Car insurance compare quotes is an essential step for anyone looking to get the best possible coverage for their vehicle. By comparing quotes from multiple insurance companies, you can ensure that you’re getting the right coverage at the right price.

In this guide, we’ll walk you through the different types of car insurance coverage available, the factors that affect quotes, and the best methods for comparing quotes. We’ll also provide a list of frequently asked questions about car insurance compare quotes.

Comparing car insurance quotes is crucial for finding the best coverage at the most affordable price. If you don’t own a car but still need occasional access to one, consider non-owner car insurance. This type of insurance provides coverage when you rent or borrow a vehicle, protecting you from financial liability in case of an accident.

By comparing car insurance quotes that include non-owner car insurance options, you can ensure comprehensive coverage that fits your specific needs and budget.

Car Insurance Coverage Types

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/6ZSXS37WCJABPPHK7A5HJAQBAY?w=700)

Car insurance coverage is a legal requirement in most countries and provides financial protection against the risks associated with driving a vehicle. There are different types of car insurance coverage available, each with its own benefits and limitations.

Liability Coverage: This coverage is required by law and protects you if you are responsible for causing an accident that results in injuries or property damage to others.

Collision Coverage: This coverage protects your vehicle if it is damaged in an accident, regardless of who is at fault.

Comprehensive Coverage: This coverage protects your vehicle against damage or theft from non-collision events, such as fire, theft, vandalism, or natural disasters.

To ensure you’re getting the best deal on car insurance, it’s essential to compare quotes from multiple providers. National General Car Insurance is a reputable company that offers competitive rates and comprehensive coverage options.

By comparing quotes from National General and other insurers, you can make an informed decision that meets your specific needs and budget.

Factors Affecting Quotes

The cost of car insurance varies depending on several factors, including:

- Driver’s age and driving history

- Vehicle type and value

- Location

- Annual mileage

- Deductible amount

- Coverage limits

Comparison Methods

There are several ways to compare car insurance quotes:

- Online comparison tools: These tools allow you to enter your information and receive quotes from multiple insurance companies.

- Insurance agents: You can contact an insurance agent to get quotes from different companies.

- Directly from insurance companies: You can visit the websites of individual insurance companies to get quotes.

Online Comparison Tools

There are several online comparison tools available, including:

| Tool | Features | Capabilities |

|---|---|---|

| The Zebra | – Quotes from multiple insurance companies | – Compare quotes side-by-side |

| NerdWallet | – Personalized recommendations | – Track changes in quotes over time |

| Insurify | – Instant quotes | – Get pre-approved for coverage |

Benefits of Comparing Quotes: Car Insurance Compare Quotes

Comparing car insurance quotes can help you save money and get the best coverage for your needs. By comparing quotes, you can:

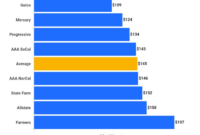

- Find the lowest price for the coverage you need

- Identify discounts and savings you may qualify for

- Ensure you have the right coverage for your vehicle and driving habits

Additional Considerations

When comparing car insurance quotes, it’s important to consider the following factors:

- Customer service: Check the customer service ratings of the insurance companies you’re considering.

- Financial stability: Make sure the insurance company you choose is financially stable.

- Policy terms: Read the policy terms carefully to understand what is and is not covered.

Closing Summary

Comparing car insurance quotes is a simple and effective way to save money on your insurance premiums. By following the tips in this guide, you can be sure that you’re getting the best possible coverage for your needs.

Question Bank

What are the different types of car insurance coverage?

To secure the most competitive car insurance rates, comparing quotes from multiple providers is essential. Numerous online platforms facilitate this process.

However, if you prefer in-person interactions, consider reaching out to car insurance agencies near me. They can provide personalized guidance and assist you in finding the best coverage options for your specific needs.

By comparing quotes and consulting with local agencies, you can make informed decisions that safeguard your financial well-being and ensure peace of mind on the road.

There are many different types of car insurance coverage available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

What factors affect car insurance quotes?

The factors that affect car insurance quotes include the driver’s age, driving history, vehicle type, and location.

What are the best methods for comparing car insurance quotes?

There are a few different methods for comparing car insurance quotes, including online comparison tools, insurance agents, and direct contact with insurance companies.