Trading Forex using algorithmic strategies is a rapidly growing field that offers the potential for increased profits and reduced risk. In this comprehensive guide, we will explore the basics of algorithmic Forex trading, including the different types of strategies, how to design and implement an algorithmic strategy, and how to test and optimize your strategy for success.

The content of the second paragraph that provides descriptive and clear information about the topic

To ensure the seamless execution of algorithmic trading strategies in Forex, traders can leverage the benefits of Forex VPS hosting for automated trading.

Forex VPS hosting provides a dedicated virtual server that operates 24/7, ensuring uninterrupted trade execution and minimizing the risks associated with hardware failures or internet connectivity issues.

This allows traders to fully capitalize on algorithmic strategies and maximize their trading potential.

Introduction to Algorithmic Forex Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Algorithmic_Trading_Apr_2020-01-59aa25326afd47edb2e847c0e18f8ce2.jpg?w=700)

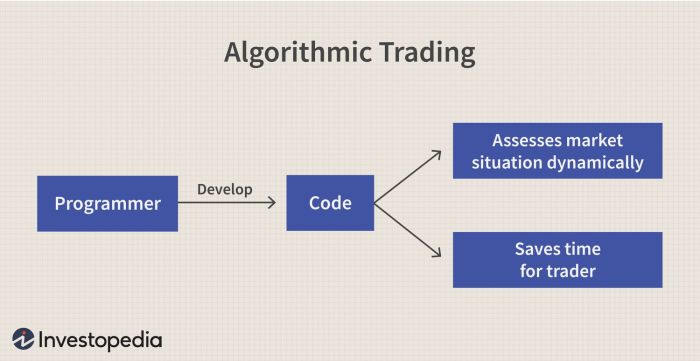

Algorithmic trading, also known as automated trading, involves using computer programs or algorithms to execute trades in the Forex market.

These algorithms are designed to analyze market data, identify trading opportunities, and automatically place and manage trades based on predefined rules.

Algorithmic trading offers several benefits, including increased efficiency, reduced emotional bias, and the ability to backtest and optimize strategies.

However, it also comes with challenges, such as the need for technical expertise, the potential for over-optimization, and the risk of system failures.

Trading Forex using algorithmic strategies requires a deep understanding of market dynamics. A crucial aspect is calculating pip value, which determines the potential profit or loss for each point movement in the exchange rate.

To accurately calculate pip value, traders can refer to the guide How to calculate pip value in Forex.

This knowledge is essential for algorithmic strategies that rely on precise calculations to maximize returns and manage risk in the volatile Forex market.

Types of Algorithmic Strategies: Trading Forex Using Algorithmic Strategies

There are various types of algorithmic strategies used in Forex trading, each with its own unique approach to identifying and executing trades. Some common types include:

- Trend-following strategies: These strategies identify and follow established market trends, aiming to profit from the continuation of the trend.

- Mean reversion strategies: These strategies seek to exploit price fluctuations by buying when prices are low and selling when prices are high, based on the assumption that prices will eventually return to their mean.

- Range-bound strategies: These strategies focus on trading within a defined price range, aiming to profit from the oscillation of prices within that range.

Designing an Algorithmic Strategy

Designing an algorithmic strategy involves several key steps:

- Identifying trading opportunities: Determine the specific market conditions or patterns that trigger the strategy to enter or exit a trade.

- Setting entry and exit points: Establish the criteria for entering and exiting trades, including price levels, technical indicators, or other signals.

- Managing risk: Implement risk management techniques to limit potential losses, such as position sizing, stop-loss orders, and risk-reward ratios.

Implementing an Algorithmic Strategy

Implementing an algorithmic strategy requires the use of a trading platform that supports automated trading. Popular platforms include MetaTrader 4 and 5, cTrader, and NinjaTrader.

When Trading Forex using algorithmic strategies, it’s crucial to consider Forex swap rates and rollover. These rates can impact the profitability of your trades, as they determine the cost of holding a position overnight.

Understanding how swap rates work and how they can affect your trading strategy is essential for successful Forex trading using algorithmic strategies.

Different programming languages and tools can be used to create algorithmic strategies, such as MQL4, MQL5, Python, and C++. The choice of language depends on the platform used and the trader’s technical expertise.

Testing and Optimizing an Algorithmic Strategy

Testing and optimizing an algorithmic strategy is crucial to ensure its performance and robustness. This involves:

- Backtesting: Simulating the strategy’s performance on historical data to evaluate its profitability, risk, and other metrics.

- Forward testing: Running the strategy on live data to assess its performance in real-time market conditions.

- Optimization: Adjusting the strategy’s parameters to improve its performance, based on the results of backtesting and forward testing.

Risk Management in Algorithmic Forex Trading

Algorithmic Forex trading involves inherent risks that need to be carefully managed. These risks include:

- Market volatility: Unexpected market movements can lead to losses.

- System failures: Technical issues with the trading platform or the algorithm itself can disrupt trading.

- Over-optimization: Excessive optimization can lead to the strategy becoming too specific to historical data, resulting in poor performance in real-time trading.

To mitigate these risks, it is essential to implement sound risk management techniques, such as:

- Position sizing: Determining the appropriate trade size based on account balance and risk tolerance.

- Stop-loss orders: Setting orders to automatically close trades when prices reach a predetermined level, limiting potential losses.

- Risk-reward ratios: Ensuring that the potential reward of a trade outweighs the potential risk.

Conclusion

Algorithmic Forex trading is a powerful tool that can help you to achieve your financial goals. By following the steps Artikeld in this guide, you can create and implement an algorithmic strategy that will help you to trade Forex more profitably and efficiently.

Essential FAQs

What is algorithmic Forex trading?

Algorithmic Forex trading is a method of trading Forex using computer programs that automatically execute trades based on pre-defined rules.

What are the benefits of algorithmic Forex trading?

Algorithmic Forex trading offers a number of benefits, including increased profits, reduced risk, and the ability to trade 24 hours a day, 7 days a week.

What are the challenges of algorithmic Forex trading?

Algorithmic Forex trading also comes with a number of challenges, including the need for programming skills, the risk of system failure, and the potential for over-optimization.