Real estate investments for businesses offer a strategic avenue for growth and success, providing a solid foundation for long-term profitability and stability. Throughout this guide, we will explore the various facets of real estate investments tailored to businesses, delving into key strategies and considerations that can propel your venture to new heights.

Introduction to Real Estate Investments for Businesses

Real estate investments for businesses involve purchasing, owning, managing, renting, or selling real estate properties for the purpose of generating income or profit. Businesses often invest in real estate to diversify their portfolios, secure long-term financial stability, and take advantage of potential appreciation in property value.

The Importance of Real Estate Investments for Business Growth

Real estate investments play a crucial role in the growth and success of businesses. By owning commercial properties, businesses can benefit from stable cash flow, tax advantages, and increased asset value over time. Additionally, real estate investments provide businesses with a tangible asset that can be used as collateral for loans or other financial opportunities.

- Stable Cash Flow: Rental income from leased properties can provide a consistent revenue stream for businesses, helping to offset operational costs and increase profitability.

- Tax Advantages: Businesses can take advantage of tax deductions on mortgage interest, property depreciation, and other expenses associated with owning real estate properties.

- Asset Appreciation: Real estate properties have the potential to increase in value over time, allowing businesses to build equity and wealth through capital appreciation.

Successful real estate investments can significantly enhance a business’s financial position and overall growth potential.

Examples of Successful Business Ventures Through Real Estate Investments

- Amazon: The e-commerce giant has invested heavily in real estate, owning warehouses, fulfillment centers, and office spaces to support its operations and logistics network.

- McDonald’s: The fast-food chain strategically owns many of its restaurant locations, providing a stable source of income through lease payments from franchisees.

- Google: The tech company has made substantial real estate investments in acquiring office buildings and campuses to accommodate its growing workforce and innovation hubs.

Types of Real Estate Investments for Businesses

Real estate investments offer a variety of options for businesses looking to diversify their portfolios and generate income. Understanding the different types of real estate investments available can help businesses make informed decisions based on their goals and budget.

Commercial Real Estate

Commercial real estate involves properties used for business purposes, such as office buildings, retail spaces, and industrial warehouses. Investing in commercial real estate can provide businesses with stable rental income and the potential for long-term appreciation. However, it also comes with higher upfront costs and risks, such as fluctuations in the economy and market demand.

Residential Real Estate

Residential real estate includes properties used for housing purposes, such as single-family homes, apartments, and condominiums. Investing in residential real estate can offer businesses a steady stream of rental income and potential tax benefits. The risks associated with residential real estate investments include vacancies, property damage, and tenant turnover.

Industrial Real Estate

Industrial real estate comprises properties used for manufacturing, distribution, and storage facilities. Investing in industrial real estate can be lucrative for businesses due to high rental yields and long-term lease agreements. However, it requires a significant capital investment and specialized knowledge of the sector to mitigate risks related to market demand and technological advancements.

Choosing the Right Investment for Your Business

When selecting a real estate investment, businesses should consider their financial goals, risk tolerance, and market conditions. Conducting thorough research, seeking professional guidance, and evaluating the potential returns and risks associated with each type of investment can help businesses make informed decisions. For example, a technology company may benefit from investing in office spaces in tech hubs, while a retail brand may find success in acquiring prime retail locations.

Strategies for Successful Real Estate Investments

Investing in real estate can be a lucrative venture for businesses, but success requires careful planning and strategic decision-making. Here are some key strategies for businesses looking to maximize returns on their real estate investments.

Importance of Location

Location is crucial when it comes to real estate investments. Choosing the right location can significantly impact the value and potential returns of a property. Businesses should consider factors such as proximity to amenities, accessibility, and future development plans when selecting a location for their real estate investments.

Market Research and Due Diligence

Before making any real estate investment decisions, businesses should conduct thorough market research and due diligence. This includes analyzing market trends, evaluating property values, and assessing potential risks. By taking the time to gather relevant information, businesses can make informed investment choices that are more likely to result in positive returns.

Leveraging Financing Options

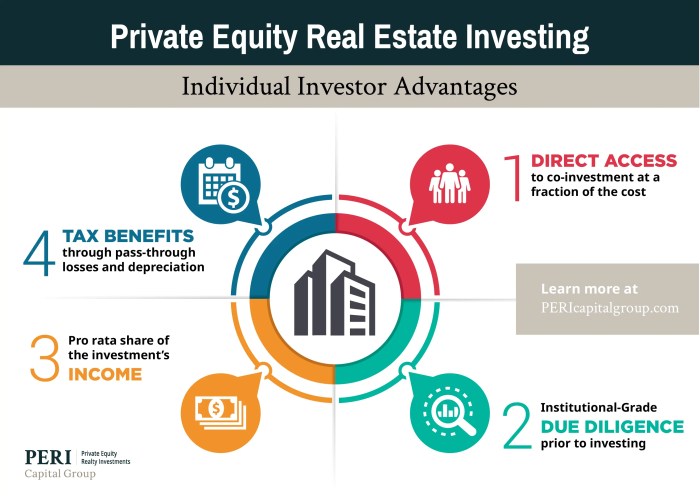

Businesses can leverage various financing options to fund their real estate investments. From traditional bank loans to alternative financing methods like crowdfunding or private equity, there are numerous ways to access capital for real estate projects. By exploring different financing options, businesses can optimize their investment strategies and maximize their returns.

Effective Management of Real Estate Investments

Managing real estate investments effectively is essential for long-term success. This involves tasks such as property maintenance, tenant management, and financial monitoring. Businesses should develop a comprehensive management plan to ensure that their real estate investments remain profitable and sustainable over time.

Legal and Tax Considerations in Real Estate Investments

When it comes to real estate investments for businesses, there are important legal and tax considerations that need to be taken into account. Understanding these factors is crucial to ensure compliance with regulations and maximize the benefits of the investment.

Key Legal Considerations for Businesses

- Property Ownership: Businesses need to be aware of the legal implications of owning real estate, including zoning laws, building codes, and environmental regulations.

- Contracts: Understanding and negotiating contracts such as lease agreements, purchase agreements, and construction contracts is essential to protect the business’s interests.

- Liability: Businesses must consider liability issues related to property ownership, such as premises liability and potential lawsuits from tenants or third parties.

Tax Implications of Real Estate Investments

- Depreciation: Real estate investments offer tax benefits through depreciation deductions, allowing businesses to reduce taxable income and save on taxes.

- Capital Gains: Capital gains on the sale of real estate are subject to tax, so businesses need to plan for these tax implications when selling properties.

- 1031 Exchange: Businesses can defer capital gains taxes by reinvesting in another property through a 1031 exchange, providing a tax-efficient strategy for real estate investments.

Optimizing Tax Benefits

- Consulting with tax professionals: Businesses should work with tax advisors to develop tax-efficient strategies for real estate investments and maximize deductions.

- Utilizing tax credits: Taking advantage of tax credits available for certain types of real estate investments can further reduce tax liabilities for businesses.

Examples of Legal and Tax Issues

- Land use restrictions: Businesses may encounter legal challenges related to zoning laws or restrictions on the use of the property.

- Tax audits: Businesses investing in real estate may face tax audits to ensure compliance with tax laws and regulations.

- Contract disputes: Legal issues can arise from contract disputes with tenants, contractors, or other parties involved in real estate transactions.

In conclusion, real estate investments present a lucrative opportunity for businesses to thrive and expand their portfolio. By implementing the right strategies and staying informed about legal and tax implications, businesses can position themselves for long-term success in the dynamic real estate market.

When it comes to affordable residential housing, it’s crucial to stay updated on the key insights, trends, and future prospects in the market. Understanding these factors can help investors make informed decisions. For a comprehensive guide on this topic, check out Affordable Residential Housing: Key Insights Trends and Future Prospects.

Investors looking to delve into residential property appreciation need a thorough understanding of the market. This in-depth guide provides valuable insights for investors aiming to maximize their profits. Explore more on this topic at Residential Property Appreciation: An In-Depth Guide for Investors.

Maximizing profit from residential rental income requires a solid grasp of key concepts and strategies. Investors can enhance their understanding and boost their earnings by exploring the insights shared in this guide. Dive deeper into this topic at Residential Rental Income: Maximizing Profit and Understanding Key Concepts.