Beginning with Alternative investments for business, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Businesses today are constantly seeking ways to diversify their investment portfolios beyond traditional options. Alternative investments offer a unique avenue for businesses to explore, providing opportunities for growth and increased returns. In this article, we delve into the realm of alternative investments for business, exploring real estate, private equity, and hedge funds as viable options for businesses looking to expand their investment horizons.

Overview of Alternative Investments for Business

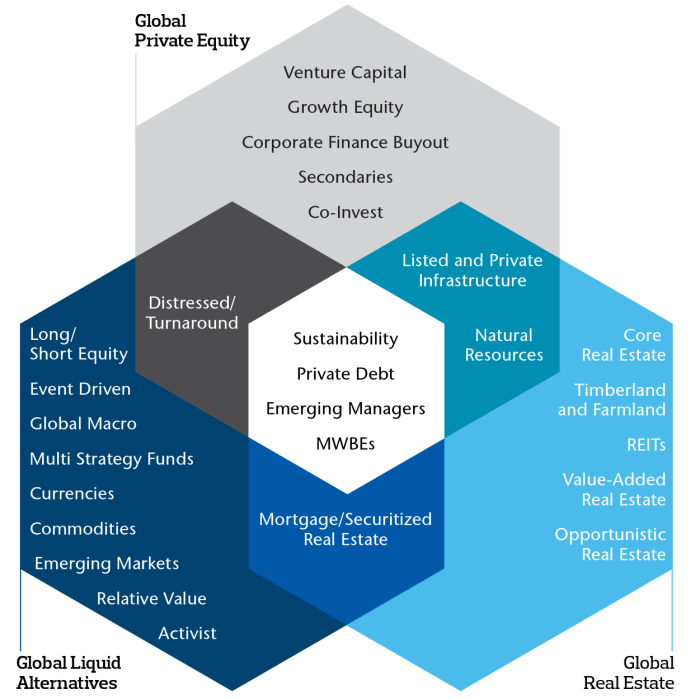

Alternative investments in the context of business refer to non-traditional investment options beyond stocks, bonds, and cash. These can include private equity, hedge funds, real estate, commodities, and more. Diversifying investment portfolios with alternatives is crucial for businesses to reduce risk and potentially enhance returns.

Importance of Diversifying Investment Portfolios with Alternatives

Diversification is essential for managing risk in investment portfolios. By including alternative investments, businesses can spread their risk across different asset classes that may have low correlation with traditional investments. This can help protect the portfolio during market downturns and provide opportunities for growth.

- Private Equity: Investing in privately-held companies can offer high returns but comes with higher risk due to the illiquid nature of these investments.

- Hedge Funds: These investment funds can employ various strategies to generate returns, such as long/short equity or event-driven investing.

- Real Estate: Investing in commercial properties, residential real estate, or real estate investment trusts (REITs) can provide income and potential appreciation.

- Commodities: Investing in commodities like gold, oil, or agricultural products can help diversify a portfolio and act as a hedge against inflation.

Real Estate Investments: Alternative Investments For Business

:max_bytes(150000):strip_icc()/28989470852_697aff879d_o-1ba1877f53f14869bccda3037fc93f83.jpg?w=700)

Investing in real estate can be a lucrative alternative for businesses looking to diversify their portfolio and generate passive income. Real estate investments offer a tangible asset that can appreciate over time and provide a steady stream of rental income.

Commercial Real Estate vs. Residential Real Estate Investments, Alternative investments for business

When it comes to real estate investments, businesses have the option to invest in either commercial or residential properties. Commercial real estate typically involves properties such as office buildings, retail spaces, and industrial warehouses. On the other hand, residential real estate includes single-family homes, multi-family properties, and condominiums.

Benefits of Commercial Real Estate Investments:

- Diversification: Commercial properties offer businesses the opportunity to diversify their investment portfolio beyond traditional stocks and bonds.

- Higher Income Potential: Commercial properties often yield higher rental income compared to residential properties.

- Longer Lease Terms: Commercial leases typically have longer lease terms, providing a more stable income stream for businesses.

Risks of Commercial Real Estate Investments:

- Market Volatility: Commercial real estate values can be influenced by economic factors, leading to fluctuations in property values.

- Vacancy Risk: Vacancies in commercial properties can impact rental income, especially during economic downturns.

- Regulatory Changes: Changes in zoning laws or regulations can affect the profitability of commercial real estate investments.

Benefits of Residential Real Estate Investments:

- Larger Market: Residential properties cater to a larger pool of potential tenants, reducing the risk of long-term vacancies.

- Stable Demand: The demand for residential properties remains relatively stable, providing a consistent rental income stream.

- Lower Entry Barrier: Residential properties may have a lower barrier to entry compared to commercial properties, making it more accessible for businesses.

Risks of Residential Real Estate Investments:

- Market Saturation: Oversupply of residential properties in certain markets can lead to decreased rental income and property values.

- Tenant Turnover: High turnover rates among residential tenants can result in increased management costs for businesses.

- Property Management: Residential properties may require more hands-on management compared to commercial properties.

Generating Passive Income through Real Estate Investments

One of the key advantages of real estate investments for businesses is the ability to generate passive income. By renting out properties, whether commercial or residential, businesses can earn a steady stream of rental income without actively participating in day-to-day operations. This passive income can provide businesses with a reliable source of cash flow to supplement other revenue streams and grow their overall wealth.

Private Equity Investments

Private equity is a form of alternative investment where investors pool funds to acquire ownership stakes in private companies or engage in buyouts of public companies to take them private. This investment strategy involves investing in companies that are not publicly traded on the stock exchange.

Role of Private Equity in Business

Private equity investments play a crucial role in providing capital to businesses for growth, expansion, or restructuring. By injecting capital into companies, private equity investors can help businesses achieve their strategic objectives and enhance their operational efficiency.

Criteria for Investing in Private Equity

- Long-term Investment Horizon: Businesses should have a long-term investment horizon when considering private equity, as these investments typically have a lock-up period of several years before generating returns.

- Risk Tolerance: Private equity investments are illiquid and carry higher risks compared to traditional investments, so businesses should assess their risk tolerance before committing capital.

- Alignment of Interests: It is essential to ensure that the goals and interests of the business align with those of the private equity firm to maximize the potential for a successful partnership.

Potential Returns and Liquidity Challenges

Private equity investments have the potential to deliver significant returns, especially when the invested companies experience growth and profitability. However, these returns are not realized until the investment is exited, which can take several years. The illiquid nature of private equity investments means that businesses may face challenges in accessing their capital during the investment period, requiring a long-term commitment to the investment strategy.

Hedge Fund Investments

Hedge funds are alternative investment vehicles that pool capital from accredited investors to invest in a diverse range of assets. Unlike traditional investment options such as stocks and bonds, hedge funds have more flexibility in their investment strategies and can use leverage to amplify returns.

Strategies Employed by Hedge Funds

- Hedging: Hedge funds use various hedging strategies to protect their portfolios from market downturns and minimize risk.

- Long/Short Equity: This strategy involves taking long positions in undervalued assets while shorting overvalued assets, aiming to profit from market inefficiencies.

- Event-Driven: Hedge funds capitalize on corporate events such as mergers, acquisitions, or bankruptcies to generate returns.

- Global Macro: This strategy involves making bets on macroeconomic trends by investing in various asset classes across different regions.

Risks and Rewards of Hedge Fund Investments

- Rewards: Hedge funds have the potential to generate high returns, especially during market volatility or when traditional investments are underperforming. They can also provide portfolio diversification and access to unique investment opportunities.

- Risks: Hedge funds are known for their high fees, lack of transparency, and potential for significant losses. Additionally, their use of leverage can amplify both gains and losses, making them riskier than traditional investments.

- Regulatory Risks: Regulatory changes or scrutiny can impact the operations and profitability of hedge funds, adding an additional layer of risk for investors.

In conclusion, alternative investments present businesses with a plethora of opportunities to grow and diversify their financial holdings. By considering options like real estate, private equity, and hedge funds, businesses can navigate the complexities of the investment landscape with confidence and strategic foresight. Embracing alternative investments can lead to enhanced portfolio performance and resilience in the face of market fluctuations.

Investing in new technology is essential for maximizing business growth and innovation. By adopting the latest tech trends, companies can streamline operations, improve efficiency, and stay ahead of the competition. Embracing innovation can lead to new opportunities and increased profits. Learn more about Investing in new technology Maximizing Business Growth and Innovation to take your business to the next level.

Securing funding for small business investments is crucial for success. Whether it’s through loans, grants, or investors, having the financial resources to expand and grow is key. With the right funding, small businesses can scale up operations, launch new products, and reach a wider market. Discover more about Funding for small business investments Key to Success to ensure your business thrives.

Corporate investment strategies play a vital role in maximizing financial growth and stability. By diversifying portfolios, analyzing market trends, and making strategic decisions, companies can secure long-term success. Implementing effective investment strategies can help businesses weather economic uncertainties and achieve sustainable growth. Explore Corporate Investment Strategies Maximizing Financial Growth and Stability to elevate your financial performance.