Forex exotic currency pair volatility presents a captivating realm within the financial markets, where unique characteristics and market dynamics converge. This volatility, often higher than that of major currency pairs, offers both opportunities and challenges for traders seeking to navigate its intricacies.

Understanding the factors influencing exotic currency pair volatility, employing effective trading strategies, and implementing robust risk management measures are essential for success in this dynamic market.

Forex exotic currency pair volatility can be a significant concern for traders due to the unpredictable nature of these markets. However, understanding the risks involved and implementing effective risk management strategies can help mitigate these challenges.

For those seeking peace of mind on the road, Discover Good Car Insurance: A Comprehensive Guide to Protecting Your Vehicle provides valuable insights into safeguarding your automotive investment.

By navigating these complex financial landscapes, traders can navigate the complexities of Forex exotic currency pair volatility with confidence.

Exotic Currency Pair Volatility Overview

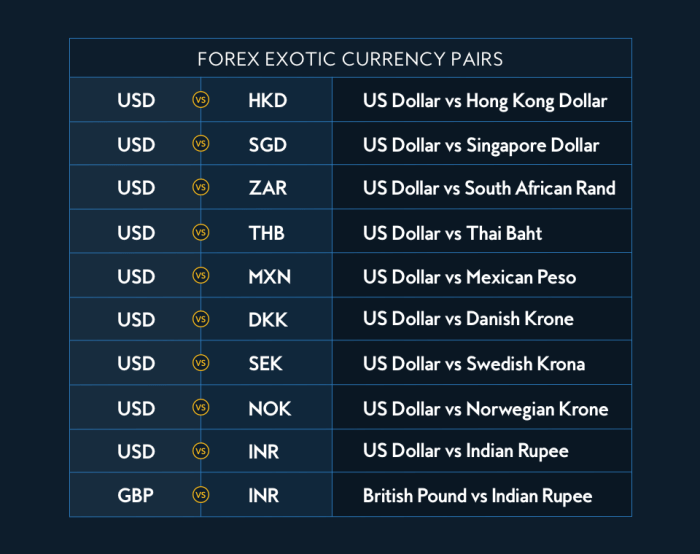

Exotic currency pairs, which involve currencies from emerging or developing economies, are known for their high volatility compared to major currency pairs. Volatility refers to the extent of price fluctuations in a currency pair over time, and exotic pairs exhibit significant variations due to several factors.

Factors influencing volatility in exotic currency pairs include economic growth prospects, political stability, central bank policies, and global market conditions.

Highly volatile exotic currency pairs include those involving currencies like the Turkish Lira (TRY), Mexican Peso (MXN), and Brazilian Real (BRL), which have experienced substantial price swings in the past.

Volatility Measurement and Analysis

Measuring volatility in exotic currency pairs is crucial for risk assessment and trading strategies. Common methods include:

- Historical Volatility: Measures the standard deviation of price changes over a specific period.

- Implied Volatility: Derived from option prices, it indicates market expectations of future volatility.

Historical volatility data is valuable for predicting future volatility patterns. Statistical models and indicators, such as Bollinger Bands and Average True Range (ATR), are used to analyze volatility trends and identify potential trading opportunities.

Forex exotic currency pair volatility can be a significant factor in determining trading strategies. For instance, pairs like USD/TRY or USD/MXN exhibit higher volatility compared to major pairs.

Understanding this volatility is crucial for managing risk and maximizing profits. However, it’s equally important to consider factors beyond currency markets, such as insurance coverage.

Kemper Car Insurance offers comprehensive policies with competitive quotes and discounts. By exploring Kemper Car Insurance: Coverage Quotes Discounts and More , you can safeguard your vehicle while staying informed about Forex exotic currency pair volatility.

Trading Strategies for Volatile Exotic Currency Pairs

Trading volatile exotic currency pairs requires specific strategies:

- Scalping: Involves making numerous small trades with tight stop-losses to capture quick price movements.

- Swing Trading: Holding positions for a few days to weeks, aiming to profit from larger price swings.

- Trend Following: Identifying and riding long-term trends, with the goal of maximizing gains.

Risk management is critical, including techniques like diversification, hedging, and position sizing. Successful trading strategies leverage volatility by identifying entry and exit points based on technical analysis and market conditions.

Economic and Market Factors Affecting Volatility

Economic and market events can significantly impact exotic currency pair volatility:

- Central Bank Policies: Interest rate decisions and monetary policies affect currency values.

- Political Stability: Political turmoil or uncertainty can lead to currency fluctuations.

- Global Economic Conditions: Economic growth, inflation, and recessionary pressures influence currency demand and supply.

Monitoring and anticipating these factors is essential for adjusting trading strategies and managing risk.

Risk Management and Volatility Mitigation, Forex exotic currency pair volatility

Risk management is paramount when trading volatile exotic currency pairs:

- Diversification: Spreading investments across different asset classes and currencies to reduce risk.

- Hedging: Using financial instruments to offset potential losses.

- Position Sizing: Determining the appropriate trade size based on risk tolerance and account balance.

Risk management tools and techniques, such as stop-loss orders and trailing stops, help mitigate risk and protect against significant losses.

Ultimate Conclusion

In conclusion, Forex exotic currency pair volatility demands a nuanced approach, blending market analysis, strategic trading, and prudent risk management.

By embracing the complexities of these unique currency pairs, traders can harness their potential for both profit and portfolio diversification.

Clarifying Questions: Forex Exotic Currency Pair Volatility

What are the key factors driving exotic currency pair volatility?

Economic and political stability, central bank policies, and global economic conditions all play a significant role in shaping the volatility of exotic currency pairs.

How can traders measure and analyze volatility in exotic currency pairs?

Forex exotic currency pair volatility can be influenced by various factors, such as political instability or economic crises. For those seeking a deeper understanding of insurance coverage and regulations,

Florida Car Insurance: A Comprehensive Guide to Coverage and Regulations provides valuable insights.

However, it’s crucial to monitor exotic currency pair volatility to assess its potential impact on investments and financial strategies.

Historical volatility data, statistical models, and technical indicators provide valuable insights into volatility patterns and can assist in predicting future volatility.

What are some effective trading strategies for volatile exotic currency pairs?

Scalping, swing trading, and trend following are popular strategies employed by traders to capitalize on the volatility of exotic currency pairs.

How can traders manage risk when trading volatile exotic currency pairs?

Diversification, hedging, and position sizing are essential risk management techniques for mitigating the potential risks associated with trading exotic currency pairs.