Forex margin trading explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with Semrush author style and brimming with originality from the outset. Embark on a journey through the intricate world of leveraged trading, where risk and reward dance in delicate balance, and knowledge is the key to unlocking untold potential.

Forex margin trading involves using borrowed capital to increase potential profits, but also carries increased risk. To protect your assets, consider exploring Discover Good Car Insurance: A Comprehensive Guide to Protecting Your Vehicle. This guide provides insights into choosing the right insurance policy to safeguard your vehicle.

Understanding both Forex margin trading and car insurance can help you make informed financial decisions.

Delve into the mechanics of margin trading, unraveling the mysteries of leverage and stop-out levels. Discover the strategies employed by seasoned traders, mastering risk management techniques that separate the successful from the vanquished.

Explore the regulatory landscape, ensuring fair and transparent practices, and embrace technological advancements that empower traders with unprecedented efficiency and control.

Forex Margin Trading Overview

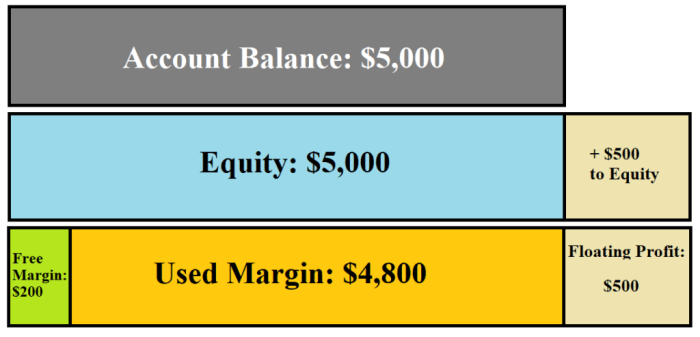

Forex margin trading involves using borrowed capital to increase potential returns on trades. It allows traders to control a larger position size than their initial deposit, amplifying both profits and losses.

Forex margin trading involves leveraging borrowed funds to increase potential profits, but it also amplifies losses. Understanding the volatility of exotic currency pairs, such as those discussed in Forex exotic currency pair volatility , is crucial for managing risk in margin trading.

Exotic pairs exhibit higher volatility due to lower liquidity and political or economic factors, making them suitable for experienced traders with a higher risk tolerance.

By incorporating this knowledge into their margin trading strategies, traders can better navigate the complexities of the Forex market.

Benefits include increased profit potential, flexibility to trade with larger positions, and 24/7 market access. However, risks include potential for significant losses, margin calls, and stop-out levels.

Mechanics of Margin Trading: Forex Margin Trading Explained

Leverage, expressed as a ratio, determines the amount of borrowed capital available to traders. For example, 1:100 leverage allows a trader to control a position 100 times larger than their initial deposit.

Margin calls occur when the trader’s equity falls below a certain level, requiring them to add funds or close positions to meet margin requirements. Stop-out levels are triggered when equity falls below a critical point, automatically closing positions to prevent further losses.

Strategies for Margin Trading

- Scalping: Executing numerous small trades with tight stop-loss and take-profit levels to accumulate small profits.

- Day Trading: Opening and closing positions within the same trading day, capitalizing on short-term price fluctuations.

- Position Trading: Holding positions for extended periods, aiming for larger profit potential from long-term trends.

- Hedging: Using multiple positions to offset risk and reduce potential losses.

Choosing a Forex Margin Broker

- Regulation: Ensure the broker is licensed and regulated by a reputable financial authority.

- Security: Verify the broker’s security measures to protect client funds and data.

- Leverage: Consider the leverage ratios offered by the broker and select one that aligns with your risk tolerance.

- Fees and Spreads: Compare trading fees, spreads, and commissions to find the most cost-effective broker.

Examples of Margin Trading in Forex

| Initial Deposit | Leverage | Position Size | Profit/Loss | Margin Call Trigger |

|---|---|---|---|---|

| $1,000 | 1:100 | $100,000 | +5% | $950 |

| $5,000 | 1:50 | $250,000 | -10% | $4,500 |

Last Recap

Forex margin trading explained has illuminated the intricacies of this dynamic financial arena, empowering you with the knowledge to navigate its complexities with confidence.

Whether you seek to amplify your profits or mitigate risks, this comprehensive guide has equipped you with the tools and insights to make informed decisions and pursue your trading aspirations with a newfound sense of clarity and purpose.

FAQs

What is Forex margin trading?

Forex margin trading, where traders leverage borrowed funds to amplify potential profits, provides a unique opportunity to enhance returns. To effectively utilize leverage in Forex trading, it’s essential to understand the principles and strategies involved.

Our comprehensive guide, How to trade Forex with leverage , offers a detailed analysis of leverage, including its advantages and risks, helping traders navigate the complexities of Forex margin trading.

Forex margin trading is a leveraged trading strategy that allows traders to increase their buying power by borrowing funds from their broker.

What are the benefits of Forex margin trading?

The benefits of Forex margin trading include increased buying power, potential for higher profits, and flexibility in trading strategies.

What are the risks of Forex margin trading?

The risks of Forex margin trading include the potential for significant losses, margin calls, and stop-out levels.

How can I mitigate the risks of Forex margin trading?

You can mitigate the risks of Forex margin trading by using proper risk management techniques, such as setting stop-loss orders, limiting leverage, and diversifying your portfolio.