Investment return on business assets plays a crucial role in determining the financial success of a company. Understanding how to optimize this return is key to sustainable growth and profitability. Let’s delve into the essentials of maximizing ROI on business assets.

Importance of Investment Return on Business Assets

Understanding the investment return on business assets is crucial for financial success as it provides valuable insights into how effectively a company is utilizing its resources to generate profits. By analyzing this metric, businesses can make informed decisions to optimize their asset allocation and maximize returns.

Crowdfunding for business investments has become a popular way for entrepreneurs to raise capital for their ventures. By leveraging online platforms, businesses can access a wider pool of investors and secure funding for their projects. Crowdfunding allows businesses to connect with supporters who believe in their vision and are willing to contribute financially. To explore the benefits of crowdfunding for business investments, visit Crowdfunding for business investments.

Impact on Overall Performance and Growth

Investment return directly impacts the overall performance and growth of a business by influencing profitability, efficiency, and competitiveness. A high return on assets indicates that a company is generating more income from its investments, which can lead to increased shareholder value and sustainable growth.

Real estate investment trusts (REITs) offer a unique opportunity for investors to diversify their portfolios with real estate assets without having to directly own property. REITs generate income through rental properties, mortgages, and other real estate investments. Investing in REITs can provide steady cash flow and potential for capital appreciation. To learn more about real estate investment trusts (REITs), visit Real estate investment trusts (REITs).

- Improved Profitability: Businesses that effectively manage their assets to yield higher returns can achieve greater profitability, as they are able to generate more revenue with the same level of investment.

- Enhanced Efficiency: Optimizing asset utilization and monitoring investment returns help businesses operate more efficiently, reducing wastage and improving productivity.

- Competitive Advantage: Companies that consistently achieve a high return on assets are better positioned to outperform competitors, attract investors, and secure financing for future growth initiatives.

Examples of Optimized Investment Return

Several businesses have demonstrated the importance of optimizing investment return on assets to drive success. One notable example is Apple Inc., which has strategically managed its product development and marketing investments to achieve a consistently high return on assets, leading to market dominance and record-breaking profits.

Financial planning for business investments is crucial for the success of any enterprise. By carefully analyzing cash flow, expenses, and potential risks, businesses can make informed decisions about where to allocate their funds. Creating a solid financial plan can help businesses weather economic downturns and seize opportunities for growth. For more information on financial planning for business investments, visit Financial planning for business investments.

By focusing on maximizing investment returns, businesses can unlock their full potential for growth and profitability, ensuring long-term sustainability and success in the competitive marketplace.

Calculating Investment Return on Business Assets

When it comes to determining the success of your business investments, calculating the return on business assets is crucial. This calculation provides valuable insights into the efficiency and profitability of your assets, helping you make informed decisions to maximize returns.

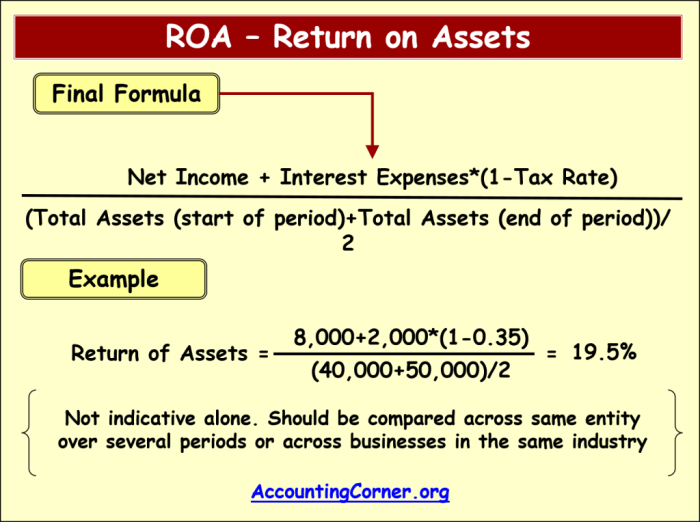

Formula for Calculating ROI for Business Assets

To calculate the return on investment (ROI) for business assets, you can use the following formula:

ROI = (Net Profit from Asset – Cost of Asset) / Cost of Asset

This formula takes into account the net profit generated by the asset and divides it by the initial cost of the asset. The resulting percentage indicates the return on investment for that particular asset.

Examples of Different Types of Business Assets and ROI

- Real Estate Property: A commercial property purchased for $500,000 generates a net profit of $100,000 per year. The ROI for this asset would be calculated as follows:

ROI = ($100,000 – $500,000) / $500,000 = -0.8 or -80%

Since the ROI is negative, it indicates that the investment is not yielding positive returns.

- Machinery and Equipment: A manufacturing company invests $200,000 in new machinery, which results in an additional $50,000 in annual profits. The ROI for this asset would be:

ROI = ($50,000 – $200,000) / $200,000 = -0.75 or -75%

Again, a negative ROI suggests that the investment may not be as profitable as expected.

Significance of Accurately Calculating ROI for Strategic Decision-Making

Accurately calculating ROI for business assets is essential for making strategic decisions regarding investments. By understanding the actual returns generated by each asset, business owners can identify underperforming assets, reallocate resources to more profitable investments, and optimize their overall asset portfolio. This data-driven approach enables informed decision-making and helps businesses achieve their financial goals effectively.

Strategies to Maximize Investment Return on Business Assets

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg?w=700)

Maximizing investment return on business assets is crucial for ensuring the financial health and sustainability of a company. By implementing effective strategies, businesses can optimize the performance of their assets and generate higher returns. Let’s explore some key strategies that businesses can use to maximize their investment return on assets.

Diversification of Assets

Diversifying assets is a common strategy used by businesses to spread risk and maximize returns. By investing in a variety of assets such as stocks, bonds, real estate, and commodities, companies can reduce the impact of market fluctuations on their overall portfolio. This strategy helps to ensure a more stable and consistent return on investment over the long term.

Regular Performance Monitoring

Monitoring the performance of business assets on a regular basis is essential for identifying areas of improvement and making informed decisions. By analyzing key performance indicators and trends, companies can adjust their asset allocation and investment strategies to maximize returns. Regular performance monitoring also helps businesses to identify underperforming assets and take corrective actions to enhance their profitability.

Strategic Asset Allocation, Investment return on business assets

Strategic asset allocation involves determining the optimal mix of assets in a portfolio based on the company’s financial goals, risk tolerance, and market conditions. By strategically allocating assets across different investment categories, businesses can achieve a balance between risk and return. This approach helps to capitalize on market opportunities while minimizing potential losses, ultimately maximizing the overall investment return.

Case Study: Company X

Company X, a multinational corporation, successfully implemented a strategic asset allocation strategy to maximize its investment return. By diversifying its assets across various sectors and geographies, Company X was able to achieve a consistent return on investment even during economic downturns. Through regular performance monitoring and adjustments to its asset allocation, Company X maintained a competitive edge in the market and continued to generate strong returns for its investors.

Risks and Challenges Associated with Investment Return on Business Assets

Investing in business assets to maximize returns comes with its own set of risks and challenges that businesses need to navigate effectively. These risks can impact the overall ROI and profitability of the business, making it crucial for companies to address them proactively.

Market Volatility and Its Impact on Investment Returns

Market volatility is a common external factor that can significantly impact investment returns on business assets. Sudden market fluctuations, economic downturns, or geopolitical events can lead to a decrease in asset values and hinder the expected returns for businesses. It is essential for companies to monitor market trends closely and implement strategies to mitigate the impact of market volatility on their asset returns.

- Develop a diversified asset portfolio: By diversifying investments across different asset classes, industries, or geographical regions, businesses can reduce the overall risk exposure to market volatility.

- Implement risk management strategies: Utilize hedging techniques, options contracts, or other risk management tools to protect against potential losses due to market fluctuations.

- Stay informed and adapt quickly: Regularly monitor market updates, economic indicators, and industry trends to make informed decisions and adjust investment strategies accordingly in response to changing market conditions.

Liquidity Risks and Challenges

Liquidity risks refer to the difficulty of selling an asset quickly without significantly impacting its market value. Businesses may face challenges in converting their assets into cash when needed, leading to potential liquidity issues that can affect investment returns.

- Maintain a balanced cash flow: Ensure that the business has sufficient cash reserves or access to credit facilities to meet short-term financial obligations and unexpected expenses without having to liquidate assets at unfavorable prices.

- Plan for contingencies: Develop contingency plans and stress test the business’s liquidity position to assess its ability to withstand financial shocks or disruptions in the market.

- Optimize asset allocation: Regularly review and adjust the asset allocation strategy to ensure a balance between liquidity needs and long-term investment objectives, taking into account the business’s cash flow requirements and risk tolerance.

In conclusion, mastering the art of maximizing investment return on business assets is a strategic move that can propel a company towards long-term success. By implementing effective strategies and mitigating risks, businesses can secure a brighter financial future.