Small business funding sources take center stage in the entrepreneurial world, offering a myriad of options to fuel growth and success. From traditional methods to innovative approaches, understanding the diverse landscape of funding is crucial for every business owner. Let’s delve into the realm of financing and explore the best sources to support your entrepreneurial journey.

Traditional Small Business Funding Sources

When it comes to funding a small business, traditional sources play a crucial role in providing the necessary capital. These sources include bank loans, lines of credit, and Small Business Administration (SBA) loans. Each option has its own set of advantages and considerations that entrepreneurs should take into account when seeking funding for their business.

Bank Loans

Bank loans are a common funding source for small businesses. These loans are typically provided by commercial banks and are available to businesses with a solid credit history and financial track record. The application process for a bank loan involves submitting a detailed business plan, financial statements, and other relevant documentation. Interest rates and repayment terms vary depending on the bank and the specific loan agreement.

Lines of Credit

A line of credit is another traditional funding source that provides businesses with flexibility in accessing capital as needed. Unlike a traditional loan, a line of credit allows business owners to borrow funds up to a predetermined limit and only pay interest on the amount borrowed. This can be a valuable resource for businesses that have fluctuating cash flow or seasonal revenue patterns.

SBA Loans

Small Business Administration loans are backed by the federal government and are designed to help small businesses access affordable financing. These loans have lower interest rates and longer repayment terms compared to traditional bank loans. However, the application process for an SBA loan can be more complex and time-consuming, requiring detailed financial information and business plans.

Overall, traditional funding sources like bank loans, lines of credit, and SBA loans are essential options for small businesses looking to secure the capital needed to start or grow their operations. Entrepreneurs should carefully consider the terms and requirements of each funding source to determine the best fit for their business needs.

Alternative Small Business Funding Sources

Crowdfunding, angel investors, and venture capital are popular alternative funding options for small businesses seeking financial support outside of traditional avenues. These sources offer unique opportunities and challenges compared to more conventional funding methods.

Crowdfunding

Crowdfunding platforms allow entrepreneurs to raise funds from a large number of individual investors, often in exchange for rewards, equity, or pre-purchase of products/services. Some well-known crowdfunding platforms include Kickstarter, Indiegogo, and GoFundMe. This method can help businesses validate their ideas, build a customer base, and generate buzz. However, it requires a significant amount of marketing effort and may not always result in reaching the funding goal.

Angel Investors

Angel investors are affluent individuals who provide capital to startups in exchange for equity ownership. These investors often bring valuable industry knowledge and connections to the table. While angel funding can be faster and more flexible than traditional loans, it typically involves giving up a portion of ownership and decision-making control in the business.

Venture Capital

Venture capital firms invest in high-potential startups with the expectation of significant returns. They provide not only funding but also mentorship and strategic guidance. Venture capital can fuel rapid growth and expansion, but it comes with the pressure to achieve aggressive growth targets and may involve giving up a substantial share of the company.

Examples of successful small businesses funded through alternative sources include Oculus VR, which raised over $2.4 million on Kickstarter before being acquired by Facebook for $2 billion, and Uber, which received early funding from angel investors like Chris Sacca and Naval Ravikant before attracting venture capital investment.

Self-Funding and Personal Savings

Self-funding a small business involves using personal funds, such as savings or assets, to finance the business operations. This method of funding can provide entrepreneurs with greater control over their business and can be a viable option when traditional funding sources are limited. However, it also comes with risks and challenges that need to be carefully considered.

Bootstrapping and Personal Savings

Bootstrapping is a common self-funding method where entrepreneurs use their own resources to start and grow their business. This can include personal savings, credit cards, or even borrowing against personal assets. By bootstrapping, small business owners can maintain full ownership and control over their business without having to rely on external investors.

- Bootstrapping allows entrepreneurs to start their business with minimal debt, reducing financial risk.

- Personal savings can provide a financial cushion during the early stages of the business when revenue may be limited.

- Using personal funds demonstrates commitment and confidence in the business, which can be attractive to potential investors or lenders in the future.

Strategies for Using Personal Funds Effectively

When using personal funds to finance a small business, it’s essential to create a detailed budget and financial plan to ensure that the funds are being utilized efficiently. Small business owners can also consider the following strategies to make the most of their personal funds:

- Separate personal and business finances to track expenses and income accurately.

- Prioritize spending on essential business needs, such as product development, marketing, and hiring key employees.

- Explore cost-saving measures, such as negotiating with suppliers, using free or low-cost marketing channels, and minimizing overhead expenses.

Risks and Benefits of Self-Funding, Small business funding sources

Self-funding a small business comes with its own set of risks and benefits that entrepreneurs should carefully evaluate before making the decision to use personal funds:

- Risks:

- Personal financial risk: Using personal savings or assets can put the entrepreneur’s personal finances at risk if the business does not succeed.

- Limited resources: Self-funding may restrict the business’s growth potential if additional capital is needed for expansion or scaling.

- Benefits:

- Control: Self-funding allows entrepreneurs to retain full control over their business decisions without external influence.

- Flexibility: Entrepreneurs can make quick decisions and adapt to market changes without the need for approval from investors.

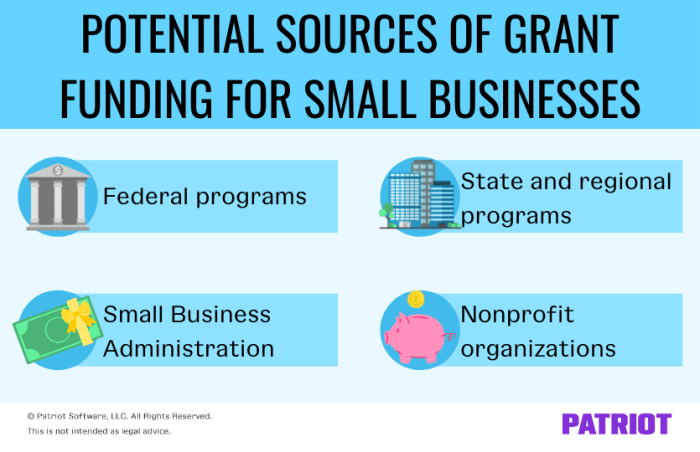

Government Grants and Programs: Small Business Funding Sources

Government grants and programs play a vital role in providing financial support to small businesses. These funding sources are typically offered by government agencies at the federal, state, and local levels to help entrepreneurs start, grow, and sustain their businesses.

Types of Government Grants and Programs

- Federal Grants: The federal government offers a variety of grants to support small businesses in different industries. These grants may be targeted towards specific business sectors, research and development projects, or initiatives that promote economic growth.

- State Grants: State governments also provide grants to small businesses within their jurisdictions. These grants can help businesses access capital, expand operations, or implement new technologies.

- Local Programs: Local governments and municipalities may offer grants and programs to support small businesses within their communities. These programs often focus on job creation, economic development, and revitalization efforts.

Eligibility Criteria and Application Process

- Eligibility: Each government grant or program has specific eligibility criteria that businesses must meet to qualify for funding. This may include factors such as the size of the business, industry sector, location, and the intended use of the funds.

- Application Process: Small business owners interested in government grants and programs must typically submit a detailed application outlining their business plan, financial projections, and how the funds will be used. The application process may also involve interviews, site visits, and due diligence reviews.

Examples of Successful Small Businesses

One example of a successful small business that has benefited from government grants is XYZ Tech, a software startup that received a federal grant to develop a new cybersecurity solution. With the funding, XYZ Tech was able to hire additional developers, conduct market research, and launch their product successfully.

In conclusion, navigating the realm of small business funding sources requires a strategic approach and a keen understanding of the available options. By leveraging a mix of traditional and alternative sources, entrepreneurs can secure the financial backing needed to propel their businesses to new heights. Stay informed, stay innovative, and watch your business thrive in the competitive market landscape.

Investing in new technology is crucial for maximizing business growth and innovation. By staying ahead of the curve with the latest advancements, companies can streamline operations and improve their products or services. Embracing new technology can give businesses a competitive edge in today’s fast-paced market. Learn more about Investing in new technology Maximizing Business Growth and Innovation.

Securing funding for small business investments is key to success. Whether it’s through loans, grants, or investors, having the financial resources to expand and grow is essential for small businesses. With the right funding, companies can innovate, hire new talent, and reach new markets. Discover more about Funding for small business investments Key to Success.

Corporate investment strategies play a vital role in maximizing financial growth and stability. By carefully planning where to allocate resources, companies can ensure long-term success and sustainability. From mergers and acquisitions to diversifying portfolios, strategic investments can drive profitability and minimize risks. Explore more about Corporate Investment Strategies Maximizing Financial Growth and Stability.