Understanding slippage in Forex is paramount for traders seeking to navigate the dynamic and often unpredictable currency market. Slippage, the difference between the expected and executed price of a trade, can significantly impact trading strategies and profitability. This comprehensive guide delves into the intricacies of slippage, its consequences, and effective management techniques.

The complexities of the Forex market, characterized by high liquidity and rapid price fluctuations, create an environment where slippage is an inherent challenge. Understanding the factors contributing to slippage empowers traders to mitigate its impact and enhance their trading performance.

Understanding Slippage in Forex

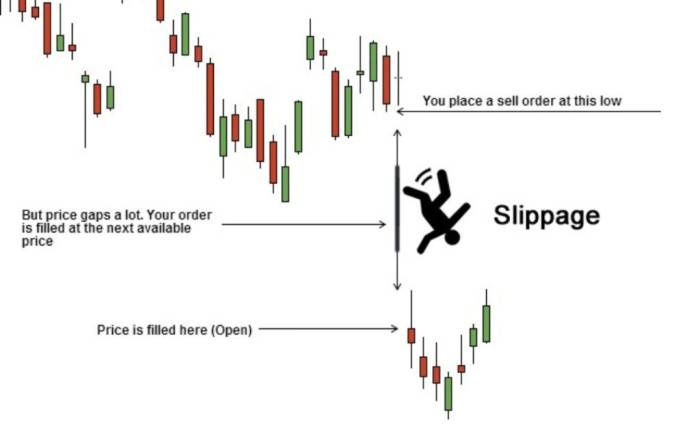

Slippage, a prevalent phenomenon in Forex trading, occurs when the executed price of a trade differs from the intended price due to various market dynamics and factors. Understanding slippage is crucial for traders to effectively manage their trading strategies and mitigate its potential impact on their profits.

Understanding slippage in Forex is crucial, as it can significantly impact your trading performance. To minimize the effects of slippage, it’s recommended to practice on Forex demo accounts before trading with real money.

Demo accounts allow you to simulate real-world trading conditions without risking any capital, providing a valuable platform to hone your skills and gain a better understanding of slippage and other market dynamics.

Forex Market Dynamics

Slippage arises from the fast-paced and volatile nature of the Forex market. When a trader places an order, the market price may fluctuate rapidly, causing the execution price to deviate from the requested price.

Impact of Slippage on Trading

Slippage can significantly affect trading outcomes. Positive slippage occurs when the execution price is more favorable than the intended price, leading to unexpected profits. Negative slippage, however, can result in losses, as the execution price is less favorable than anticipated.

Managing Slippage

Traders can employ various techniques to minimize slippage. These include:

- Using limit orders: Limit orders specify the maximum or minimum acceptable price for a trade, reducing the likelihood of significant slippage.

- Trading during high-liquidity periods: Market liquidity ensures that there are sufficient buyers and sellers, minimizing the spread between the bid and ask prices and reducing slippage.

Technological Advancements, Understanding slippage in Forex

Electronic trading platforms have significantly reduced slippage by automating the execution process and providing real-time market data. This has led to faster execution times and reduced price discrepancies.

Understanding slippage in Forex involves recognizing the difference between the quoted price and the actual execution price. This can be influenced by market volatility, liquidity, and spreads.

Forex liquidity and spreads play a crucial role, as higher liquidity generally leads to tighter spreads and reduced slippage.

Therefore, traders should consider market conditions and liquidity when evaluating potential slippage risks.

Regulatory Considerations

Regulatory bodies play a vital role in ensuring fair trading practices and managing slippage. They establish guidelines for brokers to disclose their slippage policies and provide mechanisms for traders to report excessive slippage.

Closure

Managing slippage effectively requires a combination of technical expertise, risk management strategies, and a deep understanding of market dynamics.

By embracing technological advancements, leveraging liquidity, and adhering to regulatory guidelines, traders can minimize the impact of slippage and optimize their trading outcomes.

Understanding slippage in Forex is not merely about mitigating losses but also about seizing opportunities and maximizing profitability in the ever-evolving currency market.

Question & Answer Hub: Understanding Slippage In Forex

What is the primary cause of slippage in Forex trading?

Slippage primarily occurs due to rapid market movements and liquidity constraints, where the executed price deviates from the intended price.

How can traders minimize the impact of slippage?

Minimizing slippage involves using limit orders, trading during high-liquidity periods, and selecting brokers with tight spreads and fast execution speeds.

What are the regulatory considerations surrounding slippage in Forex?

Understanding slippage in Forex is crucial to avoid significant losses. To ensure optimal trading performance, consider utilizing Forex VPS hosting for automated trading.

This specialized hosting solution provides a stable and low-latency environment, minimizing slippage and maximizing trade execution efficiency.

By utilizing VPS hosting, traders can effectively mitigate the impact of slippage on their Forex trading strategies, leading to enhanced profitability.

Regulatory bodies enforce guidelines to ensure fair trading practices, including measures to mitigate excessive slippage and protect traders’ interests.