Starting with International business investments, this paragraph aims to provide a captivating overview of the topic, drawing readers in with valuable insights and information.

Types of International Business Investments

International business investments come in various forms, each with its own characteristics and benefits. Two common types of investments in the global market are direct investments and portfolio investments.

Direct Investments

Direct investments involve acquiring a controlling interest in a foreign company or establishing a new business operation in a different country. This type of investment allows for a high level of control and involvement in the day-to-day operations of the business. Examples of direct investments include setting up a manufacturing plant in a foreign country or acquiring a retail chain in a new market.

Portfolio Investments

Portfolio investments, on the other hand, involve investing in a collection of assets such as stocks, bonds, or mutual funds in foreign markets. Unlike direct investments, portfolio investments do not offer control over the operations of the companies in which the investment is made. Instead, investors rely on the performance of the overall portfolio. Examples of portfolio investments include buying shares of a foreign company on the stock exchange or investing in a foreign government bond.

Foreign Direct Investment (FDI) vs. Foreign Portfolio Investment (FPI)

Foreign direct investment (FDI) and foreign portfolio investment (FPI) differ in terms of control, risk, and level of involvement. FDI allows for a higher degree of control and influence over the invested business, while FPI offers more liquidity and flexibility as investments can be easily bought or sold. FDI is typically a long-term investment strategy, whereas FPI is more short-term oriented.

Overall, both types of international business investments play a crucial role in the global economy, attracting capital, creating jobs, and fostering economic growth in different countries.

Factors Influencing International Business Investments

When considering international business investments, several factors play a crucial role in shaping investment decisions. These factors can range from political stability and economic conditions to cultural differences, all of which have a significant impact on the success or failure of investments in foreign markets.

Political Factors:

Political stability and government policies are key determinants of international business investments. Countries with stable governments and favorable policies for foreign investors often attract more investments. On the other hand, political unrest, corruption, and frequent policy changes can create uncertainty and deter investors from committing capital.

Economic Conditions:

The economic conditions of a country also heavily influence investment decisions. Factors such as GDP growth, inflation rates, exchange rates, and availability of resources can affect the feasibility and profitability of investments. Investors typically prefer countries with strong economic fundamentals and growth potential for their international ventures.

Cultural Differences:

Cultural differences can impact international business investments in various ways. Understanding the cultural norms, values, and communication styles of a target market is crucial for successful investments. Failure to adapt to local customs and preferences can lead to misunderstandings, conflicts, and ultimately, unsuccessful business ventures.

Political Factors Impacting International Investments

- Government stability and policies

- Political unrest and corruption

- Policy changes affecting investments

Economic Conditions and Investment Decisions

- GDP growth and economic stability

- Inflation rates and currency fluctuations

- Availability of resources and infrastructure

Role of Cultural Differences in International Investments

- Understanding local customs and norms

- Effective communication strategies

- Adapting products/services to local preferences

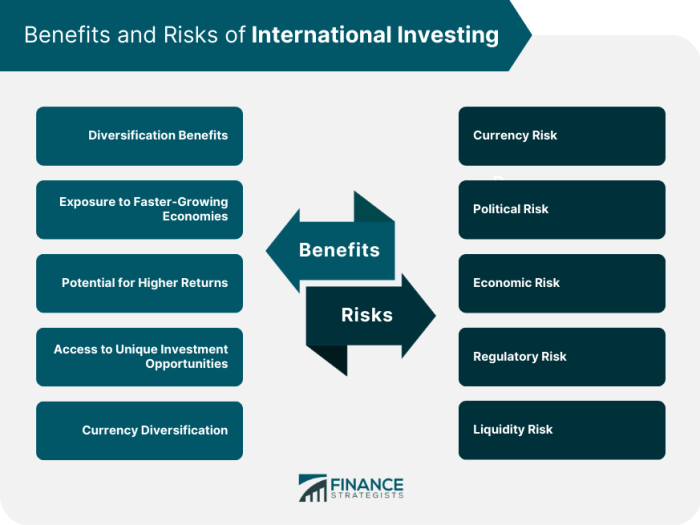

Strategies for Managing Risks in International Investments

When engaging in international investments, it is crucial to implement strategies to manage risks effectively. This involves mitigating factors such as currency exchange rate fluctuations, political instability, and other uncertainties that may affect investments.

Hedging Against Currency Exchange Rate Risks

Currency exchange rate risks can significantly impact the returns on international investments. To hedge against these risks, investors can employ various strategies such as:

- Forward Contracts: These agreements allow investors to lock in an exchange rate for a future date, reducing the impact of currency fluctuations.

- Options Contracts: Investors can purchase options that give them the right, but not the obligation, to exchange currencies at a predetermined rate.

- Currency Swaps: This involves exchanging cash flows in different currencies to mitigate exchange rate risks.

Importance of Diversification in Managing Risks

Diversification plays a key role in managing risks in international investments. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce the impact of adverse events on their portfolio. Diversification helps to minimize the correlation between investments, providing a buffer against volatility in specific markets.

Examples of Political Risks and Mitigation Strategies, International business investments

Political risks, such as changes in government policies, regulations, or geopolitical instability, can pose significant challenges to international investments. Some examples of political risks include:

- Expropriation: The government may seize assets without adequate compensation.

- Political Instability: Civil unrest or regime changes can disrupt business operations.

- Regulatory Changes: New laws or regulations can impact the profitability of investments.

To mitigate political risks, investors can consider strategies such as:

- Political Risk Insurance: Purchasing insurance policies to protect against losses due to political events.

- Joint Ventures: Partnering with local companies to navigate regulatory challenges and political environments.

- Diversification: Spreading investments across countries with different political landscapes to reduce overall risk exposure.

Emerging Trends in International Business Investments

Technology plays a significant role in shaping global investment trends. The digital revolution has transformed the way businesses operate, enabling easier access to international markets and investment opportunities. This has led to a rise in cross-border investments and the globalization of capital flows.

Impact of Technology on Global Investment Trends

- Blockchain technology has revolutionized the way transactions are conducted, making them more secure and efficient.

- Artificial intelligence and big data analytics are used to analyze market trends and make data-driven investment decisions.

- Online platforms and mobile apps have made it easier for investors to manage their international portfolios and access real-time market information.

Rise of Sustainable and Socially Responsible Investments

- Investors are increasingly prioritizing environmental, social, and governance (ESG) factors in their investment decisions.

- Companies that adopt sustainable practices and demonstrate social responsibility are seen as more attractive investment opportunities.

- Impact investing, which aims to generate positive social and environmental impact alongside financial returns, is gaining popularity among investors.

Growing Importance of Emerging Markets in International Investment Portfolios

- Emerging markets offer high growth potential and diversification benefits for international investment portfolios.

- Investors are looking beyond traditional markets to capitalize on the growth opportunities presented by emerging economies.

- Countries like China, India, Brazil, and Indonesia are becoming key players in the global economy, attracting significant investment flows.

In conclusion, International business investments offer a world of opportunities for savvy investors looking to expand their portfolios globally. This summary highlights the key points discussed and leaves readers with a lasting impression of the importance of strategic investment decisions in the international market.

When it comes to making smart investment decisions, choosing the best sectors for business investment is crucial. Understanding the market trends and potential growth areas can help maximize returns and minimize risks.

There are numerous benefits of business investments that go beyond just financial gains. Investing in a business can provide opportunities for growth, diversification, and even tax advantages.

For business owners looking to manage their investments on the go, utilizing the best investment apps for businesses can streamline the process and provide real-time insights into market performance.