate fixed income.

In conclusion, mastering the art of building an investment portfolio is crucial for long-term financial success. By understanding the nuances of asset allocation, risk management, and tax-efficient investing, individuals can pave the way towards a secure financial future. Start building your investment portfolio today and watch your wealth grow steadily over time.

Business mergers and acquisitions play a crucial role in shaping the business landscape. Companies merge or acquire other businesses to expand their market reach and diversify their offerings. Understanding the intricacies of these processes is essential for business growth and sustainability. Learn more about business mergers and acquisitions to stay ahead in the competitive market.

For beginners in the business world, investment can be a daunting task. However, with the right guidance and tips, anyone can start investing wisely. Whether it’s stocks, real estate, or starting a business, knowing the basics of investing is key. Explore business investment tips for beginners to kickstart your investment journey on the right foot.

Securing funding for a business is a crucial step towards success. Whether it’s through loans, investors, or crowdfunding, having the right funding strategy can make or break a business. Learn effective strategies and techniques on how to secure funding for business to fuel your entrepreneurial dreams and take your business to new heights.