Private funding for business growth sets the stage for innovative strategies and accelerated development in the corporate world. As companies strive for expansion and market dominance, securing private funding becomes a pivotal aspect of their growth trajectory.

Exploring the nuances of private funding options and the intricacies of securing investments, this comprehensive guide sheds light on the dynamic landscape of financial support for ambitious businesses.

Overview of Private Funding for Business Growth

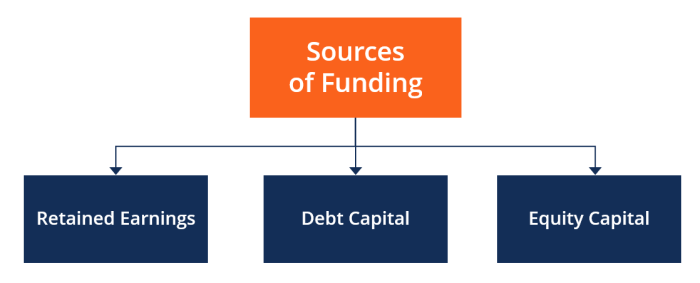

Private funding in the context of business growth refers to capital investment coming from individuals or private organizations rather than from public sources like banks or government grants. This type of funding can be in the form of equity, debt, or a combination of both, and it is often used by businesses to expand operations, launch new products, or enter new markets.

Private funding is significant for businesses as it provides them with the necessary resources to fuel growth and innovation. Unlike traditional financing options, private funding can offer more flexibility, personalized terms, and access to expertise and networks. Additionally, private investors are often willing to take on more risk in exchange for potentially higher returns, which can be advantageous for businesses looking to scale rapidly.

Some examples of private funding sources available to businesses include angel investors, venture capital firms, private equity funds, crowdfunding platforms, and family offices. These investors can provide funding at various stages of a business’s growth, from early-stage seed funding to later-stage expansion capital. Each type of private funding source has its own criteria, investment preferences, and expected returns, making it essential for businesses to choose the right fit based on their specific needs and goals.

Types of Private Funding: Private Funding For Business Growth

Private funding for business growth can come in various forms, each with its own set of characteristics and implications for the business receiving the investment. Understanding the different types of private funding options is crucial for entrepreneurs looking to scale their businesses effectively.

Angel Investors

Angel investors are individuals who provide capital for startups or small businesses in exchange for ownership equity in the company. They typically invest their own funds and can offer valuable expertise and connections in addition to financial support. Angel investors tend to be more hands-on than other types of investors and are often involved in the strategic direction of the business.

- Investment Size: Angel investors usually invest smaller amounts compared to venture capitalists or private equity firms. They may provide seed funding or early-stage capital to kickstart a business.

- Control: Angel investors may have a say in the decision-making process of the company but usually have less control compared to venture capitalists or private equity investors.

- Risk: Angel investors are willing to take on higher risks as they invest in early-stage companies with the potential for high returns.

One example of a successful business that utilized angel investors is Uber. The ride-sharing company received funding from angel investors in its early stages, helping it grow into the global giant it is today.

Venture Capitalists

Venture capitalists are professional investors who manage funds from institutions or high-net-worth individuals. They invest in startups and small businesses with high growth potential in exchange for equity ownership. Venture capitalists often provide not only financial support but also strategic guidance and mentorship to the companies they invest in.

- Investment Size: Venture capitalists typically invest larger amounts than angel investors, making them suitable for businesses looking to scale rapidly.

- Control: Venture capitalists may have a significant influence on the management and strategic decisions of the company due to their substantial investment stakes.

- Risk: Venture capitalists seek high returns on their investments and are willing to take on considerable risks in exchange for potential rewards.

An example of a successful business that raised funding from venture capitalists is Airbnb. The global accommodation marketplace secured funding from venture capital firms to expand its operations and reach a wider audience.

Private Equity

Private equity involves investing in established companies with the goal of driving growth and profitability. Private equity firms raise capital from institutional investors and high-net-worth individuals to acquire equity stakes in companies. They typically work closely with the management team to improve operations, increase efficiency, and ultimately enhance the value of the business.

- Investment Size: Private equity firms invest significant amounts of capital in established companies, often with the aim of restructuring and growing the business.

- Control: Private equity investors typically have a high level of control over the companies they invest in, influencing strategic decisions and operational changes.

- Risk: Private equity investments carry risks associated with the performance of the acquired company and the ability to generate returns for investors.

A notable example of a business that benefited from private equity funding is Burger King. The fast-food chain was acquired by a private equity firm, which helped revitalize the brand and drive expansion initiatives.

Process of Securing Private Funding

Securing private funding for business growth involves a series of steps that are crucial for success. From preparing a compelling pitch deck to building relationships with potential investors, each stage plays a significant role in securing the needed funding.

Key Components of a Compelling Pitch Deck

A compelling pitch deck is essential for capturing the attention of potential investors and convincing them of the viability of your business. Key components of a compelling pitch deck include:

- A clear and concise explanation of your business idea and value proposition

- Information about the market opportunity and competition

- Demonstration of a strong business model and revenue projections

- Details about the team and their expertise

- A well-defined ask, outlining the amount of funding needed and the purpose

Tips for Building Relationships with Private Investors, Private funding for business growth

Building relationships with private investors is crucial for securing funding successfully. Here are some tips to help you establish strong connections with potential investors:

- Attend networking events and industry conferences to meet potential investors in person

- Create a strong online presence through social media and professional networking platforms

- Provide regular updates on your business progress and milestones to keep investors engaged

- Personalize your approach and tailor your pitch to each individual investor’s interests and preferences

- Be transparent and honest in your communications to build trust with investors

Benefits and Challenges of Private Funding

Private funding offers several benefits for businesses looking to grow and expand. One of the main advantages is the flexibility it provides in terms of terms and conditions compared to traditional bank loans. Additionally, private funding can often be accessed more quickly, allowing businesses to seize opportunities in a timely manner. However, businesses may also face challenges when seeking private funding, including higher interest rates and the need to give up equity.

Benefits of Private Funding

- Flexibility in terms and conditions

- Quick access to funds

- Potential for tailored funding solutions

- Less stringent eligibility requirements

Challenges of Private Funding

- Higher interest rates compared to traditional loans

- Need to give up equity in the business

- Less regulatory oversight compared to banks

- Potential for conflicts with investors

Strategies for Overcoming Challenges

- Shop around for the best private funding terms

- Seek out reputable private investors with a track record of success

- Ensure clear communication and alignment with investors on goals and expectations

- Work with financial advisors to negotiate favorable terms

In conclusion, private funding emerges as a catalyst for transformative growth, offering a pathway to realize entrepreneurial visions and drive sustainable success. By navigating the complexities of private funding with strategic insights and a proactive approach, businesses can thrive and flourish in today’s competitive environment.

Looking for some great online business investment ideas to grow your portfolio? Consider exploring different industries and markets to diversify your investments for long-term success.

Securing the right amount of funding is crucial for any business to thrive. Learn more about effective strategies for business capital investment to ensure your company’s financial stability and growth.

Thinking of making early-stage business investments ? Take the time to research and analyze potential opportunities to make informed decisions that can lead to profitable outcomes in the future.